In a landscape where ESG is often treated as a compliance formality, Diginex (DGNX) is redefining the market, transforming sustainability data into a core growth engine powered by AI, with recent acquisitions marking a bold evolution into a full‑stack data activation leader. Its recent $2 billion purchase of Resulticks, a real-time customer engagement and AI analytics firm, is proof of an extreme shift: from an ESG software provider to an all-stack data activation leader.

The deal, funded in stock worth $1.4 billion, in cash at $100 million, and in up to $500 million performance-based earnouts, isn’t just about size; it’s about reshaping how ESG creates value. Diginex is making a bold bet that the future of ESG lies not in static disclosure, but in transforming sustainability data into dynamic engagement engines, solutions that enhance customer experience, build brand loyalty, and unlock new revenue streams. In an age in which ESG is shifting from duty to opportunity, that could be one largest moat.

Diginex’s planned $13 million all-share acquisition of Matter DK strengthens its position in the ESG data space. Matter’s advanced analytics and investment-focused sustainability insights will deepen Diginex’s value proposition, enabling richer, AI-powered reporting for clients. With regulatory demands rising, the deal enhances Diginex’s ability to deliver end-to-end ESG solutions and scale its reach across the financial sector.

In the Engine Room: Diginex Sets the Stage for Next-Phase Expansion

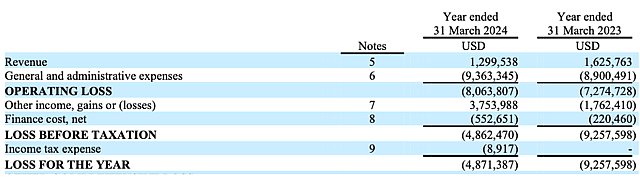

For the year ended 31 March 2024, Diginex reported revenue of $1.3 million, reflecting a transitionary phase as the company pivots toward higher-value, data-driven offerings. While this was slightly below the prior year’s $1.6 million, the period also included significant strategic activity, including two transformative acquisitions That lay the groundwork for future revenue acceleration. The company recorded a net loss of $8.1 million, inclusive of non-cash items such as $3.7 million in preferred share revaluation gains.

But behind that, there’s a change story. Cost profile of company shows it’s scaling a high-CAC, low-churn company model. R&D and information technological development cost amounted to $2.1 million in FY24, showing concerted effort at proprietary product optimisation. Employee-related expenses, including over $5 million in share-based compensation, reflect a deliberate strategy to deepen in-house capabilities. In the era of AI, where intellectual capital defines competitive advantage, Diginex’s commitment to attracting and retaining top-tier talent is a core pillar of its long-term moat.

Diginex reported operating costs of $9.36 million in FY24, reflecting purposeful investment to build long-term scale and product leadership. Key expenditures included $5.04 million in employee-related costs and $2.12 million in R&D and IT development, aligned with the company’s strategy to strengthen its AI capabilities and in-house talent infrastructure. While the company recorded an $8.1 million operating loss and used $5.86 million in operating cash, these figures reflect a deliberate upfront investment phase typical of high-growth SaaS and RegTech platforms. Share-based compensation of $1.35 million further signals long-term alignment with employees and leadership, a foundational element as Diginex scales its global ESG and data intelligence offering.

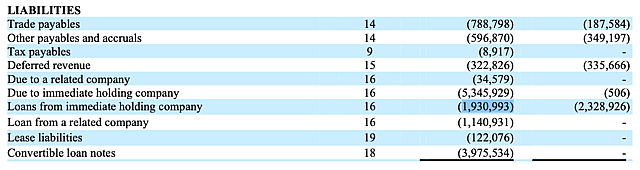

As of September 30, 2024, Diginex had raised $7.0 million as part of an $8.0 million capital round, including $1.9 million through debt conversion. All outstanding loans and convertible notes were automatically converted into equity when the IPO registration statement became effective on December 20, 2024. There are no legal or economic restrictions on intercompany fund transfers across Diginex subsidiaries. The company raised $10.61 million in gross proceeds from its IPO in January 2025, significantly improving its balance sheet and liquidity position.

Looking ahead, Diginex has the opportunity to receive up to $69.2 million over the next 18 months through the exercise of warrants purchased by a member of the Abu Dhabi royal family. While exercising these warrants would introduce shareholder dilution, it represents a strategic step toward strengthening ties with the UAE. The company is also exploring a potential dual listing on the Abu Dhabi Securities Exchange (ADX), which could raise as much as $250 million.

Cumulatively, liabilities amount to just over $23 million, matched by an equity deficit of the same scale. However, with high-EBITDA acquisitions completed and a clearly defined AI + ESG roadmap in motion, the company is now actively entering a capital optimization phase aimed at improving liquidity, re-rating valuation, and unlocking long-term operational leverage.

Risks: Managing Tight Liquidity Amid High-Growth Execution

Diginex’s going-concern assumption is currently underpinned by the recent $8 million capital injection from Rhino Ventures, demonstrating continued confidence from long-term backers. While such support is valuable in the near term, the company is aware that long-term momentum will require broader capital market access. Whether through a successful public listing of its affiliate Interdyne or by raising additional equity on improved terms, Diginex is focused on unlocking more sustainable capital pathways aligned with its long-term growth vision.

From an operational standpoint, the integration of Resulticks and Matter DK ApS represents a meaningful strategic undertaking. While bringing together AI-powered customer engagement tools and compliance-driven ESG solutions poses executional complexity, it also offers the potential for differentiated synergy, positioning Diginex at the convergence of regulatory technology and stakeholder engagement. The company has prioritized integration planning to ensure these platforms enhance rather than distract from core operations.

In the U.S., evolving macroeconomic conditions and political uncertainty, including the potential revival of Trump-era deregulatory policies, could reduce near-term emphasis on ESG disclosure mandates. These shifts may impact regulatory priorities and influence institutional capital flows. Nonetheless, Diginex’s diversified presence across Europe and Southeast Asia, regions where ESG regulation remains robust, offers some strategic balance. Over the long term, the company continues to monitor how global developments may reshape expectations around sustainability, transparency, and data governance.

Takeaway

Diginex is not positioned as a traditional value play, but rather as a longer-term bet on the convergence of engagement technology, regulatory compliance, and AI-driven data solutions. Institutional investors may see potential upside if the company succeeds in expanding platform utility across data-intensive verticals such as investor analytics and supply chain intelligence, particularly through the integration of Resulticks and Matter DK ApS.

Have other thoughts on Diginex?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user yiannisz holds no position in NasdaqCM:DGNX. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.