Last Update 01 Nov 25

Narrative Update on Analyst Price Target for Information Services Group

Analysts have adjusted their price target for Information Services Group slightly. The new target is $6.67 per share, reflecting a minimal change based on nuanced updates to company fundamentals including discount rate and future price-to-earnings assumptions.

What's in the News

- The ISG Provider Lens® AI-Driven ADM Services report for Asia Pacific highlights rising adoption of AI-powered application development and maintenance services, including automated testing and modernization of legacy systems to boost efficiency and reduce errors. (ISG Key Developments)

- Enterprises are turning to enterprise service management (ESM) platforms with embedded AI capabilities to streamline operations across business functions beyond IT and drive measurable gains in efficiency and service delivery. (ISG Key Developments)

- ISG has initiated a research study on mainframe modernization, focusing on hybrid IT integration, cloud-native development and GenAI-driven strategies to transform mainframe services and software. (ISG Key Developments)

- Findings from recent ISG research reveal growing demand for modern learning management systems that integrate compliance and personalized learning experiences, with top vendors recognized in new ISG Buyers Guides™. (ISG Key Developments)

- Information Services Group is examining how AI, analytics, and digital tools are helping mid-tier and specialist service providers enhance manufacturing sector efficiency and resilience amid global supply chain challenges. (ISG Key Developments)

Valuation Changes

- Consensus Analyst Price Target remains unchanged at $6.67 per share, reflecting stability in projected fair value.

- The discount rate has risen slightly from 9.56% to 9.59%, indicating a marginal increase in the rate used to value future cash flows.

- Revenue growth projections are effectively unchanged, staying at approximately 4.54%.

- The net profit margin estimate is steady at roughly 4.78%, with no notable change.

- The future P/E (price-to-earnings) ratio has increased very slightly from 30.10x to 30.13x, suggesting a minimal adjustment in valuation expectations.

Key Takeaways

- Expanding demand for AI and digital transformation services is boosting ISG's revenue growth, while recurring revenues and acquisitions improve earnings quality and geographic reach.

- Growing need for specialized advisory due to regulatory and technological complexity enhances ISG's competitive position and supports stable, higher-margin performance.

- Rising automation, client insourcing, and intensifying competition threaten ISG's revenue, margins, and scalability as demand for traditional advisory services becomes less predictable and more commoditized.

Catalysts

About Information Services Group- Operates as an artificial intelligence (AI) centered technology research and advisory company in the Americas, Europe, and the Asia Pacific.

- Accelerating enterprise investment in AI and digital transformation-driven by the ongoing modernization of IT infrastructure and operations-continues to expand the addressable market for advisory firms like ISG, as seen by surging AI-related revenues and expanding client interest, which is likely to fuel strong top-line revenue growth.

- ISG's increasing penetration into the mid-market via its ISG Tango platform, alongside growth in recurring revenue streams (now 45% of total revenue), is creating more stable, higher-margin revenue sources and is poised to improve net margins and earnings quality going forward.

- Strategic acquisitions, such as the recent purchase of Martino & Partners to grow the European public sector business and deepen service offerings beyond central to municipal government clients, are expanding ISG's client base and geographic reach, representing future catalysts for both revenue and EBITDA growth.

- Clients' ongoing need to optimize technology spend amid economic uncertainty, cost pressures, and the shift toward cloud and AI is sustaining strong demand for ISG's core sourcing, benchmarking, and advisory services-positioning the company to benefit from long-term, resilient demand that supports consistent revenue growth.

- The rising complexity of AI, multi-vendor sourcing, and increasing regulatory scrutiny means enterprises require specialized, independent expertise, enhancing the competitive positioning and pricing power of firms like ISG and supporting sustained expansion in net margins.

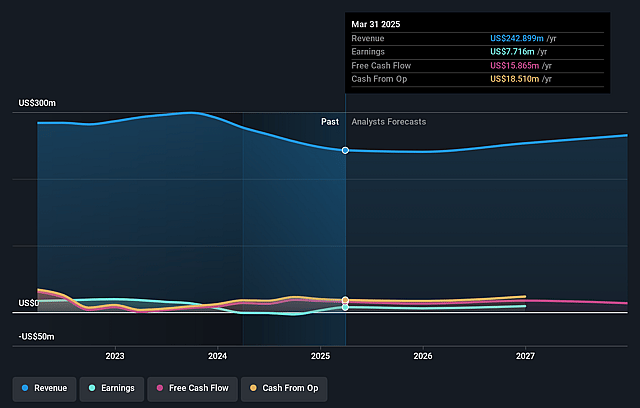

Information Services Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Information Services Group's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.3% today to 4.8% in 3 years time.

- Analysts expect earnings to reach $13.2 million (and earnings per share of $0.25) by about September 2028, up from $7.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.5x on those 2028 earnings, down from 31.7x today. This future PE is lower than the current PE for the US IT industry at 32.4x.

- Analysts expect the number of shares outstanding to decline by 1.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.51%, as per the Simply Wall St company report.

Information Services Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The rapid maturation of AI and automation technologies could commoditize many advisory services currently offered by ISG, leading clients to use digital tools or in-house solutions instead, thereby suppressing long-term revenue growth and potentially compressing margins.

- Larger enterprises are focusing on building in-house AI, IT strategy, and benchmarking expertise in order to retain control and cut external consulting costs, which threatens ISG's addressable market and can negatively impact revenues and client retention rates.

- Despite near-term momentum, European markets remain cautious and subject to macroeconomic and geopolitical uncertainties, which could delay or cancel large transformation projects and result in more cyclical and unpredictable revenues for ISG.

- Increased competition from major consulting and technology firms expanding their end-to-end digital transformation offerings may outcompete ISG's more focused, niche portfolio, putting pressure on market share and pricing, thus impacting revenue growth and profit margins.

- ISG's business model remains heavily reliant on recurring but human-capital-intensive services, and limited operational leverage may restrict the scalability of earnings, particularly if technology-driven clients increasingly adopt DIY benchmarking tools or more fully automated solutions, pressuring both revenues and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.25 for Information Services Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $274.4 million, earnings will come to $13.2 million, and it would be trading on a PE ratio of 23.5x, assuming you use a discount rate of 9.5%.

- Given the current share price of $5.17, the analyst price target of $5.25 is 1.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.