Last Update 09 Feb 26

Fair value Decreased 3.42%QLYS: Recent Price Target Cuts Will Likely Temper Richness Of Current Pricing

The analyst price target for Qualys has been revised from $117 to $113, as analysts factor in updated assumptions around revenue growth, profit margins, and future P/E multiples following a series of recent price target reductions across the Street.

Analyst Commentary

Bearish analysts have been trimming their price targets on Qualys in a series of moves that collectively point to more cautious expectations around the stock. Recent cuts of US$4 to US$10 from multiple firms, including JPMorgan, highlight a reset in how near term risk and reward is being viewed.

While each report has its own angle, the common thread is a more guarded stance on how much investors should be willing to pay for Qualys under current assumptions on growth, margins, and future P/E multiples.

Bearish Takeaways

- Repeated target cuts clustered over a short period suggest bearish analysts are reassessing what they see as a rich valuation relative to their updated revenue and earnings assumptions.

- The reductions in price targets of US$4 to US$10 indicate concerns that execution risks or slower than previously assumed growth could limit upside from current levels.

- Some bearish analysts are tying lower targets to more conservative P/E multiples, reflecting a view that the stock may need a wider margin of safety if near term performance does not fully match prior expectations.

- The breadth of cuts, including from large firms such as JPMorgan, signals that caution is not isolated to a single view and that a portion of the Street is more focused on downside and volatility risk.

What's in the News

- The Trump administration is reported to be weighing whether to enlist private companies in cyberwarfare efforts, which could influence how investors think about cybersecurity vendors such as Qualys, although the article does not name specific beneficiaries (New York Times, periodical).

- Qualys issued earnings guidance for the first quarter of 2026, with expected revenues between US$172.5 million and US$174.5 million and GAAP net income per diluted share in a range of US$1.29 to US$1.36, based on an assumed 21% effective tax rate and approximately 36.0 million diluted shares (company guidance).

- For full year 2026, Qualys projected revenues between US$717.0 million and US$725.0 million and GAAP net income per diluted share between US$5.20 and US$5.48, based on approximately 35.4 million diluted shares (company guidance).

- On February 5, 2026, Qualys increased its equity buyback authorization by US$200 million, bringing the total plan authorization to US$1.6 billion (company announcement).

Valuation Changes

- Fair Value Estimate reduced from US$117 to US$113, reflecting a slightly lower central value for the shares in the updated model.

- Discount Rate adjusted marginally from 8.44% to 8.42%, indicating only a very small change in the assumed risk profile.

- Revenue Growth moved from 7.80% to 6.54%, pointing to more conservative expectations for how quickly sales may expand over time.

- Net Profit Margin refined from 25.21% to 24.97%, a modest pullback in assumed profitability on each dollar of revenue.

- Future P/E lowered from 24.59x to 23.52x, implying a slightly lower multiple applied to expected earnings in the updated valuation work.

Key Takeaways

- Embedded security features in major cloud platforms threaten to reduce demand for Qualys’ tools as customers consolidate spending with larger providers.

- Shifts toward integrated security, regulatory hurdles, and aggressive competition could compress margins, slow growth, and erode Qualys’ market share.

- Strong industry demand, innovative platform expansion, and effective partner strategies position Qualys for resilient recurring revenue, improved margins, and competitive advantage amid rising cybersecurity needs.

Catalysts

About Qualys- Provides cloud-based platform delivering information technology (IT), security, and compliance solutions in the United States and internationally.

- The ongoing rise of cloud infrastructure managed by hyperscale providers such as AWS and Azure is likely to result in significant security capabilities being embedded natively in cloud offerings, which could substantially erode demand for Qualys’ third-party security tools and negatively impact future revenue growth as customers consolidate spend within the hyperscaler ecosystem.

- Increasing regulatory scrutiny around data privacy and cross-border data flows is expected to create additional compliance costs or impede Qualys’ ability to scale internationally, leading to margin compression and slower expansion of overall earnings power.

- The rapid shift towards integrated, all-in-one security platforms by larger enterprises may favor more diversified or horizontally integrated cybersecurity companies, leaving Qualys, with its reliance on vulnerability management and slower entry into adjacent markets, at risk of declining customer retention and weaker top-line growth.

- Intense competition and the accelerating pace of AI-driven security innovation among peers could expose Qualys’ slower innovation cycles, resulting in long-term erosion of market share and stagnation in revenue from its core product offerings.

- Growing industry consolidation may lead to dominant players bundling security solutions at aggressive price points, thereby elevating customer acquisition costs for Qualys and ultimately exerting sustained downward pressure on both net margins and earnings growth over the long run.

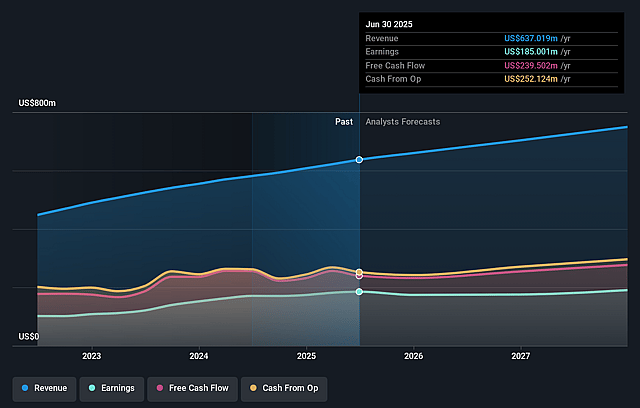

Qualys Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Qualys compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Qualys's revenue will grow by 4.5% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 29.2% today to 25.6% in 3 years time.

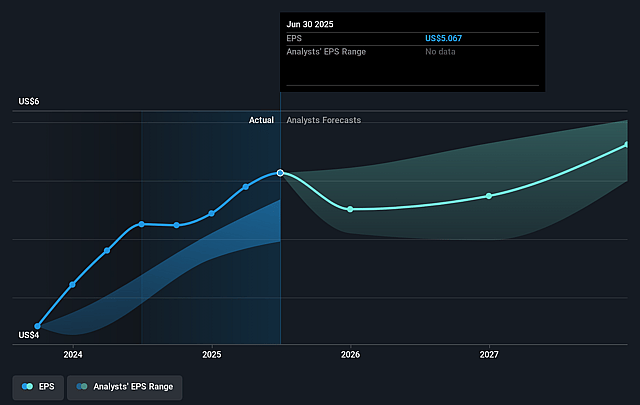

- The bearish analysts expect earnings to reach $181.3 million (and earnings per share of $4.9) by about July 2028, down from $181.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 24.8x on those 2028 earnings, down from 28.1x today. This future PE is lower than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to decline by 1.32% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.9%, as per the Simply Wall St company report.

Qualys Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The acceleration of digital transformation and the proliferation of cloud adoption are greatly expanding organizations’ cybersecurity needs, fueling persistent demand for unified cloud-native solutions like Qualys, which could drive sustained revenue growth and help maintain strong earnings.

- Intensifying regulation worldwide around cybersecurity and audit readiness is proving to be a strong secular tailwind, as organizations must invest in automated risk management, compliance, and evidence collection solutions—an area where Qualys is innovating and gaining customer traction, which could help stabilize and grow net margins.

- Qualys’ expansion and rapid innovation of its unified cloud platform—including new products like the Enterprise TruRisk Management (ETM) and TotalAI—are driving greater customer stickiness, furthering upsell opportunities, and increasing average revenue per user, which in turn supports predictable recurring revenues and long-term profitability.

- The company’s partner-first strategy is accelerating, with nearly half of revenue now coming through partners, international growth outpacing domestic, and partner-led bookings increasing, all of which could lower customer acquisition costs and expand revenue opportunities, thus improving earnings and operating leverage over time.

- As cyber threats escalate and enterprise customers seek to consolidate fragmented security tooling onto integrated platforms, Qualys’ ability to ingest and orchestrate data across its own and third-party solutions sets it up to benefit from industry consolidation, allowing continued margin expansion and top-line growth even as competitors enter the space.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Qualys is $105.23, which represents two standard deviations below the consensus price target of $136.11. This valuation is based on what can be assumed as the expectations of Qualys's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.0, and the most bearish reporting a price target of just $90.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $708.6 million, earnings will come to $181.3 million, and it would be trading on a PE ratio of 24.8x, assuming you use a discount rate of 7.9%.

- Given the current share price of $140.34, the bearish analyst price target of $105.23 is 33.4% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Qualys?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.