Key Takeaways

- Strategic shift towards mid-market and enterprise clients may cause temporary churn and revenue dip, aiming for higher long-term customer value.

- Platform modernization and new capabilities focus involve significant investments, potentially compressing margins short-term, aiming for future efficiency and growth.

- BlackLine's focus on high-value deals, cloud transition, and AI investment enhances revenue potential, cost efficiency, and competitive edge.

Catalysts

About BlackLine- Provides cloud-based solutions to automate and streamline accounting and finance operations worldwide.

- BlackLine's strategic shift towards larger enterprise and mid-market customers, while intentionally letting go of smaller accounts, may lead to temporary customer churn and lower overall customer count, impacting short-term revenue stability but aiming for higher lifetime value.

- The transition of the CFO role and the integration of new leadership may cause short-term operational disruptions or strategic changes, potentially impacting net margins due to leadership transition costs and realignment expenses.

- BlackLine's platform modernization strategy, including migration to Google Cloud, is poised to offer new capabilities but involves significant upfront investment which could initially compress operating margins before driving long-term efficiency gains.

- Competition and the intentional reduction in smaller, less profitable accounts may temporarily impact renewal rates and retention metrics, resulting in pressure on net revenue retention as the focus shifts to more complex, larger deals.

- The heavy focus on innovation and product offerings like Studio and new AI capabilities involve substantial R&D investments which could affect earnings in the short term before potentially accelerating revenue growth and improving net margins.

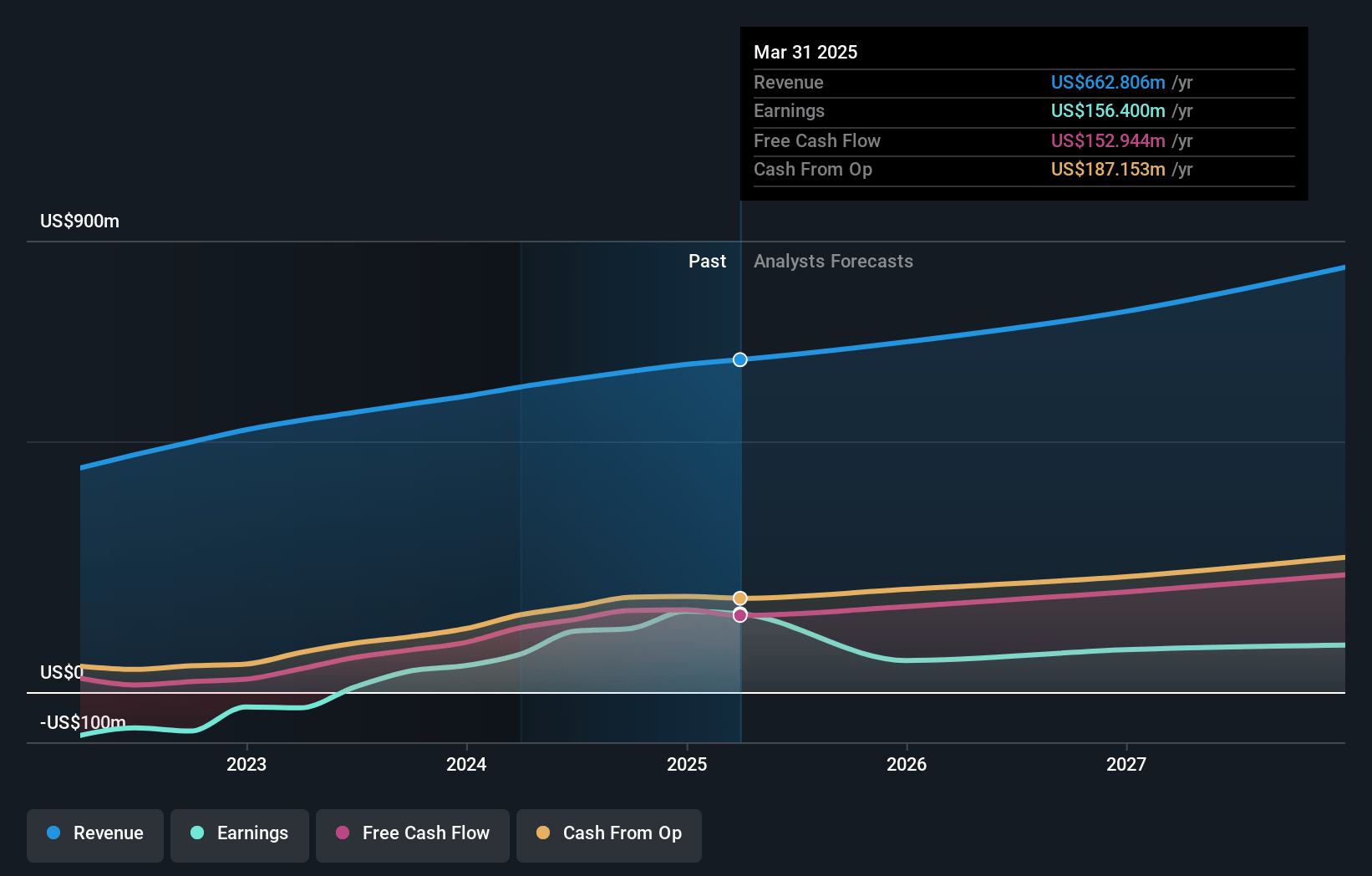

BlackLine Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming BlackLine's revenue will grow by 8.5% annually over the next 3 years.

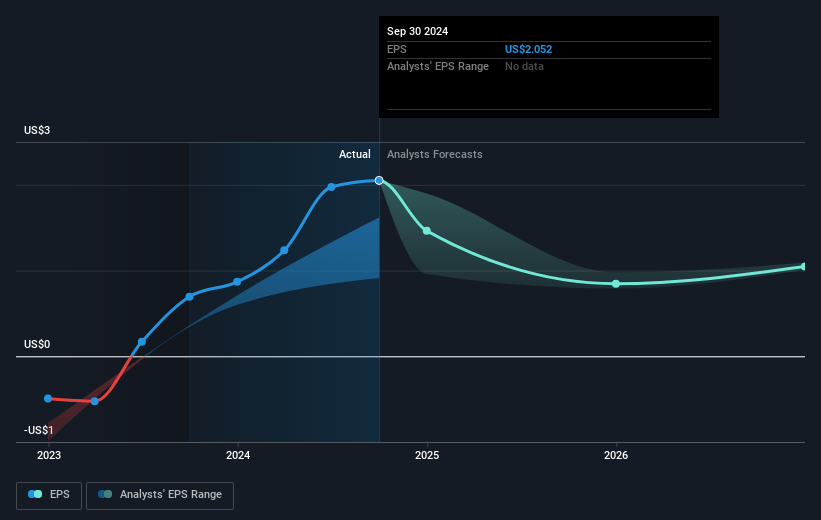

- Analysts assume that profit margins will shrink from 19.8% today to 7.0% in 3 years time.

- Analysts expect earnings to reach $57.6 million (and earnings per share of $0.67) by about January 2028, down from $126.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 120.4x on those 2028 earnings, up from 32.0x today. This future PE is greater than the current PE for the US Software industry at 43.6x.

- Analysts expect the number of shares outstanding to grow by 11.02% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.5%, as per the Simply Wall St company report.

BlackLine Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- BlackLine has reported solid financial results, exceeding revenue and profitability guidance, which suggests strong operational improvements and a resilient business model. This could impact revenue and earnings positively.

- The company is seeing larger deal sizes, particularly in mature or rapidly growing mid-market companies, which suggests a focused strategy on high-value customers that could enhance revenue and net margins.

- BlackLine's platform is being recognized for its value proposition, demonstrated by seven-figure expansion deals with major enterprises, indicating a strong potential for sustained revenue growth from existing customer upsell.

- The successful transition to Google Cloud is expected to result in cost efficiencies and accelerated product innovation, likely contributing to improved net margins and earnings over time.

- Engagement in industry-specific solutions and strategic product enhancements, such as AI capabilities, reflect increased investment in innovation that could drive future revenue growth and competitive differentiation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $65.7 for BlackLine based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $86.0, and the most bearish reporting a price target of just $50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $817.9 million, earnings will come to $57.6 million, and it would be trading on a PE ratio of 120.4x, assuming you use a discount rate of 7.5%.

- Given the current share price of $64.9, the analyst's price target of $65.7 is 1.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives