Last Update07 May 25Fair value Increased 0.87%

Key Takeaways

- Exclusive control of core domain registries and strong market demand ensure durable high-margin recurring revenues and pricing power.

- Strategic investments, market expansion, and potential .web domain launch position VeriSign for enhanced earnings and improved shareholder returns.

- Regulatory challenges, technological disruption, and market saturation threaten VeriSign’s revenue growth and profitability, while overreliance on .com contracts poses significant business concentration risk.

Catalysts

About VeriSign- Provides internet infrastructure and domain name registry services that enables internet navigation for various recognized domain names worldwide.

- Accelerating global internet adoption, particularly in emerging markets, is driving sustained growth in the domain name base as reflected in the strong new registration numbers and improved renewal rates, which is likely to support ongoing revenue expansion as more individuals and businesses establish their online presence.

- Increased digital transformation and the need for secure, distinctive online identities across sectors is expected to keep demand for .com and .net domains robust, underpinning both volume growth and the potential for premium-priced services, thereby extending high-margin recurring revenue streams.

- The company's near-exclusive control of the .com and .net registries—combined with long-term ICANN agreements and the ability to implement periodic price increases—provides significant pricing power and operating leverage, which should materially increase net margins and drive earnings growth over time.

- Continuing investments in DNS infrastructure, marketing channel programs, and security innovation are resulting in greater registrar engagement and improved customer acquisition, which positions VeriSign to benefit from broader market trends such as the proliferation of connected devices, further boosting both top-line revenues and EBITDA margins.

- Resolution of the .web top-level domain conflict and eventual launch to customers would open a substantial new market, adding incremental revenue streams that are highly accretive to earnings, especially when combined with ongoing share buybacks and a newly introduced, growing dividend, supporting higher free cash flow per share.

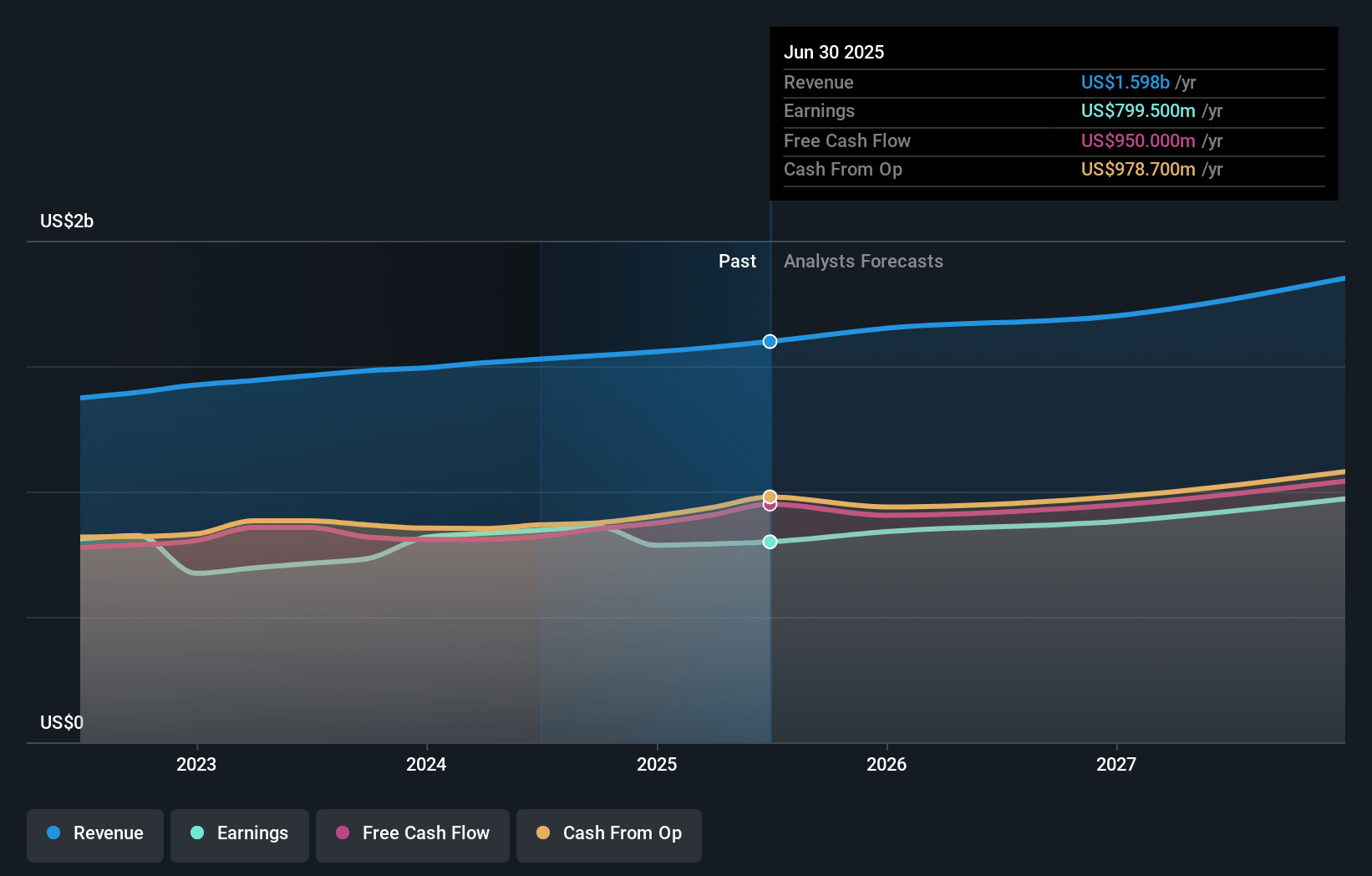

VeriSign Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on VeriSign compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming VeriSign's revenue will grow by 5.1% annually over the next 3 years.

- The bullish analysts are assuming VeriSign's profit margins will remain the same at 50.2% over the next 3 years.

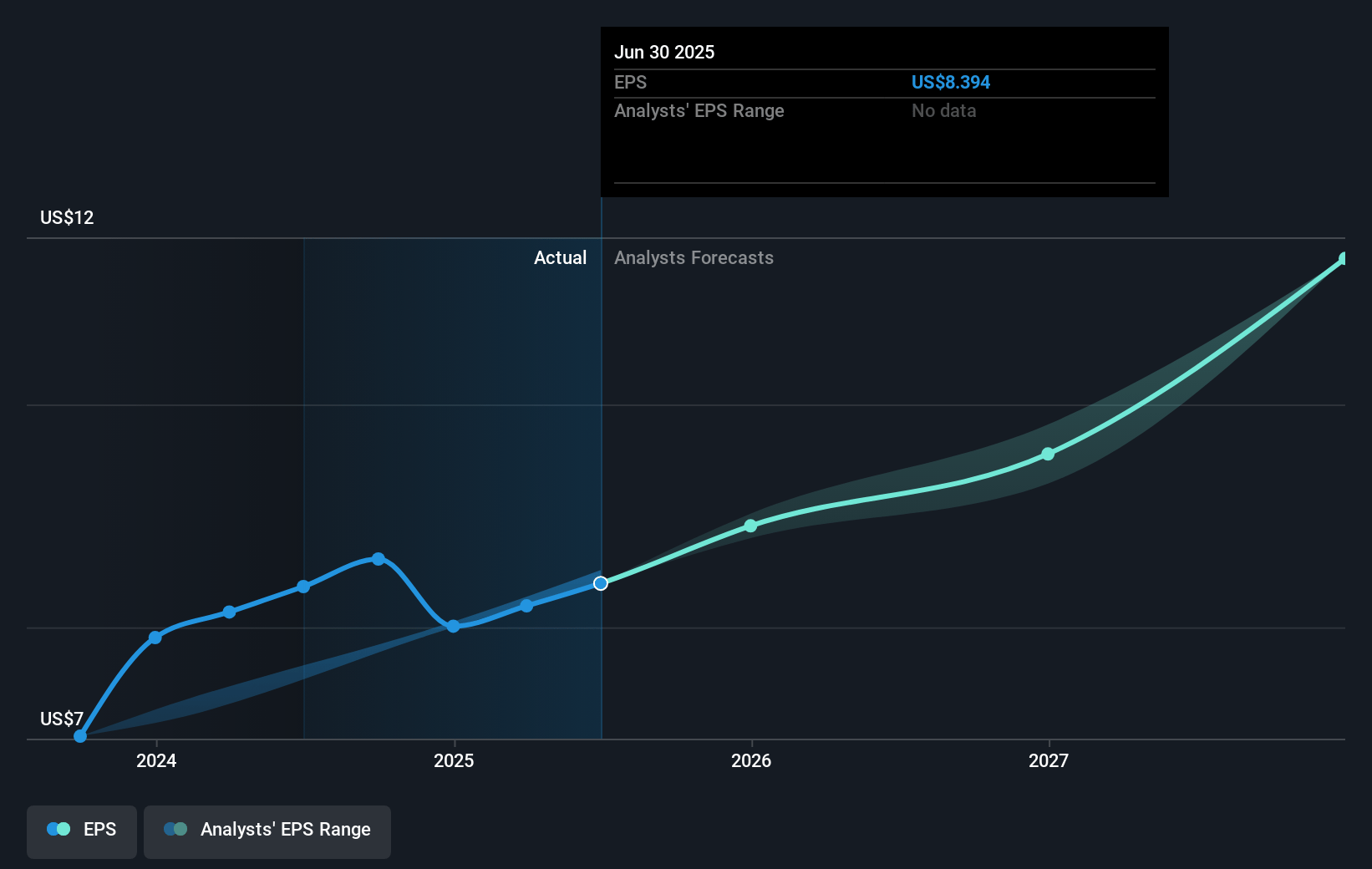

- The bullish analysts expect earnings to reach $917.0 million (and earnings per share of $10.64) by about May 2028, up from $790.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 31.5x on those 2028 earnings, down from 33.6x today. This future PE is lower than the current PE for the US IT industry at 31.8x.

- Analysts expect the number of shares outstanding to decline by 5.72% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.96%, as per the Simply Wall St company report.

VeriSign Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Greater government regulation and antitrust scrutiny of internet infrastructure monopolies could subject VeriSign's .com registry agreements to stricter pricing controls or force contract changes, directly reducing the company’s long-term revenue visibility and profitability.

- Continued technological innovation, including the rise of blockchain-based domains and decentralized digital identities, threatens to gradually erode demand for traditional domains, undermining the core driver of registrations and thus impacting future revenues.

- Saturation of internet connectivity in developed regions, combined with slower global population growth, limits the overall pool of potential new domain registrations, capping the long-term addressable market and constraining top-line revenue growth.

- The company's heavy reliance on its exclusive .com registry contract represents a significant concentration risk, meaning any loss, renegotiation under less favorable terms, or shock to this business line would have an outsized negative impact on revenue and free cash flow generation.

- Ongoing litigation, regulatory challenges, and potential increases in compliance costs—exemplified by the current disputes over newer TLDs like .web—can steadily drive up operating expenses and pressure net margins over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for VeriSign is $294.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of VeriSign's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $294.0, and the most bearish reporting a price target of just $217.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $917.0 million, and it would be trading on a PE ratio of 31.5x, assuming you use a discount rate of 8.0%.

- Given the current share price of $283.22, the bullish analyst price target of $294.0 is 3.7% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

Macroeconomic Uncertainties Will Pressure Pricing While Domain Momentum Lifts Outlook