Key Takeaways

- Datadog's focus on expanding product offerings and AI integration supports future growth and deeper customer engagement.

- Strategic expansion plans and strong execution in international markets are set to drive top-line growth and improve long-term revenues.

- Limited growth acceleration and increased operating expenses could impact Datadog's margins, while competitive challenges in AI and cloud technologies threaten market expansion.

Catalysts

About Datadog- Operates an observability and security platform for cloud applications in the United States and internationally.

- Datadog's commitment to expanding its product offerings and integrating with new technologies, such as AI and cloud infrastructure, positions it for future revenue growth and allows for deeper penetration into existing customer accounts.

- With the introduction of new features and continuous innovation, including over 400 new capabilities in a year, Datadog can potentially improve its net margins by offering more value and higher-margin services, which are attractive to enterprise clients.

- The growth in customers using multiple products within the Datadog platform suggests cross-selling opportunities leading to increased average revenue per user, which can enhance earnings.

- Strategic expansion plans, including an increased focus on international markets and channel partnerships, are set to drive top-line growth by tapping into underserved geographies and larger enterprises.

- Datadog’s strong execution in achieving record bookings and a robust pipeline indicates potential for sustained earnings growth, as these bookings often translate into long-term revenues as customers ramp usage.

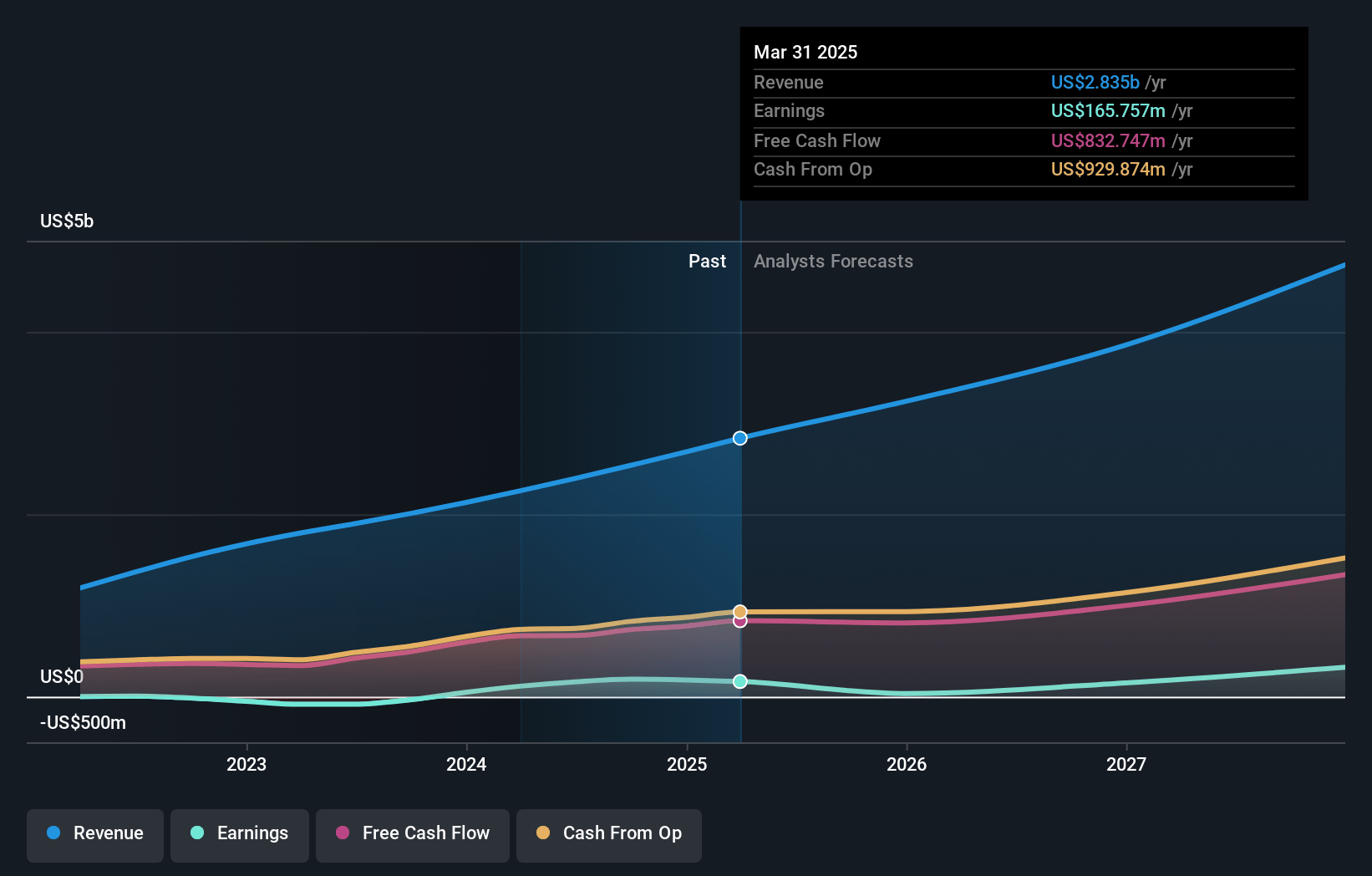

Datadog Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Datadog compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Datadog's revenue will grow by 24.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.8% today to 7.9% in 3 years time.

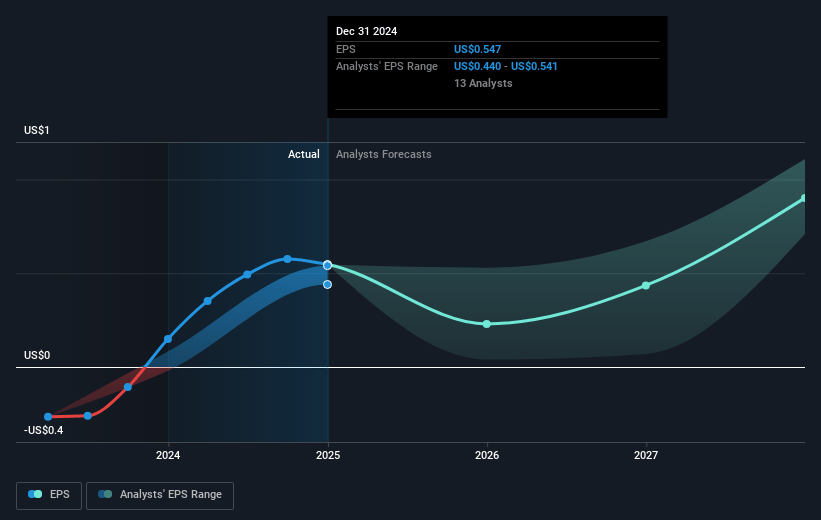

- The bullish analysts expect earnings to reach $413.0 million (and earnings per share of $1.11) by about April 2028, up from $183.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 193.8x on those 2028 earnings, up from 172.6x today. This future PE is greater than the current PE for the US Software industry at 29.6x.

- Analysts expect the number of shares outstanding to grow by 2.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.72%, as per the Simply Wall St company report.

Datadog Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The conference call mentions that usage growth from existing customers is in line with the year-ago quarter, suggesting limited acceleration, and potentially impacting future revenue growth.

- There is a note about potential volatility in revenue growth due to customers optimizing their cloud and observability usage upon contract renewals, which could influence Datadog's earnings.

- Despite strong growth from AI native customers, there are concerns about possible renewals and optimizations, which might create short-term revenue fluctuations affecting net margins.

- The competitive landscape with increasing challenges, particularly in AI and new cloud technologies, may hinder Datadog's market share expansion, impacting long-term revenue and earnings.

- Datadog's increased operating expenses, particularly in sales and marketing and R&D, grew 30% year-over-year, potentially squeezing operating margins if the anticipated growth does not materialize.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Datadog is $173.99, which represents one standard deviation above the consensus price target of $150.95. This valuation is based on what can be assumed as the expectations of Datadog's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $230.0, and the most bearish reporting a price target of just $115.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $5.2 billion, earnings will come to $413.0 million, and it would be trading on a PE ratio of 193.8x, assuming you use a discount rate of 7.7%.

- Given the current share price of $92.55, the bullish analyst price target of $173.99 is 46.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:DDOG. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.