Key Takeaways

- Investment in Oracle Cloud Infrastructure enhances Crexendo's competitive edge in Europe, supporting rapid server deployment and compliance for international growth.

- Migration to VIP system and OCI predicts cost savings and improved margins through operational efficiencies, boosting future revenue.

- Increased operating expenses and competition could pressure margins, while reliance on cloud migration and acquisitions may challenge profitability if revenue growth stalls.

Catalysts

About Crexendo- Provides cloud communication platform and services, video collaboration, and managed IT services for businesses in the United States and internationally.

- Crexendo's investment in Oracle Cloud Infrastructure (OCI) is providing a competitive advantage, particularly in Europe, allowing for rapid deployment of servers and compliance with local standards, expected to drive substantial international growth. This impacts future revenue growth.

- The ongoing migration of Crexendo Classic customers to the VIP system and hosted customers to OCI is predicted to result in cost savings from closing six data centers, thus improving net margins through operational efficiencies.

- Strategic efforts to attract Microsoft and Cisco customers are bearing fruit, with former clients reporting positive experiences migrating to Crexendo, positioning the company well for continued revenue growth.

- The development of new AI-driven applications, as revealed during their successful user group meeting, could open additional revenue-sharing opportunities and boost product offerings, enhancing revenue growth.

- Crexendo's substantial cash position and openness to acquisitions are set to bolster their strategic growth plan, potentially increasing EBITDA and offering value through strategic expansion of their market presence.

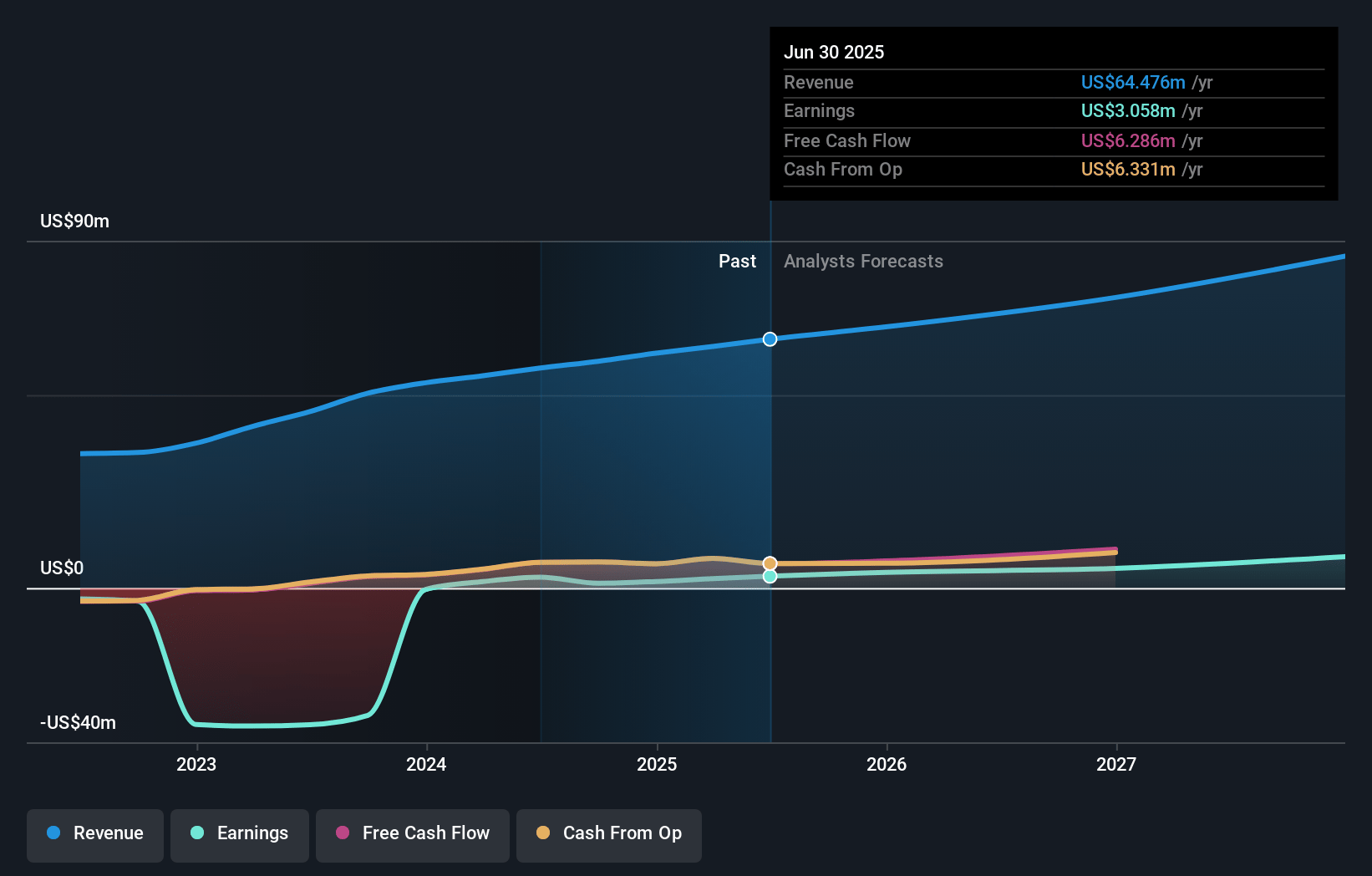

Crexendo Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Crexendo's revenue will grow by 13.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.1% today to 12.6% in 3 years time.

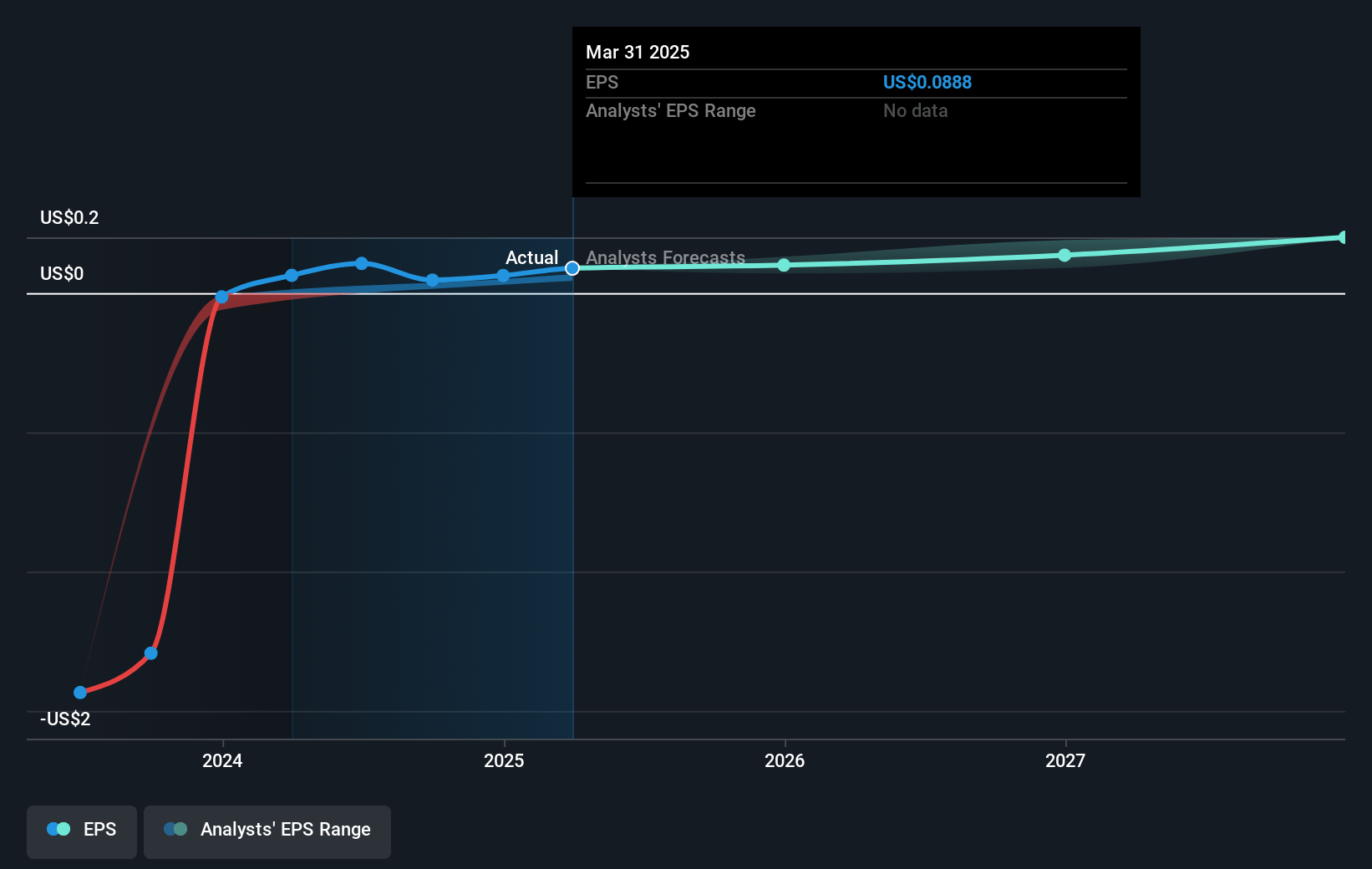

- Analysts expect earnings to reach $10.7 million (and earnings per share of $0.37) by about January 2028, up from $1.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.7x on those 2028 earnings, down from 129.7x today. This future PE is lower than the current PE for the US IT industry at 43.7x.

- Analysts expect the number of shares outstanding to grow by 2.22% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.35%, as per the Simply Wall St company report.

Crexendo Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increased operating expenses, including those from added headcount and investments in Oracle Cloud Infrastructure, may pressure net margins if revenue growth does not keep pace.

- Dependence on migrating legacy customers and transition to OCI may result in temporary operational inefficiencies, potentially affecting earnings as existing infrastructure costs persist until migration completes.

- Despite the expected benefits from acquisitions, acquisition-related intangible costs could lead to challenges in maintaining consistent GAAP profitability, impacting net income.

- The potential slowdown in UCaaS revenue growth, particularly if further macroeconomic challenges or customer churn occur, could adversely affect revenue projections.

- Continuing competition from major players like Cisco and Microsoft might result in pricing pressure or customer losses, potentially affecting future revenue streams and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $7.33 for Crexendo based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $84.8 million, earnings will come to $10.7 million, and it would be trading on a PE ratio of 23.7x, assuming you use a discount rate of 7.4%.

- Given the current share price of $5.89, the analyst's price target of $7.33 is 19.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives