Key Takeaways

- Strategic data center development and asset acquisitions position Riot to diversify revenues, enhance stability, and lower costs through operational efficiencies and recurring earnings.

- Focus on energy efficiency, vertical integration, and capital discipline strengthens Riot's competitive advantage and flexibility as the digital asset infrastructure market expands.

- Heavy exposure to Bitcoin volatility, rising competition, operational cost sensitivity, and high capital outlays create material risks to profitability, cash flow, and future strategic transitions.

Catalysts

About Riot Platforms- Operates as a Bitcoin mining company in the United States.

- Riot's large AI/HPC data center development at Corsicana is positioned to benefit from rapidly accelerating demand for AI compute and digital infrastructure, as hyperscalers and major enterprises seek scarce, large blocks of power in prime-tier markets through 2030. Securing a flagship tenant and maximizing utilization of its 1-gigawatt site could meaningfully expand Riot’s long-term revenue and introduce recurring earnings streams with greater stability than Bitcoin mining.

- The acquisition of Rhodium’s assets, including 125 megawatts of low-cost, contracted power, gives Riot flexibility to expand hash rate or launch new adjacent infrastructure projects, supporting both top-line revenue growth and lower ongoing operating costs due to the elimination of legacy hosting losses and litigation expenses.

- Riot’s continued improvements in energy efficiency and vertical integration—including proprietary power strategies, engineering capabilities, and investments in domestically manufactured mining hardware—support a further reduction in cost per mined Bitcoin and improved gross margins, positioning the company to outperform peers as renewable energy becomes a larger driver of mining economics.

- As financial institutions and governments increasingly adopt blockchain technologies and digital assets, institutional interest in Bitcoin mining and related infrastructure is expected to grow. Riot’s scale, regulatory expertise, and focus on ESG positioning put it at the forefront to capture larger market share, boosting future revenue and creating a durable competitive advantage in the sector.

- Prudent capital management through diversified financing options, including Bitcoin-collateralized credit facilities, limited share dilution, and potential project-level financing for the data center, enables Riot to fuel growth investments while defending shareholder value. This disciplined approach is likely to improve future earnings, reduce risk, and increase the company’s financing flexibility as the business scales.

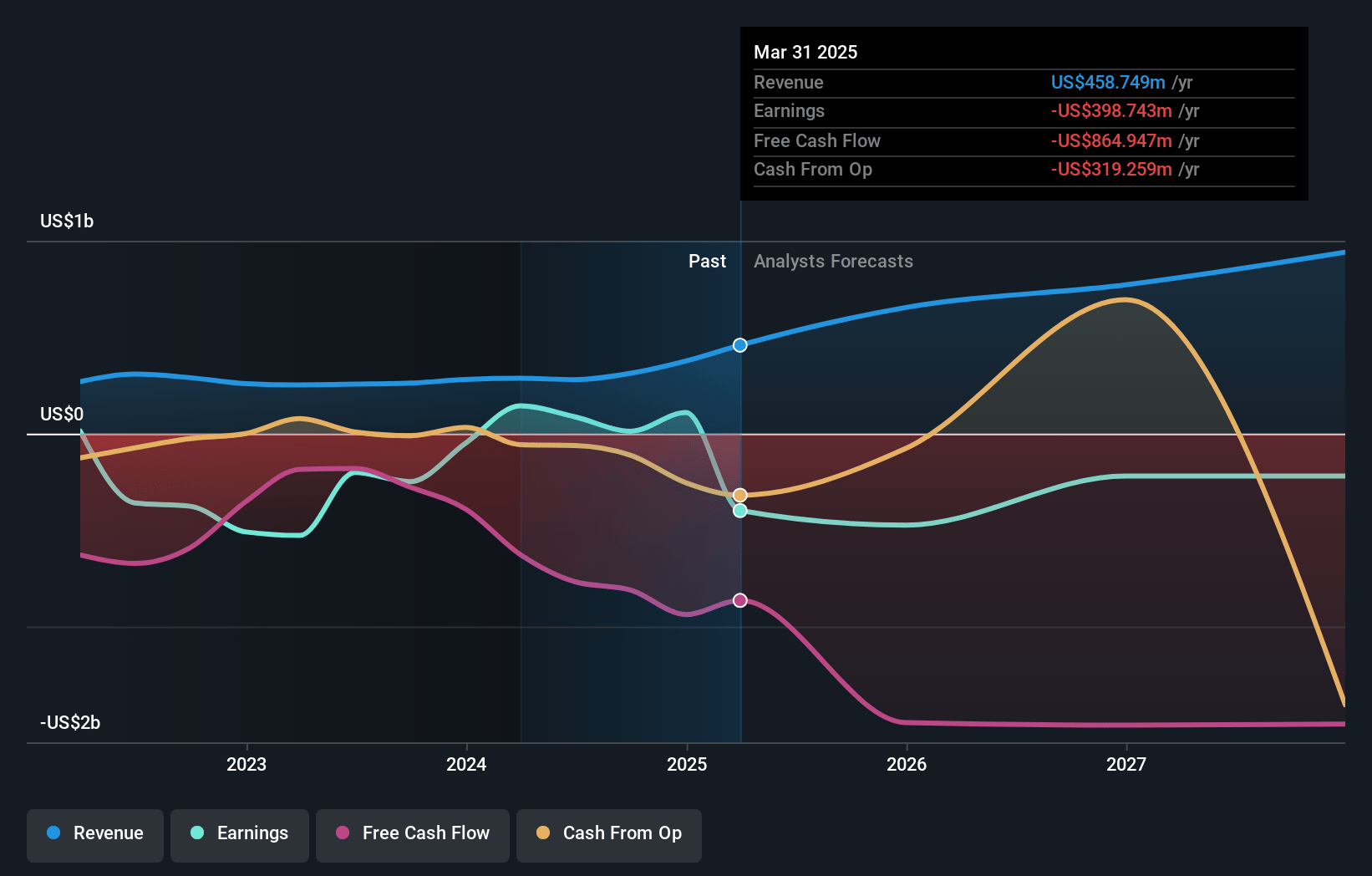

Riot Platforms Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Riot Platforms compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Riot Platforms's revenue will grow by 47.8% annually over the next 3 years.

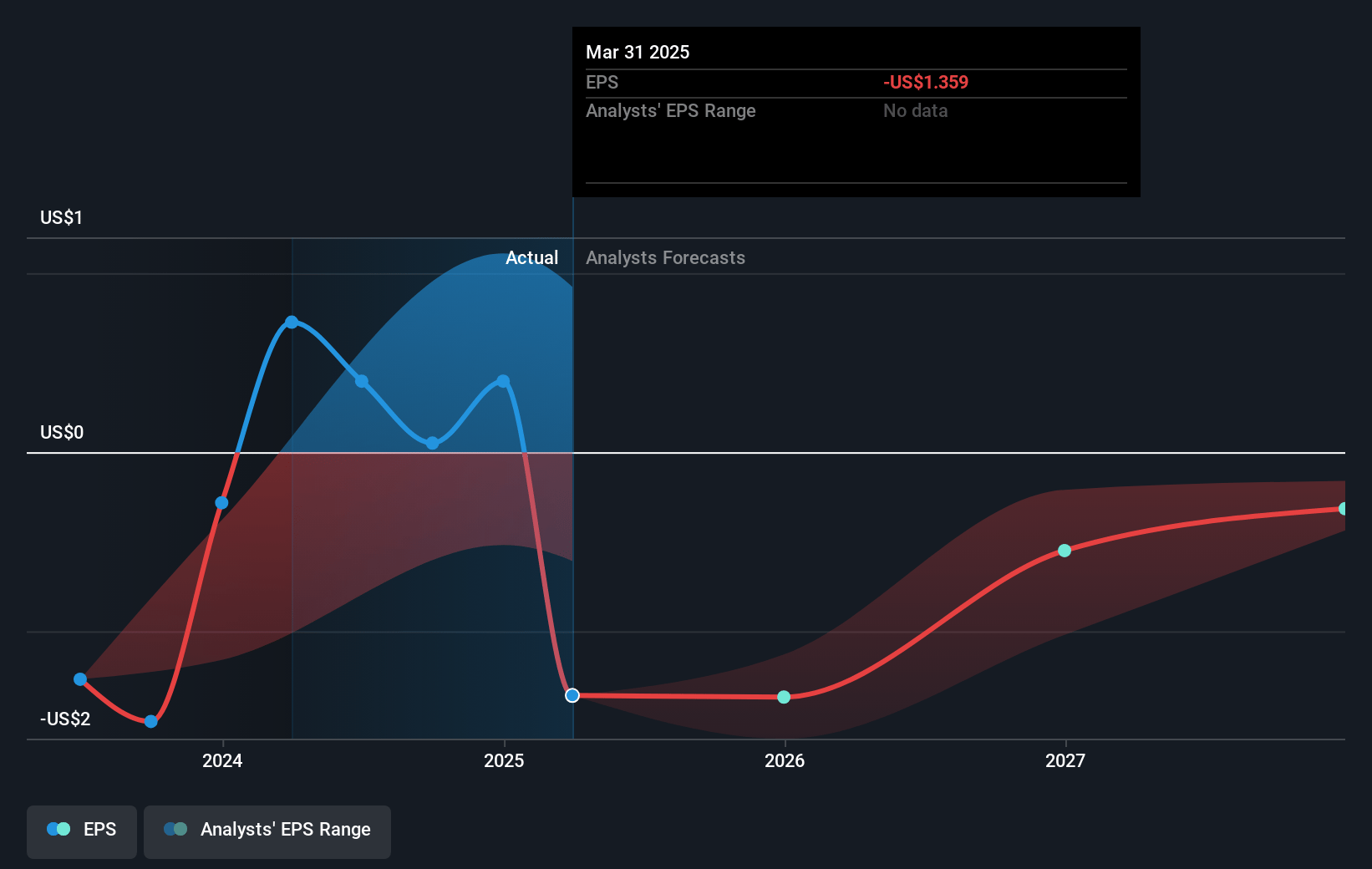

- Even the bullish analysts are not forecasting that Riot Platforms will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Riot Platforms's profit margin will increase from -86.9% to the average US Software industry of 13.2% in 3 years.

- If Riot Platforms's profit margin were to converge on the industry average, you could expect earnings to reach $195.9 million (and earnings per share of $0.45) by about July 2028, up from $-398.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 66.1x on those 2028 earnings, up from -11.1x today. This future PE is greater than the current PE for the US Software industry at 41.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.25%, as per the Simply Wall St company report.

Riot Platforms Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Riot’s ongoing reliance on Bitcoin exposes it to significant volatility and long-term secular risks, as shown by the $208 million mark-to-market write-down this quarter due to falling Bitcoin prices, which materially impacts net income and earnings stability.

- Rising global hash rates and new large-scale entrants are leading to margin compression, with Riot’s hash rate growth of 7 percent lagging the global increase of 10 percent, setting the stage for potential market share loss, lower gross margin, and squeezed profitability if the trend continues.

- The company’s model remains highly sensitive to increases in power costs, regulatory intervention, or environmental policy changes, with power expenses accounting for 81 percent of total direct mining costs, meaning even modest increases can severely erode gross profit and net margins.

- Heavy capital expenditure requirements for mining equipment, site expansion, and new data center ventures—such as the recent $48.9 million in Q1 capex and the $185 million Rhodium asset acquisition—create long-term pressure on free cash flow and may spur future dilution or debt if returns do not materialize as planned.

- Riot’s diversification strategy toward AI/HPC data centers is early-stage, with no signed leases, letters of intent, or revenue yet secured, making future returns uncertain while requiring substantial upfront investment, and leaving the company exposed to execution risk and potential drag on return on capital and earnings if the data center transition falls short of expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Riot Platforms is $23.36, which represents two standard deviations above the consensus price target of $16.27. This valuation is based on what can be assumed as the expectations of Riot Platforms's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $25.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.5 billion, earnings will come to $195.9 million, and it would be trading on a PE ratio of 66.1x, assuming you use a discount rate of 8.2%.

- Given the current share price of $12.42, the bullish analyst price target of $23.36 is 46.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.