Key Takeaways

- Demand for IT advisory and modernization is rising, supporting ISG's revenue growth and enhancing revenue visibility through longer, higher-value contracts.

- ISG's expertise and proprietary platforms position it for high-margin, recurring revenue as clients navigate digital transformation, regulatory pressures, and advanced technologies.

- Accelerating AI adoption, client caution, and competition from large providers are pressuring ISG's revenue growth, margins, and market share across key segments.

Catalysts

About Information Services Group- Operates as an artificial intelligence (AI) centered technology research and advisory company in the Americas, Europe, and the Asia Pacific.

- The rapid adoption of AI, cloud, and digital transformation is accelerating across industries, driving strong multi-year demand for IT advisory, cloud migration, and modernization projects-this is expected to expand ISG's pipeline and boost future revenue growth.

- Enterprises are facing heightened complexity in hybrid/multi-cloud environments, leading to longer, higher-value contracts and more recurring advisory needs for ISG, supporting revenue visibility and improving operating leverage.

- Sectoral recovery, particularly in Banking/Financial Services, Energy, and Manufacturing, combined with strong mega-deal activity in the Americas and EMEA, suggests an upswing in large, high-margin contracts that could meaningfully enhance top-line revenue and net margins.

- Competitive differentiation through proprietary data platforms, benchmarking, and industry-specific expertise positions ISG to capture value from increased regulatory and digital sovereignty concerns, which should drive recurring, higher-margin revenue streams.

- The convergence of GenAI, engineering, and product development services is reshaping client strategies, with ISG well-placed to benefit from the transition to higher-value, innovation-driven engagements and digital operating models, supporting sustainable earnings growth.

Information Services Group Future Earnings and Revenue Growth

Assumptions

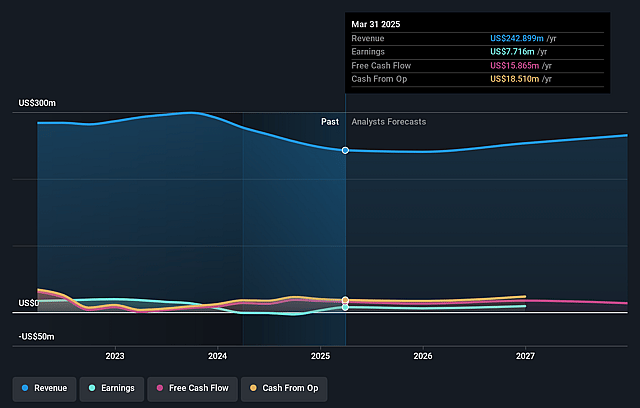

How have these above catalysts been quantified?- Analysts are assuming Information Services Group's revenue will grow by 3.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.2% today to 3.3% in 3 years time.

- Analysts expect earnings to reach $8.8 million (and earnings per share of $0.17) by about July 2028, up from $7.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.5x on those 2028 earnings, up from 28.3x today. This future PE is greater than the current PE for the US IT industry at 27.6x.

- Analysts expect the number of shares outstanding to decline by 1.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.91%, as per the Simply Wall St company report.

Information Services Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The accelerated adoption of generative AI and agentic AI is reducing the resources and time required for application modernization and certain managed services, leading to potential revenue cannibalization and declining prices for project-based work, which could negatively impact ISG's long-term revenue and margins.

- The market is seeing a pronounced decline in smaller discretionary deals (down 10% year-over-year), with continued delayed decision-making and softness in quarter-over-quarter growth, suggesting persistent caution among enterprise clients that could constrain ISG's revenue growth and pipeline visibility.

- The BPO segment, which has historically been an area of growth, reported a 25% decline in annual contract value year-to-date, along with shrinking deal sizes and commoditization driven by tech-plus-agent models-indicating margin compression and higher competition that could weaken ISG's earnings and segment profitability.

- Geopolitical uncertainty, evolving regulations (e.g., EU Digital Markets Act, AI Act), and increasing demands for digital/data sovereignty are complicating multi-region deals and elongating sales cycles, potentially slowing ISG's ability to scale and driving up compliance and operational costs, impacting its net margins.

- Large integrated service providers and hyperscalers with robust digital engineering and AI capabilities are capturing a growing share of engineering and cloud transformation opportunities, which may limit ISG's addressable market and competitive positioning, adversely affecting market share and long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.833 for Information Services Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $269.2 million, earnings will come to $8.8 million, and it would be trading on a PE ratio of 39.5x, assuming you use a discount rate of 8.9%.

- Given the current share price of $4.53, the analyst price target of $5.83 is 22.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.