Narratives are currently in beta

Key Takeaways

- Increased forward guidance could overestimate future revenue, raising discrepancies in earnings forecasts if arbitration outcomes with Lenovo and Samsung are unfavorable.

- Fixed-fee licensing agreements with major OEMs might limit revenue potential if smartphone market growth declines, affecting revenue projections and investor expectations.

- Successful licensing, strategic R&D reinvestment, and greenfield expansion drive robust revenue growth and diversification, with improved margins through reduced litigation costs.

Catalysts

About InterDigital- Operates as a global research and development company with focus primarily on wireless, visual, artificial intelligence (AI), and related technologies.

- The significant increase in forward guidance, driven by major agreements with key OEMs like OPPO and Lenovo, suggests an anticipation of robust revenue growth that could be overestimated relative to actual future performance. This impacts revenue expectations.

- The reliance on arbitration to finalize terms with Lenovo and Samsung introduces uncertainty about the final revenue recognition and net terms, which could lead to discrepancies in earnings forecasts if the outcomes are less favorable than expected.

- The ambitious target of achieving $1 billion in annual recurring revenue by 2030, with a significant increase in smartphone program revenue by 2027, could lead to inflated investor expectations regarding revenue and earnings growth if not met.

- Significant expenses associated with ongoing and future litigation or arbitration disputes could compress net margins if underestimated or rise significantly beyond current estimates.

- The impact of fixed-fee licensing agreements with large OEMs like OPPO might limit upside potential if smartphone market growth or shipment volumes decline, potentially affecting revenue projections.

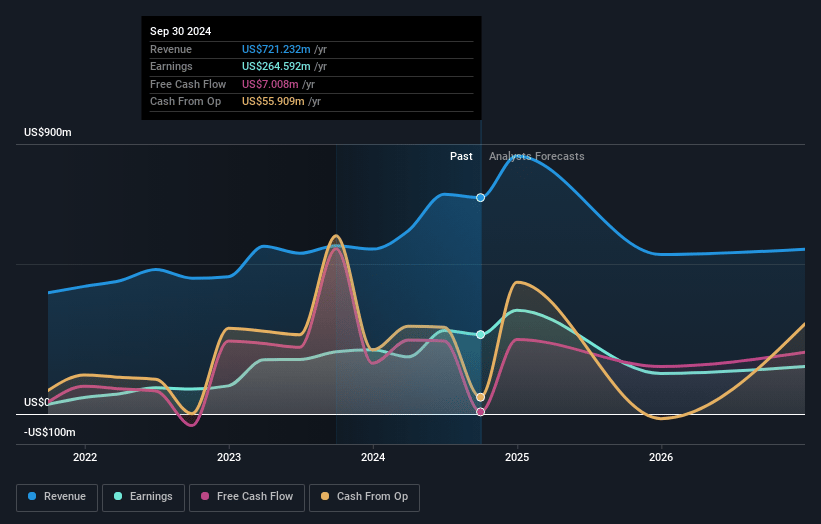

InterDigital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming InterDigital's revenue will decrease by -4.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 36.7% today to 32.4% in 3 years time.

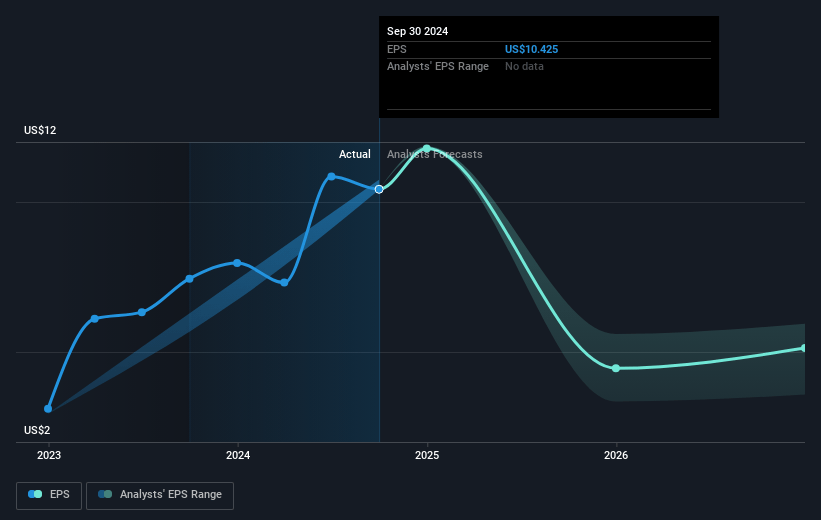

- Analysts expect earnings to reach $201.2 million (and earnings per share of $6.83) by about December 2027, down from $264.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.3x on those 2027 earnings, up from 18.4x today. This future PE is lower than the current PE for the US Software industry at 41.2x.

- Analysts expect the number of shares outstanding to grow by 5.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.19%, as per the Simply Wall St company report.

InterDigital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- InterDigital's successful license agreements with major smartphone manufacturers like OPPO, Samsung, and Apple, covering a significant portion of the global smartphone market, suggest robust revenue growth and potential for increased market share. This positively influences revenue projections.

- The company's strong patent portfolio in 5G, WiFi, and advanced video technology, recognized by independent rankings, underpins its capability to maintain and grow licensing revenue, positively impacting net margins through strategic reinvestment in R&D.

- InterDigital's projected increase in recurring revenue and cash flow, as evidenced by significant ARR growth and increased full-year revenue guidance, indicates potential for strengthened earnings and financial stability.

- The resolution of litigation with major partners and the ongoing decrease in litigation expenses point to an improvement in profit margins and operational cost efficiency.

- InterDigital's focus on expanding into new greenfield opportunities such as cloud-based video services and IoT markets represents a potential for long-term growth in revenue streams, diversifying income and supporting future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $176.5 for InterDigital based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $235.0, and the most bearish reporting a price target of just $100.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $620.7 million, earnings will come to $201.2 million, and it would be trading on a PE ratio of 31.3x, assuming you use a discount rate of 7.2%.

- Given the current share price of $192.09, the analyst's price target of $176.5 is 8.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives