Key Takeaways

- Aggressive AI integration and rapid platform adoption position BlackLine for outsized growth in revenue, profitability, and operational leverage beyond prevailing market expectations.

- Enhanced compliance capabilities and remote work resilience solidify BlackLine's role as a critical financial solution, strengthening customer retention, pricing power, and lasting market leadership.

- Narrow product focus faces rising competition, evolving customer preferences, regulatory pressures, and economic headwinds, all of which threaten future growth, margins, and market relevance.

Catalysts

About BlackLine- Provides cloud-based solutions to automate and streamline accounting and finance operations in the United States and internationally.

- Analyst consensus views AI as an incremental advantage, but BlackLine's aggressive investment and fast deployment of agentic AI across its entire product suite could not only accelerate customer adoption but also structurally enhance gross margins and operating leverage, setting up for several years of sustained outperformance in both revenue growth and profitability.

- While analysts broadly see the new platform pricing model as supporting modest revenue gains, the early success and rapid enterprise traction signal that BlackLine can unlock significantly greater ARPU expansion and market share than currently expected, especially as pricing shifts facilitate cross-departmental adoption and heightened stickiness, materially boosting both top-line growth and net retention rates.

- As regulatory scrutiny on financial processes and controls continues to intensify globally, BlackLine's robust, auditable automation and governance capabilities-now enhanced with secure, auditable AI-position the company as the default SaaS provider for compliance-driven organizations, sustaining pricing power and enabling a multi-year expansion in operating margins and revenue.

- The accelerating shift to hybrid and remote work globally is further entrenching BlackLine as the mission-critical backbone of dispersed finance teams, leading to lower customer churn and driving highly resilient and predictable recurring revenue streams well above current market expectations.

- BlackLine's accelerating go-live velocity-driven by industry-specific solutions, verticalized use cases, and rapid implementation cycles-is materially shortening time-to-value for new and existing customers, unlocking stronger near-term revenue recognition and opening up cross-sell and upsell opportunities that can compound growth in both subscription revenues and long-term customer lifetime value.

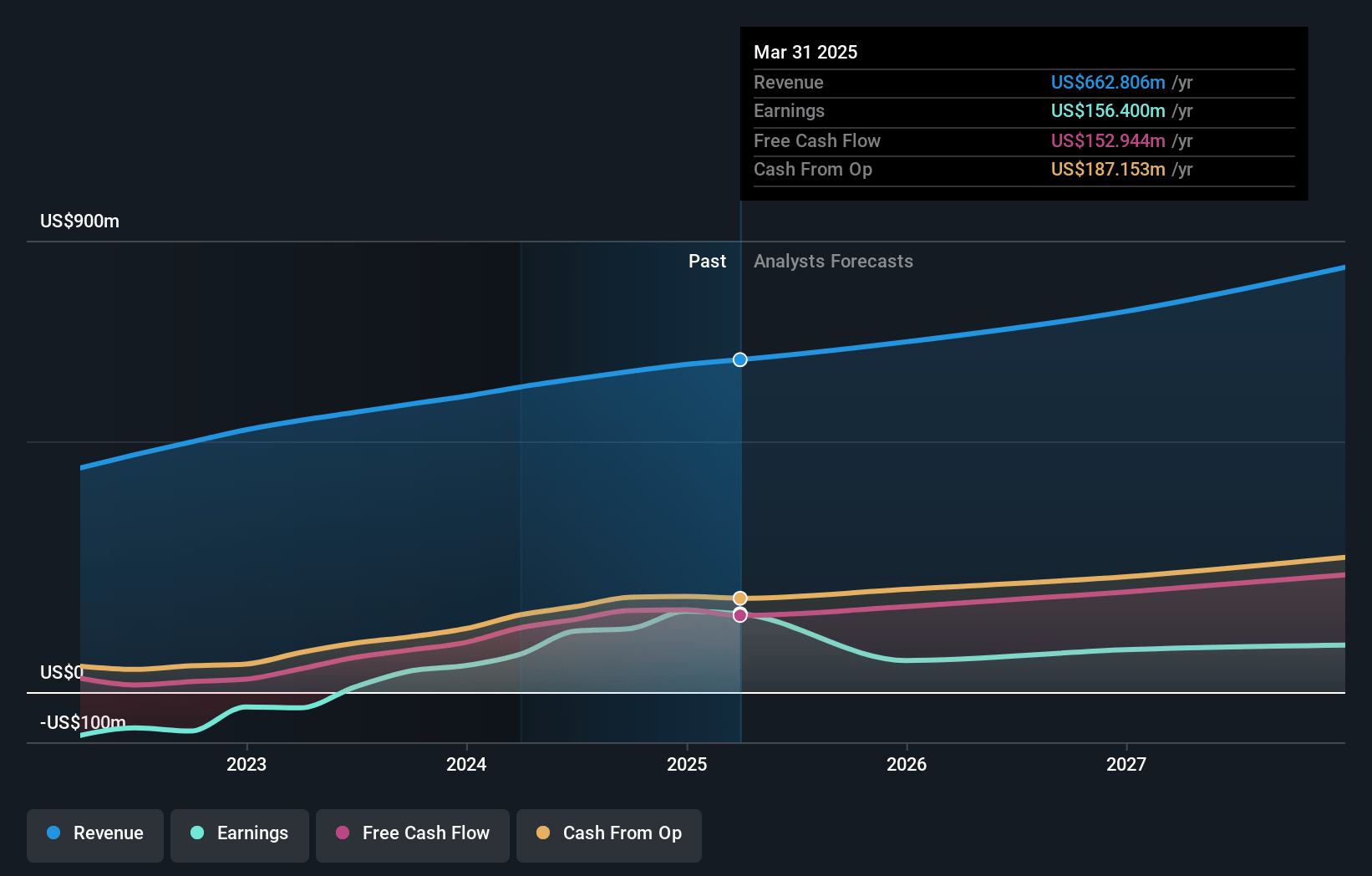

BlackLine Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on BlackLine compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming BlackLine's revenue will grow by 10.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 23.6% today to 9.1% in 3 years time.

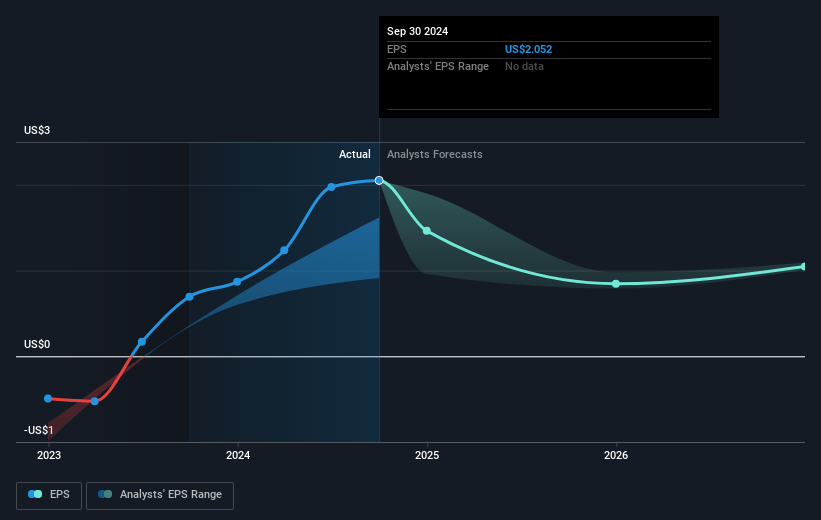

- The bullish analysts expect earnings to reach $81.4 million (and earnings per share of $0.84) by about July 2028, down from $156.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 74.4x on those 2028 earnings, up from 21.4x today. This future PE is greater than the current PE for the US Software industry at 41.8x.

- Analysts expect the number of shares outstanding to grow by 0.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.63%, as per the Simply Wall St company report.

BlackLine Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- BlackLine's historic focus and product concentration in financial close automation leaves it exposed to encroaching competition from large ERP vendors, such as SAP and Workday, who are increasingly developing their own native close solutions, which could compress future revenue growth and operating margins.

- Rapid advancements in AI automation-including generative and agentic AI-may incentivize larger enterprise customers to develop or favor in-house solutions, accelerating competitive pressures and potentially limiting BlackLine's long-term ARR and net retention growth.

- The financial software sector is undergoing consolidation, with customers showing a preference for broad, all-in-one platforms, so BlackLine risks being marginalized as a niche provider, which could shrink its addressable market and cap top-line revenue expansion.

- Heightened regulatory scrutiny surrounding cloud data security, privacy, and ongoing compliance (such as GDPR and emerging U.S. standards) could raise operating costs and slow customer adoption cycles, putting downward pressure on net margins and sales momentum.

- Prolonged economic uncertainty, customer reorganization, or slower digital transformation budgets-as highlighted by management's expanded guidance range-may lengthen sales cycles, increase customer churn (especially in mid-market), and jeopardize revenue reliability and earnings visibility over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for BlackLine is $76.22, which represents two standard deviations above the consensus price target of $57.72. This valuation is based on what can be assumed as the expectations of BlackLine's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $45.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $895.4 million, earnings will come to $81.4 million, and it would be trading on a PE ratio of 74.4x, assuming you use a discount rate of 8.6%.

- Given the current share price of $53.65, the bullish analyst price target of $76.22 is 29.6% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.