Key Takeaways

- Strong pipeline, strategic partnerships, and AI-driven solutions position Gorilla for accelerated recurring revenue and long-term earnings growth through high-value, multi-year contracts.

- Disciplined cost management, SaaS pivot, and expanding M&A activity support significant margin expansion and market share consolidation against competitors.

- Dependence on slow government contracts, customer concentration, high investment spending, increased competition, and rising regulatory hurdles could threaten revenue stability, profitability, and growth prospects.

Catalysts

About Gorilla Technology Group- Provides solutions in security, network, business intelligence, and Internet of Things (IoT) technology in Taiwan and the United Kingdom.

- While analysts broadly agree that Gorilla's $5 billion pipeline and global expansion could power revenue and margin growth, they may be materially underestimating the conversion and upsize rates-current wins like the Royal Thai project hint at multi-year, near-monopoly relationships that could unlock an order-of-magnitude acceleration in contracted recurring revenues and long-term earnings, especially as successful proof-of-concept deployments have triggered nationwide follow-on opportunities worth hundreds of millions in a single client.

- The consensus expects positive margin impact from a shift to sovereign and national infrastructure recurring revenues, but the true scale of margin expansion could be far greater as Gorilla's deliberate pivot to high-value, multi-year SaaS contracts, strategic cost discipline, and stringent deal selection create a structurally higher net margin profile-management targets gross margins drifting toward 50 percent as contract mix shifts, supporting both outsized earnings and cash flow.

- Gorilla is at an inflection point to benefit disproportionately from the explosive growth in AI-driven analytics and edge computing, with its proprietary video intelligence and AI security stack positioned as essential infrastructure for ongoing global smart city buildouts and public safety investments, suggesting a powerful, sustained demand tailwind that could drive structural outperformance in both revenue velocity and addressable market.

- Strategic partnerships, including the operational OEM agreement with Hewlett Packard Enterprise and investment in the ONE AMAZON project, provide direct access to global enterprise and governmental channels, opening non-linear new customer access, and unlocking untapped, high-value verticals in environmental intelligence, IoT, and security-these alliances should significantly expand both top-line growth and margin upside.

- Gorilla's accelerating M&A strategy in Southeast Asia, disciplined share buybacks with a fortress balance sheet, and commitment to organic plus acquisitive expansion position it to rapidly consolidate market share, outpace competitors, and leverage operating scale benefits-potentially driving both a step function in earnings power and improving equity value per share.

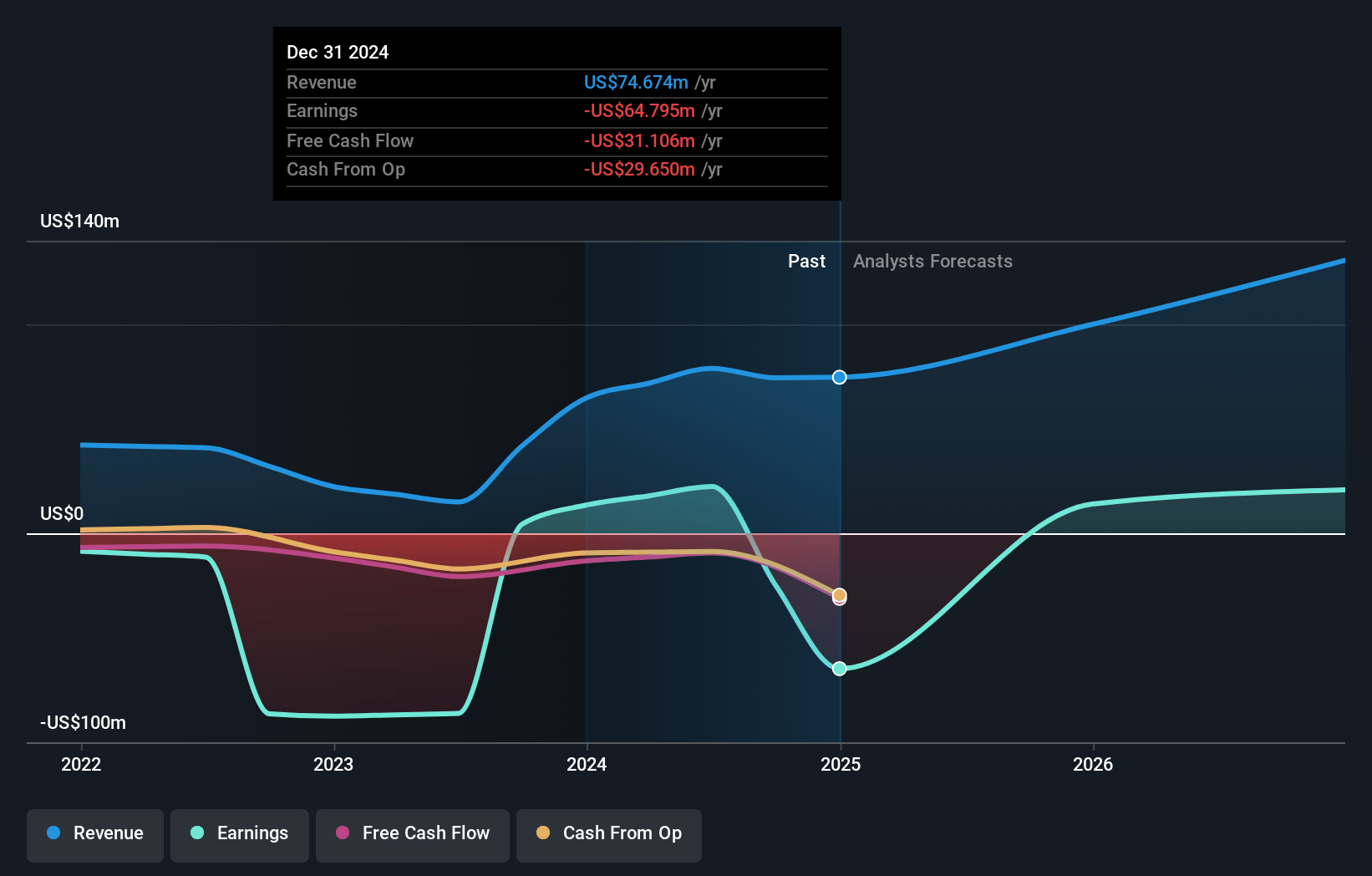

Gorilla Technology Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Gorilla Technology Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Gorilla Technology Group's revenue will grow by 36.4% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -68.7% today to 20.8% in 3 years time.

- The bullish analysts expect earnings to reach $44.5 million (and earnings per share of $1.8) by about July 2028, up from $-57.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 27.4x on those 2028 earnings, up from -7.9x today. This future PE is lower than the current PE for the US Software industry at 41.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.91%, as per the Simply Wall St company report.

Gorilla Technology Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lengthy proof-of-concept phases and slow government contracting cycles, highlighted by the company's major deals in Thailand and smart education, expose Gorilla Technology Group to extended revenue recognition timelines and the risk that expected revenues may not materialize as forecast, which could result in significant volatility to both revenue and earnings.

- Persistent reliance on a small number of large, multi-year government contracts and a few key regions creates customer concentration risk, meaning that the loss or delay of any major contract could sharply impact the company's revenue and cash flow stability.

- Sustained high levels of investment in acquisitions, partnerships, and headcount expansion, as seen with ongoing investments in projects such as ONE AMAZON and the upcoming acquisition in Thailand, could lead to increased R&D and SG&A expenses that outpace revenue growth, pressuring net margins and potentially leading to persistent net losses.

- The accelerating commoditization of AI, edge computing, and security solutions, together with intensifying competition from global technology giants and fast-moving startups, threatens Gorilla Technology Group's pricing power and market share, which could result in margin contraction and slower top-line growth over the long term.

- Heightened regulatory scrutiny and evolving data privacy laws in the company's expansion territories risk increasing compliance costs and operational complexity, constraining international growth opportunities and ultimately putting pressure on both revenue growth and net profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Gorilla Technology Group is $35.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Gorilla Technology Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $27.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $213.8 million, earnings will come to $44.5 million, and it would be trading on a PE ratio of 27.4x, assuming you use a discount rate of 8.9%.

- Given the current share price of $20.24, the bullish analyst price target of $35.0 is 42.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.