Key Takeaways

- Expanding AI-powered, cloud-connected voice services and new platform launches are driving recurring revenue, margin growth, and deeper automaker partnerships.

- Diversification into non-automotive sectors and ongoing innovation in embedded AI broaden use cases and reduce reliance on traditional auto OEMs.

- Persistent pricing pressure, stagnant contract growth, and slow diversification threaten revenue stability, while legal disputes and shrinking service opportunities undermine margins and long-term positioning.

Catalysts

About Cerence- Provides AI powered virtual assistants for the mobility/transportation market in the United States, rest of the Americas, Germany, rest of Europe, the Middle East, Africa, Japan, and rest of the Asia-Pacific.

- Rising consumer adoption of connected vehicles and increasing integration of advanced AI features are driving up the attachment rate and average price per unit (PPU) for Cerence’s technology, fueling recurring revenue and supporting future gross margin expansion as more vehicles are outfitted with subscription-based, cloud-connected voice services.

- Strategic launches and OEM interest in the new xUI hybrid Agentic AI assistant platform—showcased through partnerships with JLR, Renault, NVIDIA, and MediaTek—position Cerence to capture incremental revenue and higher engagement as automakers and consumers demand increasingly personalized, multimodal, and context-aware in-car experiences in upcoming vehicle cycles.

- New vertical expansion efforts, such as Voice Topping for self-service kiosks in industries like hospitality, healthcare, and retail, create additional long-term revenue streams and diversify the customer base, reducing reliance on traditional auto OEMs while leveraging Cerence’s existing conversational AI expertise.

- Embedded AI and edge language model innovation (e.g., CaLLM Edge) enable Cerence to expand use cases within and potentially outside the car, meeting secular demand for seamless, real-time, and privacy-focused voice interfaces and providing upside to both revenue growth and future net margins.

- Industry standardization of in-car voice assistants and the proliferation of smart, connected mobility platforms underpin a growing addressable market; Cerence’s established penetration (51% of global auto production) and a robust product backlog (~$960M over 5 years) provide visibility into near

- and mid-term revenues and cash flows.

Cerence Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cerence's revenue will grow by 3.4% annually over the next 3 years.

- Analysts are not forecasting that Cerence will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Cerence's profit margin will increase from -132.4% to the average US Software industry of 13.2% in 3 years.

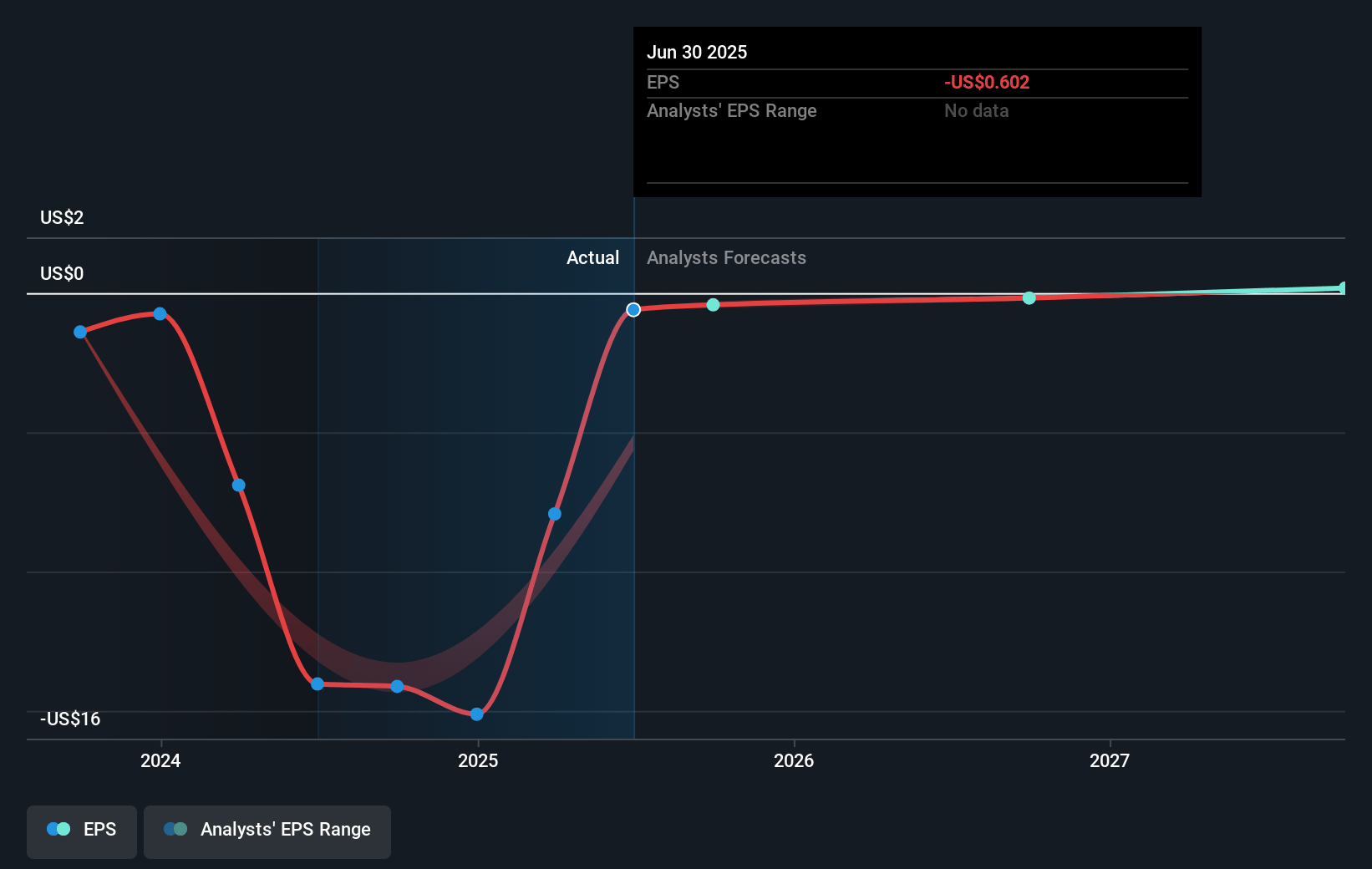

- If Cerence's profit margin were to converge on the industry average, you could expect earnings to reach $37.2 million (and earnings per share of $0.79) by about July 2028, up from $-336.6 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.5x on those 2028 earnings, up from -1.3x today. This future PE is lower than the current PE for the US Software industry at 43.8x.

- Analysts expect the number of shares outstanding to grow by 3.48% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.5%, as per the Simply Wall St company report.

Cerence Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increased downward pricing pressure from automotive OEMs, as highlighted by ongoing customer discussions about price reductions and cost-optimization negotiations, could erode average revenue per vehicle and compress Cerence's net margins and future earnings.

- The text reveals a continued decline in professional services revenue, with OEMs increasingly standardizing their software stacks and integrating more in-house, potentially shrinking Cerence’s revenue streams and diminishing their role in automotive ecosystems over time.

- Heavy reliance on variable and fixed license contracts—which showed limited growth with no new fixed contracts expected, and a flat five-year backlog—may signal stagnating core automotive revenue, creating earnings and cash flow volatility and raising concerns about long-term revenue stability.

- Legal disputes with major technology players such as Microsoft and Samsung, while aimed at protecting intellectual property, may strain partnerships, divert management attention, and introduce unpredictable litigation costs or risks of unfavorable outcomes, negatively impacting net income and future business development opportunities.

- Although non-automotive verticals are being pursued, management indicated that these efforts are in very early stages and will ramp slowly, suggesting sustained overreliance on the maturing, competitive automotive voice assistant market with limited near-term diversification, which could result in revenue stagnation if industry adoption of alternative solutions accelerates.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $11.167 for Cerence based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $16.0, and the most bearish reporting a price target of just $9.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $280.7 million, earnings will come to $37.2 million, and it would be trading on a PE ratio of 18.5x, assuming you use a discount rate of 9.5%.

- Given the current share price of $10.37, the analyst price target of $11.17 is 7.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.