Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and partnerships are enhancing Bentley's 3D geospatial applications, supporting user acquisition and revenue growth.

- Focus on asset analytics and shift to SaaS models aim for long-term revenue growth and improved margins.

- Dependency on enterprise accounts and consumption models limits growth, while challenges in China and volatility in asset analytics add revenue unpredictability.

Catalysts

About Bentley Systems- Provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

- Bentley Systems' acquisition of Cesium and partnership with Google could expand opportunities in the 3D geospatial application space, potentially driving increased subscription revenue and enhancing the iTwin platform. This partnership is expected to aid in new user acquisition and retention, impacting revenue growth positively.

- The focus on asset analytics, incorporating AI-driven insights and operations, is aimed at extending market reach and generating incremental revenue streams. This could positively influence both the ARR growth and earnings.

- Despite slowing growth in the cohesive professional services due to external delays, the emphasis on transitioning to hosted managed services and integration with iTwin could provide longer-term revenue opportunities, enhancing margins as services become more SaaS-oriented and less dependent on traditional service delivery.

- The ongoing E365 initiative, providing predictable revenue through contracts with consumption floors and ceilings, ensures a stable ARR growth, which is crucial for Bentley’s ability to manage its capital allocation towards debt refinancing and potential new acquisitions, ultimately impacting earnings sustainability.

- Bentley’s strategic focus on SMB growth through digital engagement and Virtuosity subscriptions has been successful, helping diversify the revenue base and potentially leading to higher net ARR retention rates, which would positively affect revenue and operating margins over time.

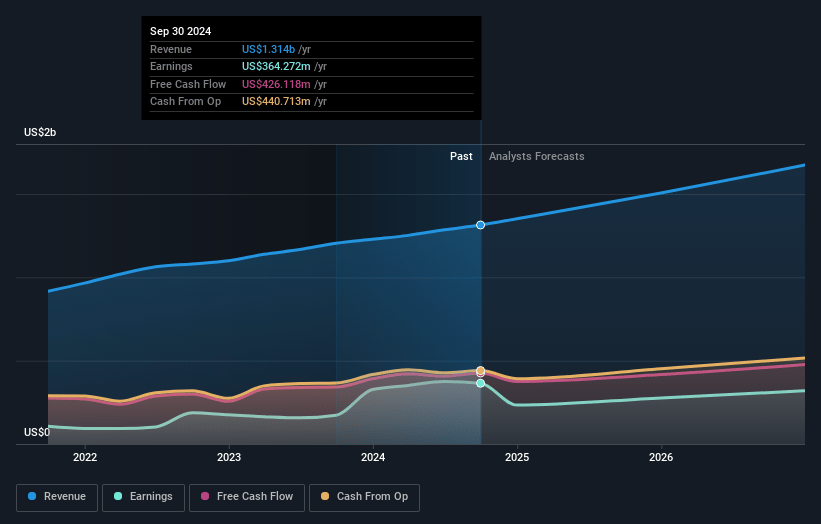

Bentley Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bentley Systems's revenue will grow by 11.0% annually over the next 3 years.

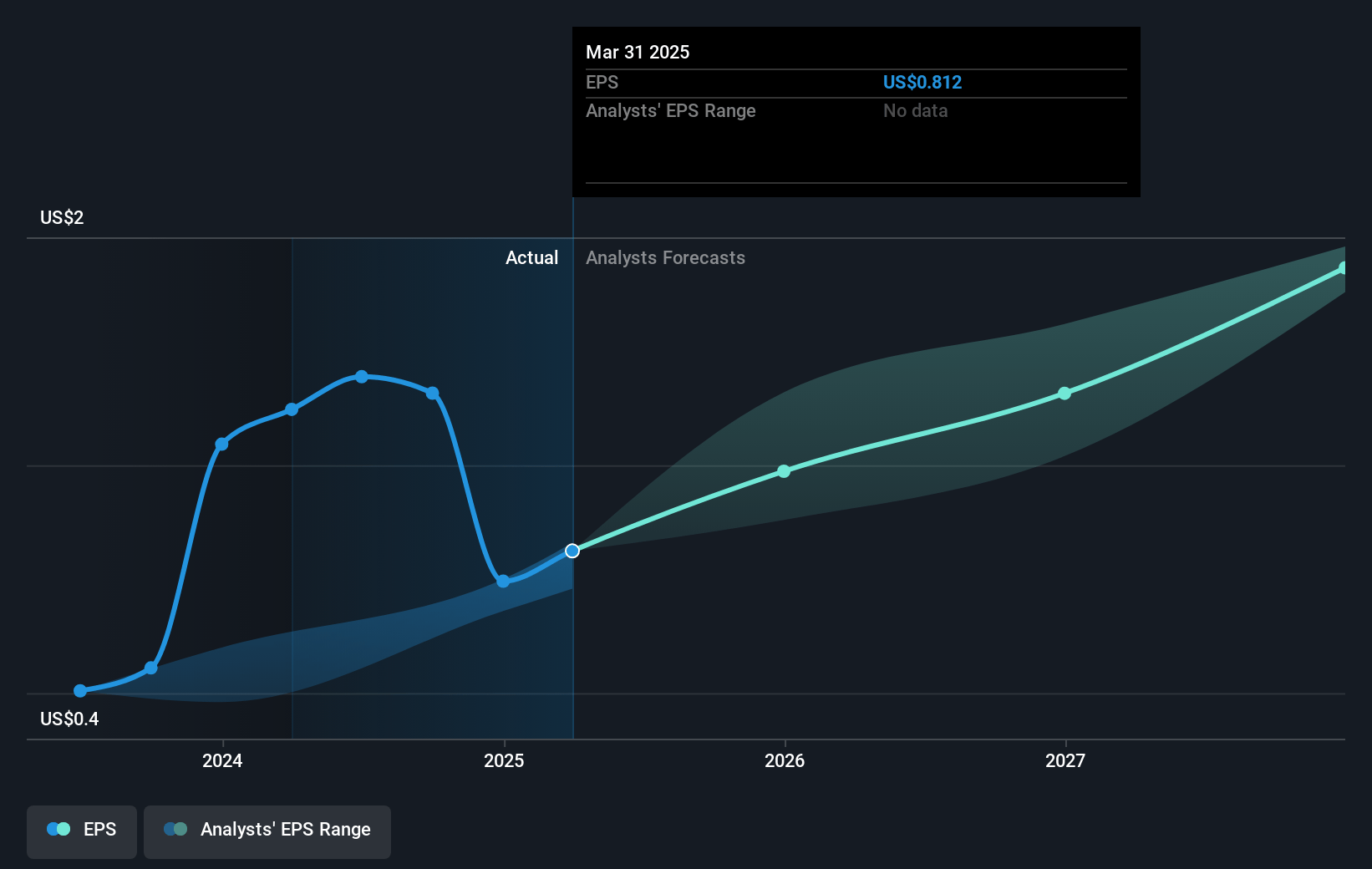

- Analysts assume that profit margins will shrink from 27.7% today to 22.5% in 3 years time.

- Analysts expect earnings to reach $405.3 million (and earnings per share of $1.25) by about January 2028, up from $364.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 55.5x on those 2028 earnings, up from 40.3x today. This future PE is greater than the current PE for the US Software industry at 43.6x.

- Analysts expect the number of shares outstanding to grow by 0.92% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.18%, as per the Simply Wall St company report.

Bentley Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on enterprise accounts and consumption-based models with fixed annual floors and ceilings may limit potential for significant quantitative upside, impacting revenue and overall growth trajectory.

- The new asset analytics business is characterized by inherent volatility and requires securing major enterprise procurements, which introduces unpredictability and risk to the revenue streams.

- The company faces ongoing challenges in the Chinese market due to geopolitical tensions and a shift towards local software preferences, which could continue to negatively impact ARR and reduce revenue from that region.

- Delays in professional services revenues, particularly related to IBM Maximo services, have curtailed total revenue growth and might continue to impact earnings if pipeline improvements do not manifest promptly.

- Despite increasing market share in water and infrastructure sectors, there remains uncertainty around future U.S. infrastructure funding and project prioritization, which could impact long-term revenue visibility and growth expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $56.58 for Bentley Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $64.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $405.3 million, and it would be trading on a PE ratio of 55.5x, assuming you use a discount rate of 7.2%.

- Given the current share price of $46.58, the analyst's price target of $56.58 is 17.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives