Key Takeaways

- Viant's growth is threatened by evolving privacy regulations, big tech consolidation, and challenges accessing crucial audience data due to the rise of walled gardens.

- High R&D and innovation demands, fragmented measurement standards, and advertiser inertia may limit Viant's operational leverage and ability to fully capture digital ad spend.

- Heightened privacy regulations, big tech dominance, and margin pressures could hinder Viant's growth and profitability despite innovation and continued investment in new technologies.

Catalysts

About Viant Technology- Operates as an advertising technology company.

- Although Viant is benefiting from the long-term migration of ad spend from linear TV to digital channels-particularly Connected TV, which now comprises 45% of platform spend and shows robust growth-the company remains exposed to future regulatory changes around consumer privacy. Tighter privacy laws or further restrictions on identifiers could reduce the effectiveness of addressable and measurable campaigns, unduly pressuring both revenue growth and net margins if Viant's innovative solutions cannot fully compensate for lost addressability.

- While adoption of Viant's privacy-centric identity solutions (such as Household ID and IRIS_ID) and AI-driven automation is accelerating, with substantial uptick in contribution ex-TAC and customer wins, Viant still faces significant risk from big tech consolidation and the continuing rise of walled gardens. If industry giants like Google or Amazon tighten their control of key inventory or data, Viant's ability to access critical audience and contextual data across premium inventory could deteriorate, limiting addressable market expansion and impeding sustained topline growth.

- Despite the attractive secular trend of clients reallocating budgets from underperforming search and social channels into measurable, incremental-lift CTV campaigns-which has driven recurring revenue and record spend-Viant's growth trajectory is at risk if the widespread adoption of incrementality measurement stalls, or if brands revert to entrenched last-touch attribution models. This potential inertia among advertisers may constrain the pace of revenue reallocation and limit Viant's leverage in expanding earnings.

- Though Viant's investments in AI and cloud-based technology have yielded operational leverage, demonstrated by adjusted EBITDA rising faster than contribution ex-TAC and expanding EBITDA margins, the pace of innovation required to keep up with rapid advances in machine learning and ongoing privacy demands could force sustained high R&D spend. Should revenue growth normalize or slow due to macro or competitive factors, the need for continual investment could suppress operating margins in the medium term.

- While the company's current client diversification and reduced exposure to tariff-impacted verticals have insulated recent results, the fragmentation of the CTV ad ecosystem and ongoing challenges in establishing unified measurement standards may slow the full monetization of next-generation media formats. Should this fragmentation persist, it could prevent Viant from fully capturing new digital ad spend, causing revenue and EBITDA growth to fall short of their long-term potential.

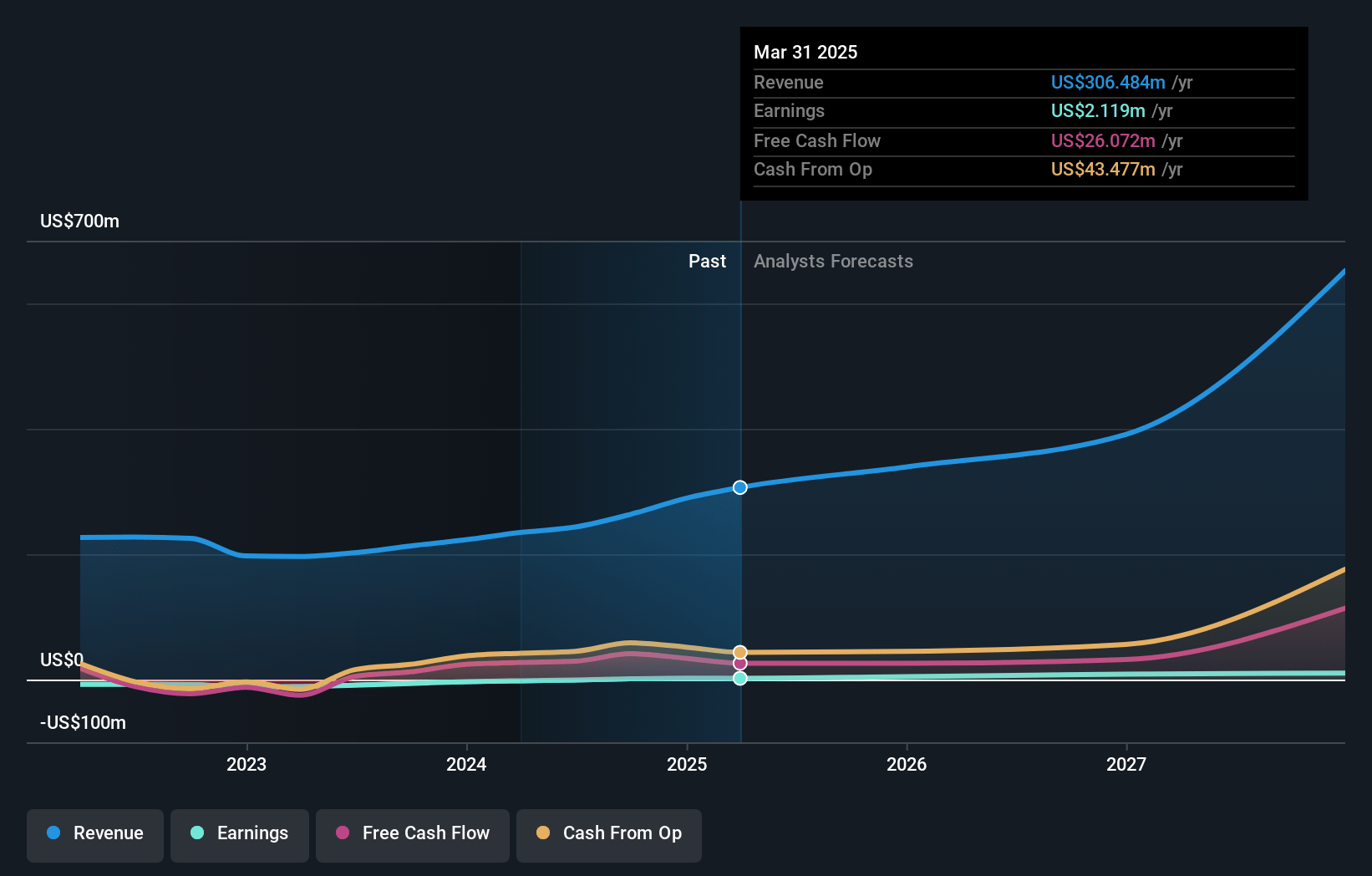

Viant Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Viant Technology compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Viant Technology's revenue will grow by 11.7% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 0.7% today to 2.2% in 3 years time.

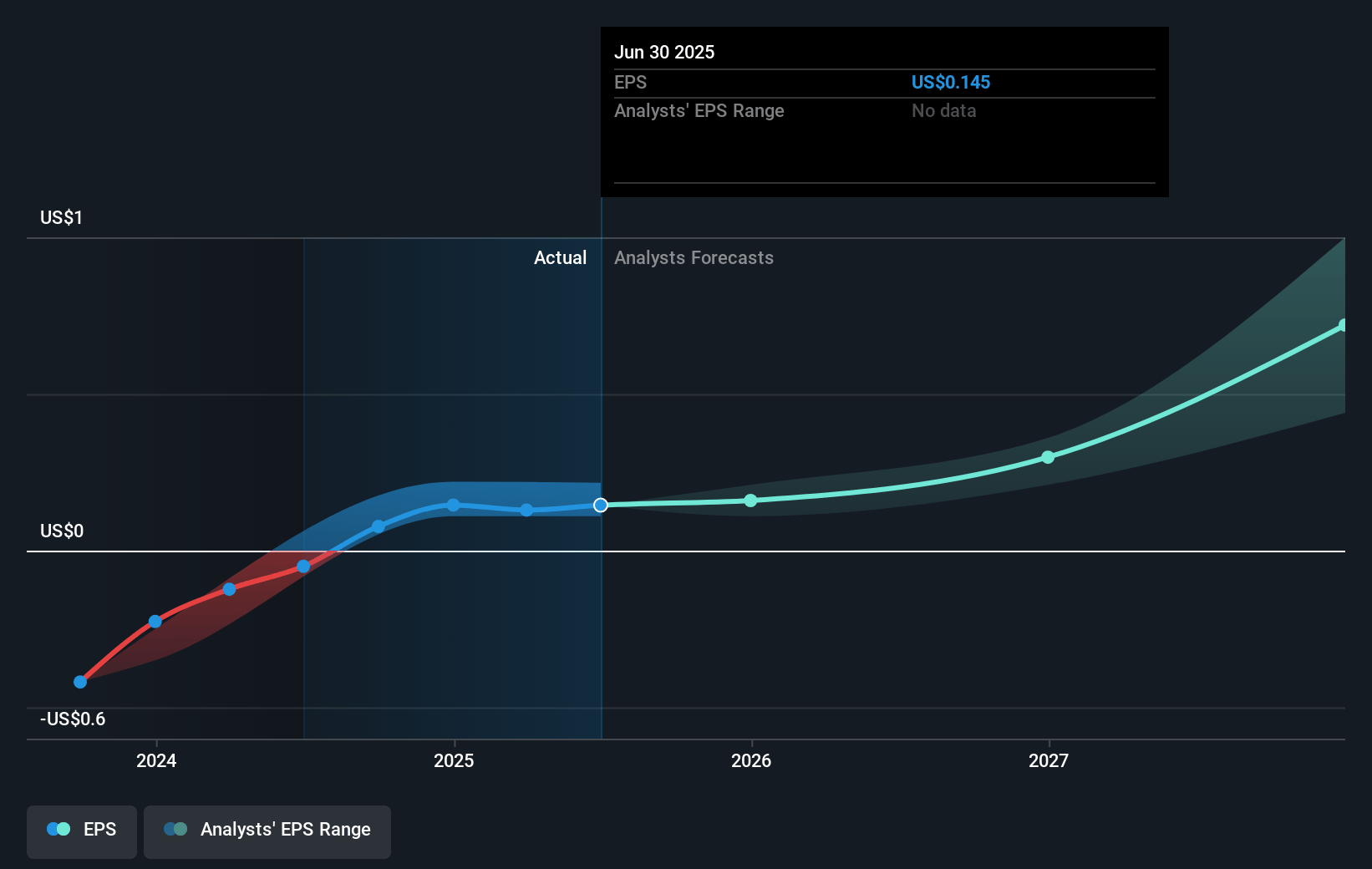

- The bearish analysts expect earnings to reach $9.2 million (and earnings per share of $0.39) by about July 2028, up from $2.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 140.2x on those 2028 earnings, up from 103.8x today. This future PE is greater than the current PE for the US Software industry at 42.7x.

- Analysts expect the number of shares outstanding to decline by 2.57% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

Viant Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing trend of increased consumer privacy regulations and deprecation of common digital identifiers like IP addresses and third-party cookies could undermine the effectiveness of Viant's core addressability solutions, making it harder to deliver targeted advertising and potentially reducing long-term revenue and advertiser retention.

- The persistent dominance of big tech walled gardens like Google, Meta, and Amazon in digital advertising creates significant barriers for open web platforms such as Viant, as exemplified by Viant's comments about Google's control of traffic and Amazon's retail media power, which could constrain Viant's access to key inventory and data, slowing future revenue growth and limiting customer expansion.

- Despite Viant's claims of innovation in AI and addressability, the ad tech industry's rapid commoditization and ongoing fee competition-particularly as large competitors absorb incremental fees or reduce costs-risk putting downward pressure on Viant's pricing power and gross margins, impacting earnings and cash flow scalability.

- Ongoing macroeconomic uncertainty, such as advertiser caution due to tariffs, has already led to notable campaign delays and spending shifts; if such headwinds persist or intensify, Viant may see increased volatility or declines in quarterly revenues, especially if delayed ad spending is not fully recouped in future periods.

- Viant's continued need for significant investment in acquisitions, R&D, and operating infrastructure to remain technologically current and to integrate new product offerings (like ViantAI and IRIS_ID) could outpace topline growth, risking net margin compression and straining the company's ability to scale profitably if customer and ad spend growth falter.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Viant Technology is $18.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Viant Technology's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $26.0, and the most bearish reporting a price target of just $18.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $427.0 million, earnings will come to $9.2 million, and it would be trading on a PE ratio of 140.2x, assuming you use a discount rate of 8.0%.

- Given the current share price of $13.88, the bearish analyst price target of $18.0 is 22.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.