Key Takeaways

- Delays in projects due to staffing and scheduling issues could lead to deferred revenue and lower short-term earnings expectations.

- Focus on transitioning existing clients to cloud services may slow immediate subscription revenue growth, impacting revenue diversification and growth potential.

- Transformation and innovation at Logility, with strong financial performance and a growing pipeline, suggests potential for increased revenue, stable earnings, and enhanced market perception.

Catalysts

About Logility Supply Chain Solutions- Develops, markets, and supports a range of computer business application software products in the United States and internationally.

- The company is experiencing delays in starting projects due to staffing challenges and client scheduling preferences, which could lead to deferred revenue recognition and lower short-term revenue expectations.

- Elongated sales cycles and deferral of large transactions into future periods, influenced by economic uncertainty and global events, may impact revenue growth and lead to unpredictability in earnings.

- There is an increased focus on converting existing on-premise clients to cloud services, but the transition process and inherent client budgeting cycles could result in longer conversion times, affecting immediate subscription revenue growth.

- The normalization of bookings skewed towards existing clients indicates an over-reliance on current clients, which could limit substantial new revenue streams and impact revenue diversification and growth potential.

- Delays in professional services projects and expected lower revenue from this segment, despite maintaining EBITDA guidance, suggest potential pressure on overall profitability and might hint at diminishing service margins impacting net earnings.

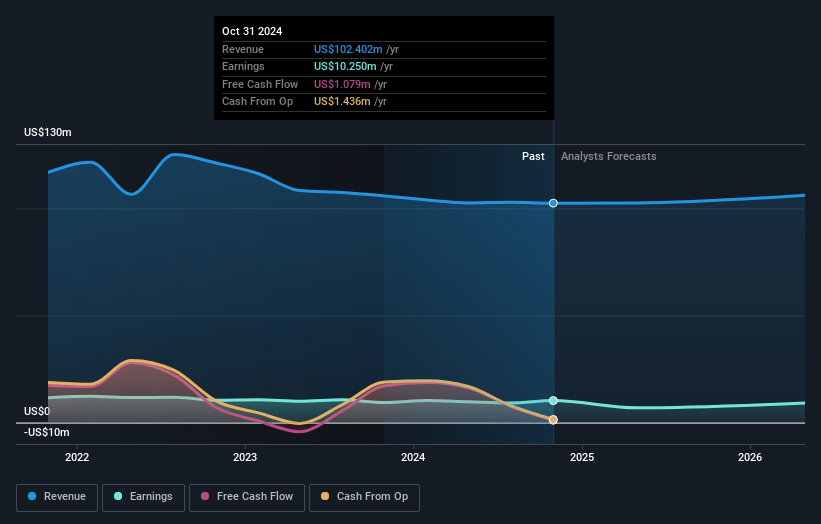

Logility Supply Chain Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Logility Supply Chain Solutions's revenue will grow by 2.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 10.0% today to 6.8% in 3 years time.

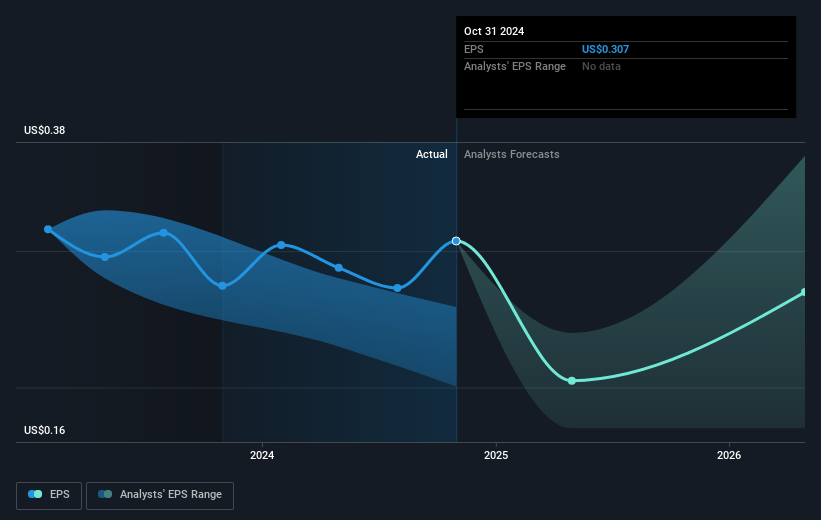

- Analysts expect earnings to reach $7.4 million (and earnings per share of $0.22) by about February 2028, down from $10.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 83.2x on those 2028 earnings, up from 46.5x today. This future PE is greater than the current PE for the US Software industry at 42.2x.

- Analysts expect the number of shares outstanding to grow by 1.38% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.31%, as per the Simply Wall St company report.

Logility Supply Chain Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The transformation and rebranding to Logility, along with the divestiture of non-core businesses, could result in streamlined operations and enhanced market perception, potentially boosting revenue and net margins.

- Strong adjusted EBITDA and earnings from continuing operations indicate healthy financial management, which could support stable earnings and net margins in the future.

- The 9% year-over-year growth in subscription revenue suggests a successful recurring revenue model, which could lead to consistent revenue and potentially higher earnings.

- The launch of new solutions like network optimization and the Decision Command Center, along with a generative AI platform, indicates innovation and market demand, potentially increasing revenue and net margins.

- A robust and growing pipeline, even with delayed deals, coupled with high client retention rates, indicates future revenue potential and stable earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.3 for Logility Supply Chain Solutions based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $109.6 million, earnings will come to $7.4 million, and it would be trading on a PE ratio of 83.2x, assuming you use a discount rate of 7.3%.

- Given the current share price of $14.14, the analyst price target of $14.3 is 1.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

WA

Consensus Narrative from 1 Analyst

AI-First Strategy Fuels Cloud Growth Amid Economic Uncertainties And Margin Pressures

Key Takeaways The shift towards AI-first strategy and cloud-hosted services is set to enrich the revenue mix with higher-margin, cloud-based revenues. Enhancements in AI for supply chain planning and corporate governance improvements are poised to drive market share expansion and attract a broader investor base.

View narrativeUS$16.00

FV

11.9% undervalued intrinsic discount4.18%

Revenue growth p.a.

0users have liked this narrative

0users have commented on this narrative

0users have followed this narrative

4 months ago author updated this narrative