Key Takeaways

- Platformization strategy and expansion in cloud security sectors may strain earnings due to acquisition costs and necessary customer buy-in.

- Rising investment in AI and new technologies might pressure margins, straining short-term profitability amid aggressive market expansion efforts.

- Strong growth in security offerings and strategic investments in AI and automation position Palo Alto Networks for sustainable growth and profitability.

Catalysts

About Palo Alto Networks- Provides cybersecurity solutions worldwide.

- Palo Alto Networks is leaning heavily into its platformization strategy, aiming to consolidate and simplify cybersecurity products for enterprises. This approach might face challenges as it requires significant customer buy-in and long-term investment, which could potentially impact revenue growth as the market adjusts to these shifts.

- The integration of AI and automation into security offerings is central to Palo Alto Networks' future strategy. While promising, this initiative requires substantial investment in technology and resources, which could impact net margins if the anticipated efficiencies and customer uptake do not materialize as quickly as expected.

- The company's aggressive expansion into the cloud security and Cortex operations sectors, highlighted by costly acquisitions like QRadar, may temporarily strain earnings. The success of these ventures hinges on quickly converting existing customers to the new platforms, posing a risk if execution falters or competition increases.

- With an ambitious goal to achieve 2,500 to 3,500 platformization deals by fiscal year 2030, Palo Alto Networks must significantly increase large-scale customer engagements. This could strain operational capacity and financial resources in the short term, potentially affecting short-term earnings as the company scales its operations.

- The rising costs of developing and maintaining new technologies such as the Prisma Access browser and AI copilots, along with the integration of acquired assets, might pressure profit margins. Such investments are essential for maintaining the company's competitive edge but could impact short-term profitability if costs outpace initial revenue gains.

Palo Alto Networks Future Earnings and Revenue Growth

Assumptions

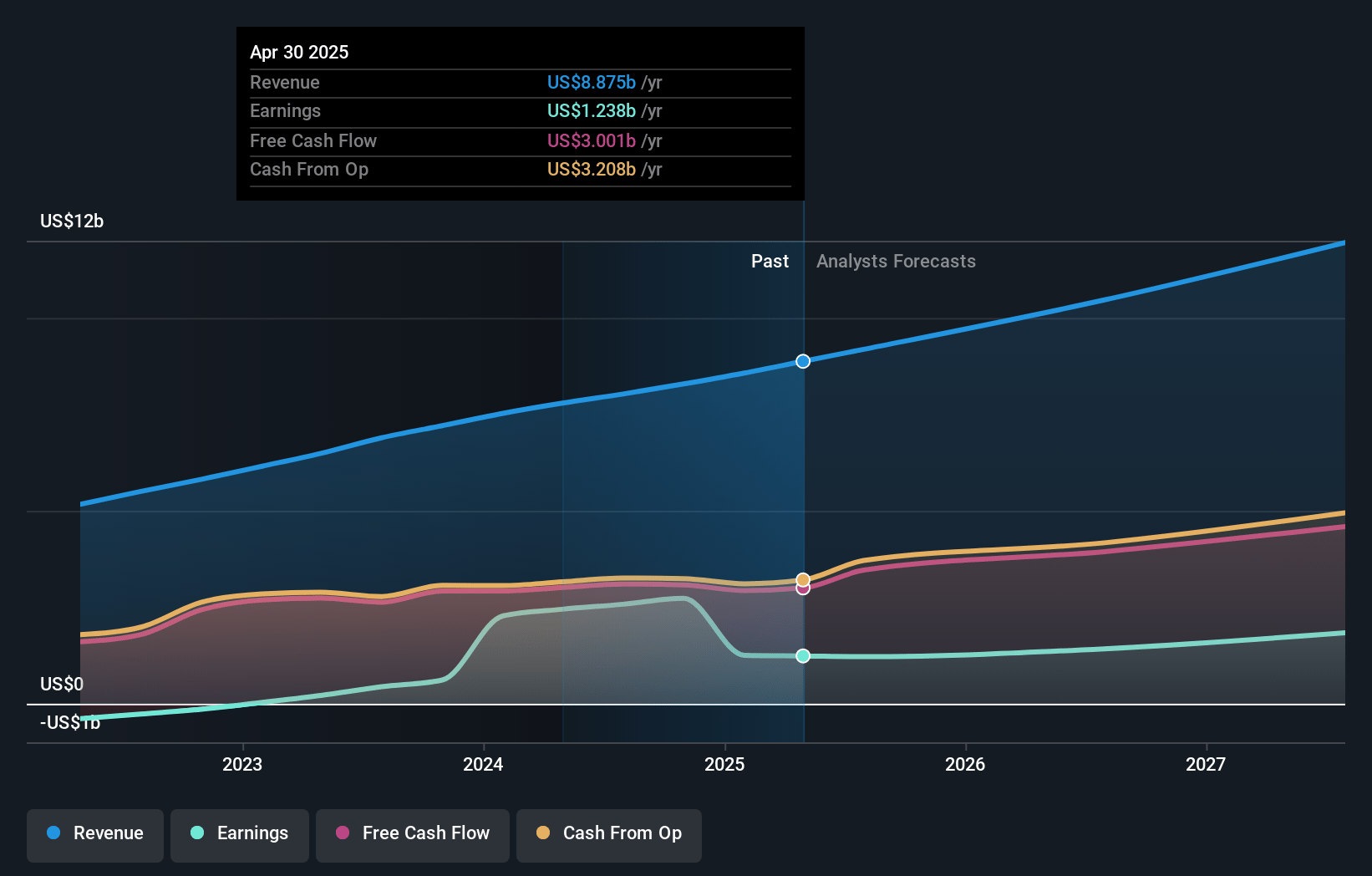

How have these above catalysts been quantified?- Analysts are assuming Palo Alto Networks's revenue will grow by 15.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 33.0% today to 16.3% in 3 years time.

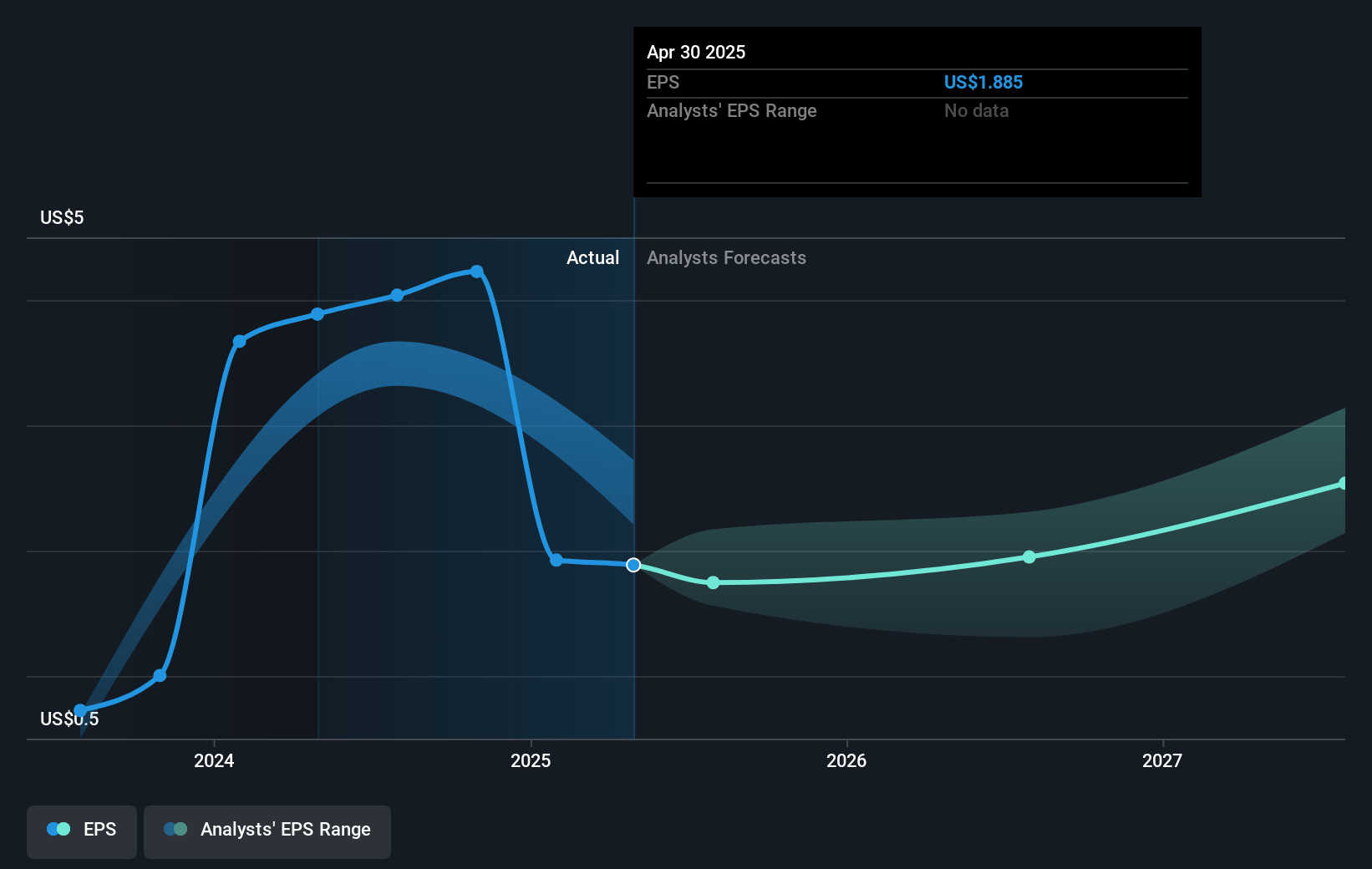

- Analysts expect earnings to reach $2.1 billion (and earnings per share of $2.92) by about January 2028, down from $2.7 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $3.0 billion in earnings, and the most bearish expecting $1.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 84.5x on those 2028 earnings, up from 46.3x today. This future PE is greater than the current PE for the US Software industry at 43.6x.

- Analysts expect the number of shares outstanding to grow by 2.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.97%, as per the Simply Wall St company report.

Palo Alto Networks Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The strong growth in next-generation security offerings, particularly in Cortex and NetSec, and NGS ARR growing 40% to $4.5 billion indicate a robust demand for Palo Alto Networks' products, which could positively impact revenue and earnings.

- The company's focus on efficiency, evident in the 60 basis point expansion in operating margins, alongside a 13% EPS growth, suggests improvements in net margins and overall profitability.

- The platformization strategy has led to large deal success, with a 30% increase in transactions over $5 million. This could further boost revenue and secure long-term customer relationships, enhancing earnings stability.

- Investment in AI and automation for threat detection and management, alongside strategic acquisitions like Talon Cyber Security and QRadar, positions the company for future growth and a strong competitive edge, potentially increasing market share and revenue.

- Exceeding fiscal year 2025 outlook in NGS ARR, revenue, and EPS due to the established platforms and innovation focus, suggests confidence in sustainable growth, positively affecting financial performance metrics like earnings and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $202.08 for Palo Alto Networks based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $240.0, and the most bearish reporting a price target of just $112.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $12.7 billion, earnings will come to $2.1 billion, and it would be trading on a PE ratio of 84.5x, assuming you use a discount rate of 7.0%.

- Given the current share price of $192.94, the analyst's price target of $202.08 is 4.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives