Last Update 15 Aug 25

Fair value Increased 16%Analysts have raised their price target for i3 Verticals from $32.00 to $37.00, citing Q3 outperformance, successful public sector transition, improved business clarity, and a stronger risk/reward profile.

Analyst Commentary

- Bullish analysts cite outperformance in Q3 results, reflecting successful execution and a smooth transition to a pure-play Public Sector software company.

- Improved visibility and clarity into the business model post-transition is considered supportive for investor confidence.

- Operating momentum and "clean execution" position the company favorably for potential revenue acceleration and further market share gains.

- A "strong setup" going into FY26 and enhanced risk/reward dynamics are seen as tailwinds for the stock’s near-term performance.

- Rising takeout potential and a more attractive relative valuation compared to software peers are noted as drivers for upward price target revisions.

What's in the News

- i3 Verticals is actively seeking acquisitions, focusing on opportunities in the public sector vertical and integrating targeted AI solutions to enhance effectiveness for customers.

- The Board of Directors authorized a share repurchase plan, allowing up to $50 million in Class A Common Stock buybacks, expiring on the earlier of September 30, 2026, or full expenditure.

- i3 Verticals was added to the Russell 2000 Defensive Index, Russell 2000 Growth-Defensive Index, and Russell 2000 Value-Defensive Index.

Valuation Changes

Summary of Valuation Changes for i3 Verticals

- The Consensus Analyst Price Target has significantly risen from $32.00 to $37.00.

- The Consensus Revenue Growth forecasts for i3 Verticals has significantly fallen from 1.3% per annum to -0.3% per annum.

- The Future P/E for i3 Verticals has significantly fallen from 52.80x to 31.47x.

Key Takeaways

- Strong demand for AI-powered public sector software and ongoing innovation drive revenue growth, customer retention, and improved margins through modernization and higher client wallet share.

- Focus on high-barrier government verticals and disciplined acquisitions ensures stable, recurring revenues and scalable growth with operational and financial flexibility.

- Growing focus on public sector software heightens exposure to revenue volatility, margin pressure, and competitive risks amid sector-specific uncertainties and evolving regulatory or technological landscapes.

Catalysts

About i3 Verticals- i3 Verticals, Inc. builds, acquires, and grows software solutions in the public sector and healthcare vertical markets in the United States and Canada.

- Increasing digitization initiatives among state and local governments are driving sustained demand for integrated public sector software solutions, as evidenced by double-digit revenue and SaaS growth for i3 Verticals, supporting continued organic revenue and ARR growth.

- i3 Verticals' deepening integration of AI and automation into its software products to modernize public sector operations (e.g., document analysis, support automation, development efficiency) both increases customer retention via higher switching costs and improves gross margins by boosting operational efficiency.

- A singular focus on high-barrier public sector verticals (education, utilities, transportation, justice/public safety) positions i3 Verticals to benefit from multi-year enterprise system upgrades and recurring, contractually escalated revenues, supporting both revenue visibility and expanding net margins.

- Ongoing product innovation and cross-selling of new modules (Justice Tech, transportation kiosks, utility ePortals, education platforms), alongside market expansion in new states, directly increase wallet share per client and drive top-line growth.

- A robust, debt-free balance sheet and large revolving credit facility enable disciplined pursuit of strategic "tuck-in" acquisitions-allowing for scalable, inorganic revenue and EBITDA growth while maintaining long-term earnings accretion.

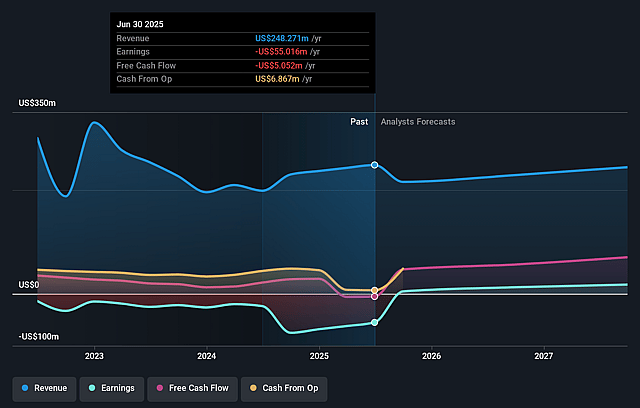

i3 Verticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming i3 Verticals's revenue will decrease by 1.0% annually over the next 3 years.

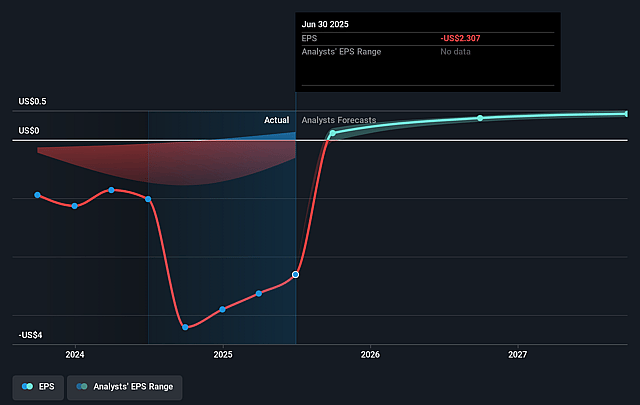

- Analysts assume that profit margins will increase from -22.2% today to 15.2% in 3 years time.

- Analysts expect earnings to reach $36.6 million (and earnings per share of $0.91) by about September 2028, up from $-55.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.5x on those 2028 earnings, up from -12.8x today. This future PE is greater than the current PE for the US Software industry at 36.6x.

- Analysts expect the number of shares outstanding to grow by 1.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.41%, as per the Simply Wall St company report.

i3 Verticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- i3 Verticals' increasing concentration in the public sector-especially government, utilities, and education-exposes the company to sector-specific budget cycles, procurement delays, and potential political or regulatory shifts, which could introduce long-term revenue volatility and dampen top-line growth.

- The company's strategy to invest heavily in talent and product development ahead of anticipated revenue opportunities (particularly in Justice Tech) increases near-term cost structure; if projected growth does not materialize as expected, this could compress margins and negatively impact earnings.

- Reliance on recurring but sometimes variable software license and professional services sales, which are subject to quarter-to-quarter swings, introduces unpredictability in revenue streams and makes long-term financial planning and forecasting challenging-potentially leading to investor skepticism and lower valuation multiples.

- Rapid advancements in technology, ongoing commoditization of vertical SaaS markets, and increasing competition from larger tech firms or more agile fintechs could render i3 Verticals' solutions less competitive over time, risking customer attrition, slower ARR growth, and heightened pricing pressure that squeeze net margins.

- The shift to a pure-play public sector software model, while creating focus, reduces diversification and increases exposure to changes in public sector IT spending priorities or regulatory actions, potentially amplifying risks to both revenue stability and earnings resilience over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $37.0 for i3 Verticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $30.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $240.9 million, earnings will come to $36.6 million, and it would be trading on a PE ratio of 42.5x, assuming you use a discount rate of 8.4%.

- Given the current share price of $29.42, the analyst price target of $37.0 is 20.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.