Narratives are currently in beta

Key Takeaways

- Verint's AI innovation and hybrid cloud model drive SaaS revenue growth, expanding gross margins through faster adoption and integration of AI solutions.

- Strategic partnerships and expanded bot capabilities position Verint to capture market share in the contact center space, accelerating revenue and earnings growth.

- Heavy reliance on AI and cloud strategy coupled with SaaS revenue variability presents execution risks affecting growth, scalability, and investor confidence.

Catalysts

About Verint Systems- Provides customer engagement solutions worldwide.

- Verint's strong AI momentum and continuous innovation in AI-powered bots, such as the introduction of the CX EX scoring bot, are expected to drive future SaaS revenue growth as customers increasingly adopt AI for customer experience automation. This impacts revenue and potential for expanding gross margins.

- Verint's hybrid cloud model allows customers to rapidly deploy AI innovations without overhauling existing infrastructure, enabling faster adoption and integration, which may result in revenue growth and improved net margins as AI-related sales increase.

- The company is reporting substantial AI-driven business outcomes for customers, such as significant cost savings and enhanced service efficiency, which should drive increased demand for Verint's AI solutions and boost recurring revenue streams.

- Verint's partnerships and integrations, like those with RingCentral, position the company to capture more market share in the contact center space, leading to potential revenue acceleration as the AI adoption cycle matures.

- The expansion of Verint's bot capabilities and offerings, particularly in bundled solutions, is expected to increase customer consumption of AI services, potentially leading to higher margin recurring revenue and improved earnings growth.

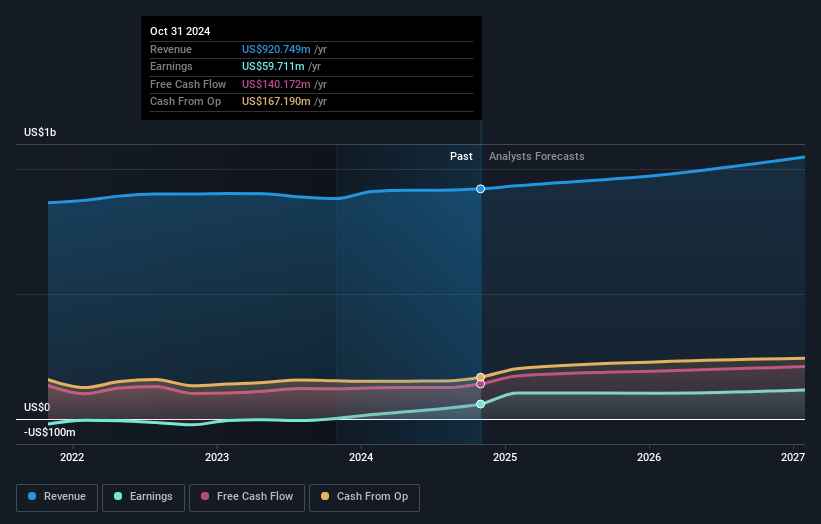

Verint Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Verint Systems's revenue will grow by 7.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.5% today to 12.5% in 3 years time.

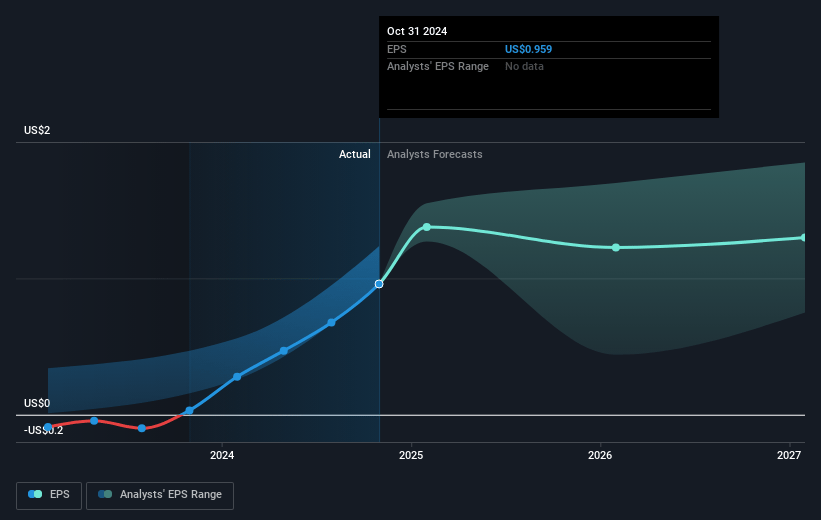

- Analysts expect earnings to reach $141.8 million (and earnings per share of $1.81) by about January 2028, up from $59.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.7x on those 2028 earnings, down from 26.8x today. This future PE is lower than the current PE for the US Software industry at 43.6x.

- Analysts expect the number of shares outstanding to grow by 8.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.6%, as per the Simply Wall St company report.

Verint Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's revenue growth is largely driven by unbundled SaaS renewal revenue, which could imply potential variability or fluctuations in future revenue streams if renewals do not materialize as expected. (Revenue impact)

- The company's growth strategy heavily relies on AI innovation and hybrid cloud adoption, which carries execution risk if customer adoption is slower than anticipated or if competitors develop superior AI solutions. (Revenue and earnings impact)

- Despite reporting strong AI-driven business outcomes, there is a risk associated with customer reluctance or delays in AI adoption that may affect the ongoing momentum and sales growth. (Revenue and earnings impact)

- Integration risks associated with acquired technologies might limit future scalability and potential cost efficiencies, potentially impacting net margins if the technologies fail to integrate smoothly or provide anticipated synergies. (Net margins impact)

- Heavy dependence on non-GAAP financial measures could obscure the underlying financial health of the company, leading to potential volatility in investor confidence if GAAP results reveal less favorable outcomes. (Earnings impact)

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $36.0 for Verint Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $32.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $141.8 million, and it would be trading on a PE ratio of 24.7x, assuming you use a discount rate of 7.6%.

- Given the current share price of $25.67, the analyst's price target of $36.0 is 28.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives