Last Update07 May 25

Key Takeaways

- Embedded security in major operating systems and agile, cloud-native rivals threaten Gen Digital’s core product relevance, revenue growth, and pricing power.

- Regulatory pressures, compliance costs, and consumer fatigue with subscriptions may compress margins and destabilize recurring revenue streams.

- Strong customer retention, strategic acquisitions, and innovation in AI-driven cybersecurity position Gen Digital for reliable growth, margin expansion, and successful market diversification.

Catalysts

About Gen Digital- Engages in the provision of cyber safety solutions for consumers.

- The widespread introduction of increasingly sophisticated built-in security features by major operating system vendors threatens to significantly reduce Gen Digital’s addressable market for core cybersecurity products, putting sustained downward pressure on future revenue growth.

- Intensifying government regulations and evolving global privacy laws are expected to drive up compliance costs and may restrict data collection capabilities for Gen Digital’s products, leading to long-term net margin compression and higher operating expenses.

- Heightened competition from more agile, cloud-native cybersecurity providers is accelerating industry commoditization, which could force Gen Digital into price wars and erode both their subscriber base and average revenue per user, ultimately threatening revenue stability and margin resilience over time.

- The company’s continued reliance on the Norton and LifeLock brand legacy poses a long-term risk as consumer preferences shift toward fully integrated, device-agnostic cybersecurity solutions, undermining Gen Digital’s pricing power and limiting their ability to maintain premium earnings growth.

- Persistent signs of consumer fatigue with subscription-based software, coupled with growing negative sentiment around bundling and auto-renewal practices, are likely to result in elevated churn rates over the next decade, destabilizing recurring subscription revenues and compressing earnings predictability.

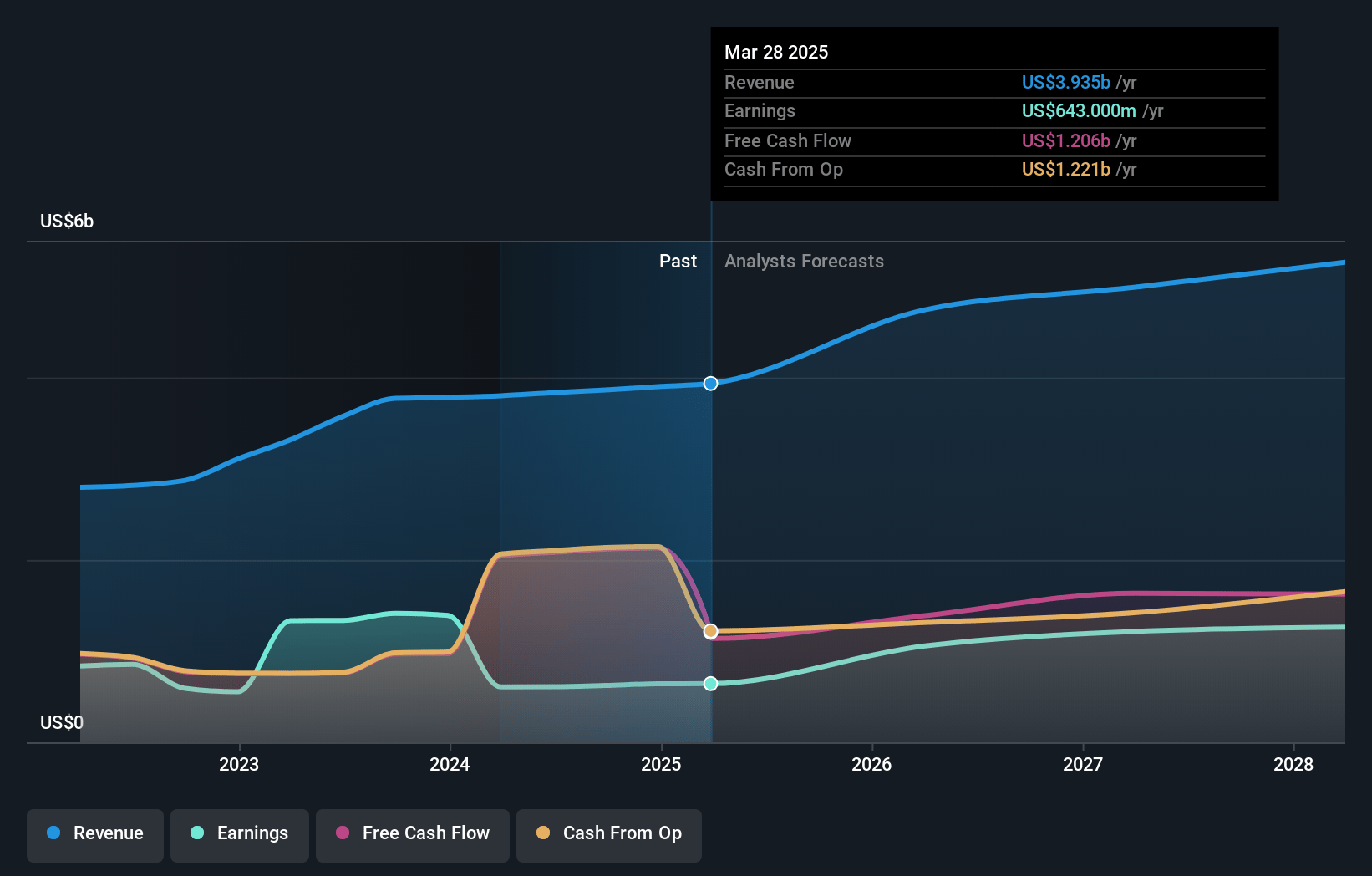

Gen Digital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Gen Digital compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Gen Digital's revenue will grow by 2.8% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 16.4% today to 28.6% in 3 years time.

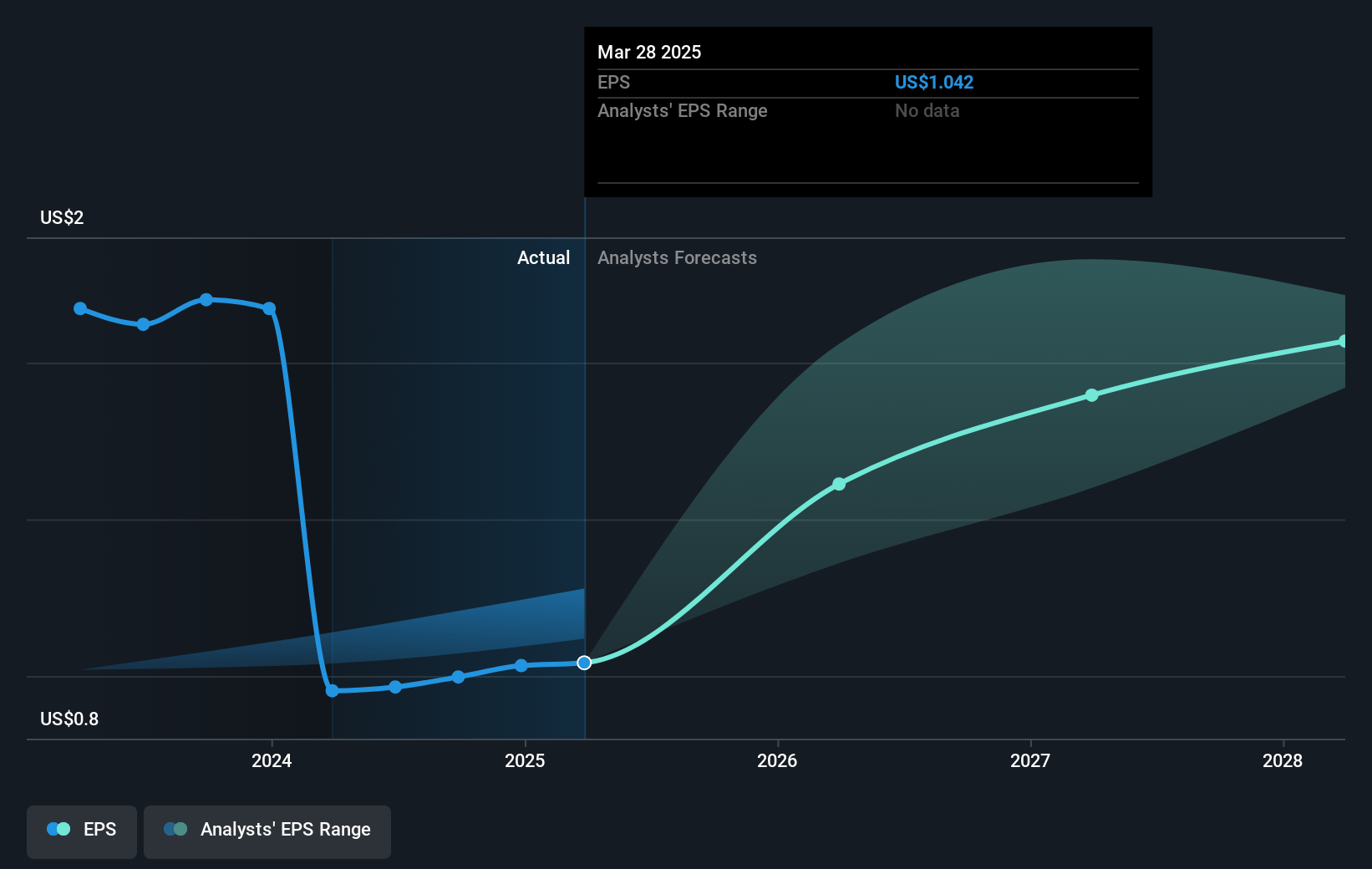

- The bearish analysts expect earnings to reach $1.2 billion (and earnings per share of $1.94) by about May 2028, up from $641.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, down from 24.7x today. This future PE is lower than the current PE for the US Software industry at 33.3x.

- Analysts expect the number of shares outstanding to decline by 1.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.07%, as per the Simply Wall St company report.

Gen Digital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The continued global rise in cyber threats, including AI-powered scams and widespread data breaches, is driving consumer and enterprise demand for Gen Digital’s cybersecurity and identity protection products, which supports robust long-term revenue growth and customer retention rates.

- Gen Digital’s recurring subscription-based business model, supported by 23 consecutive quarters of top-line growth and increasing customer counts, provides highly visible and stable cash flows, which underpin strong net margins and sustained earnings expansion.

- The successful integration of acquisitions such as MoneyLion and Avast is facilitating cross-selling opportunities, improved operational synergies, and greater access to the expanding financial wellness market, increasing Gen’s addressable market and potential for revenue diversification.

- Ongoing investment in AI-driven product innovation, personalized customer journeys, and international expansion—particularly through new markets and indirect partner channels like employee benefits—positions Gen Digital to capture long-term industry tailwinds and drive both ARPU and total bookings higher.

- Strength in customer retention and the uptake of higher-value memberships (such as 45% of direct customers now having comprehensive Cyber Safety offerings) indicate an increasing customer lifetime value, supporting margin expansion and predictable long-term earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Gen Digital is $25.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Gen Digital's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $37.0, and the most bearish reporting a price target of just $25.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $4.2 billion, earnings will come to $1.2 billion, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 9.1%.

- Given the current share price of $25.72, the bearish analyst price target of $25.0 is 2.9% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives