Last Update 24 Jan 26

Fair value Decreased 1.69%APPF: Monetization Optionality And Strong New Business Trends Will Drive Upside

Narrative Update on AppFolio

The updated analyst price target for AppFolio edges slightly lower to about US$312 from roughly US$317, as analysts fine tune fair value, discount rate, growth, margin, and future P/E assumptions while still pointing to unchanged fundamentals and multiple growth opportunities highlighted at the recent Investor Day.

Analyst Commentary

Recent commentary focuses less on changing the long term story and more on how the market is reacting to limited guidance and refreshed valuation assumptions.

Bullish Takeaways

- Bullish analysts highlight that the updated price targets, around US$312 to US$325, still imply confidence that current valuation embeds meaningful execution on growth and margin improvement over time.

- The view that fundamentals are unchanged, despite recent volatility in the share price, reinforces the idea that near term sentiment shifts are not necessarily tied to any reported deterioration in the underlying business.

- Strong new business trends mentioned around Investor Day are seen as a key support for longer term revenue growth, which analysts connect to the ability to justify premium P/E and cash flow multiples.

- Multiple opportunities to monetize the value AppFolio provides to customers are seen as important optionality, giving the company several potential levers for future expansion of both top line and unit economics.

Bearish Takeaways

- Bearish analysts focus on the company’s decision not to provide long term financial targets at this stage, which can make it harder for the market to underwrite specific margin and free cash flow trajectories in valuation models.

- The negative stock price reaction after Investor Day signals that some investors may be cautious about paying higher multiples without clearer visibility into multi year financial goals.

- Lack of detailed long term targets can widen the range of outcomes analysts plug into discount rate, growth, and margin assumptions, which may lead to more conservative fair value estimates for some market participants.

- As expectations reset around targets and timing, any perceived execution hiccups or slower than anticipated monetization of growth opportunities could weigh on sentiment even if the long term thesis is unchanged on paper.

What’s in the News

- SnapInspect integrated its property inspection and maintenance software with AppFolio, adding automated work orders, real time dashboard updates, vendor task tracking, and two way syncing of inspection data for property managers using AppFolio Stack Marketplace (Key Developments).

- The SnapInspect integration is aimed at helping multifamily and apartment managers replace manual inspection workflows at scale, with inspection data feeding directly into AppFolio and auto generating work orders that support maintenance team performance (Key Developments).

- AppFolio provided earnings guidance for 2025, with expected annual revenue in a range of US$945m to US$950m and a stated full year midpoint growth rate of 19%, tied to Plus and Max tier adoption, customer growth, new business units, and higher product and service adoption (Key Developments).

- Between July 1, 2025 and September 30, 2025, AppFolio reported no additional share repurchases and stated that it has completed the repurchase of 243,987 shares, representing 0.68%, for US$49.96m under the buyback program announced on April 24, 2025 (Key Developments).

Valuation Changes

- The consensus analyst price target fair value has edged down slightly from about US$317.20 to around US$311.83.

- The discount rate has moved marginally higher from roughly 8.41% to about 8.42%.

- The revenue growth assumption has been trimmed slightly from around 18.16% to about 18.11%.

- The net profit margin assumption has eased modestly from roughly 13.68% to about 13.51%.

- The future P/E multiple has shifted slightly lower from about 67.18x to around 66.97x.

Key Takeaways

- Rising AI adoption and digital transformation in property management strengthen AppFolio's customer acquisition, platform engagement, and long-term revenue prospects.

- Integrated ecosystem partnerships and investment in high-margin services increase platform stickiness, recurring revenue, and operational efficiency.

- Competitive pressures, regulatory risks, reliance on domestic growth, rising innovation costs, and exposure to third-party threats could constrain future revenue, margins, and differentiation.

Catalysts

About AppFolio- Provides cloud-based platform for the real estate industry in the United States.

- Accelerating adoption of AI-powered workflow automation within property management-demonstrated by a 46% increase in industry intent to use AI and 96% of customers engaging with AI solutions-positions AppFolio to continue expanding unit counts, drive top-line revenue growth, and support future increases in net margins through productivity gains.

- Expansion of integrated ecosystem partnerships (e.g., AppFolio Stack, fintech solutions, and third-party partner integrations) provides customers with more seamless, end-to-end experiences, increasing the platform's stickiness, ARPU, and recurring revenue potential.

- Elevated labor shortages and ongoing economic pressures in real estate are driving property management customers to adopt technology for cost reduction and efficiency, supporting consistent customer acquisition and minimizing churn, which will have a positive impact on revenue and retention rates.

- The growing shift toward digital transformation and cloud-based SaaS across the industry expands AppFolio's addressable market, fueling sustained customer growth, higher subscription sales, and potential long-term earnings expansion.

- Sustained investment in high-margin, value-added services-such as advanced screening (FolioScreen), payment processing, and insurance-alongside continued operational efficiency is expected to further increase net margins and support profitable revenue growth.

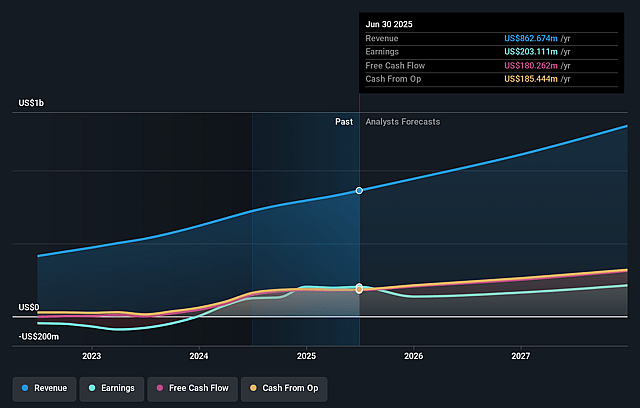

AppFolio Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AppFolio's revenue will grow by 17.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 23.5% today to 13.7% in 3 years time.

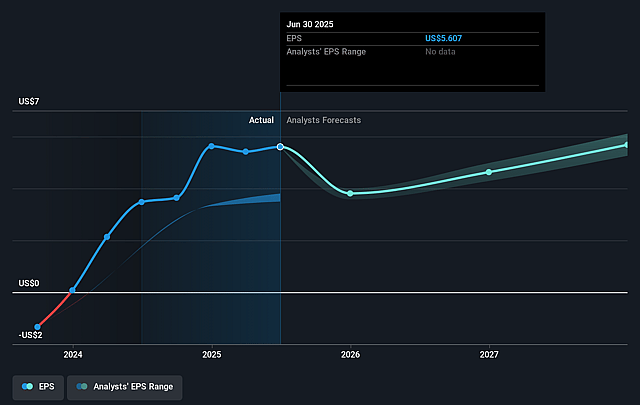

- Analysts expect earnings to reach $192.0 million (and earnings per share of $5.68) by about September 2028, down from $203.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 79.3x on those 2028 earnings, up from 49.4x today. This future PE is greater than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to decline by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.4%, as per the Simply Wall St company report.

AppFolio Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Customer growth primarily comes from new business wins and increased adoption of premium tiers within an already competitive property management segment, which may face commoditization and pricing pressure as more providers develop similar AI-powered SaaS offerings-risking future revenue growth and margin expansion as customers gain greater bargaining power.

- The company's focus remains overwhelmingly domestic, with no mention of international expansion initiatives, implying a limited addressable market; if industry growth slows or saturates in the U.S., future revenue and earnings growth could be capped as the core customer base matures.

- Heavy investment in product innovation (especially AI features) requires continually rising R&D and go-to-market spend; if competitors develop or offer comparable automation and agentic technologies, AppFolio's differentiation could erode, leading to margin pressures and slower operating leverage improvements.

- Major revenue drivers like screening, payments, and risk mitigation services rely on increasing compliance complexity and data handling; rising regulatory scrutiny and new privacy legislation could require expensive platform overhauls and increase compliance costs, directly impacting net margins.

- Partnerships with fintech and third-party integrations are becoming central to the platform's value proposition, exposing AppFolio to third-party risk (including data security) and greater competitive overlap; any significant cybersecurity incident or loss of integration partners could negatively impact customer trust, retention rates, and long-term revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $341.5 for AppFolio based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $192.0 million, and it would be trading on a PE ratio of 79.3x, assuming you use a discount rate of 8.4%.

- Given the current share price of $279.59, the analyst price target of $341.5 is 18.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AppFolio?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.