Last Update01 Aug 25Fair value Increased 5.77%

Despite a notable reduction in forecast revenue growth, Wolfspeed’s higher future P/E multiple suggests increased confidence in its earnings potential, leading to a modest increase in the consensus price target from $3.90 to $4.12.

What's in the News

- Wolfspeed, Inc. filed for Chapter 11 bankruptcy protection on June 30, 2025, listing assets and liabilities in the $1–10 billion range; the U.S. Bankruptcy Court approved joint administration of its bankruptcy cases and a combined hearing for its reorganization plan (Key Developments, Periodicals).

- The company's pre-packaged reorganization plan proposes full cash payment for administrative and unsecured claims, partial recoveries for secured and convertible notes holders (86% and 30% respectively), a 29% recovery for Renesas claims, and substantial dilution or cancellation of existing equity (Key Developments).

- Following the bankruptcy filing, Wolfspeed was dropped from major indices including the S&P 600, S&P Composite 1500, S&P Global BMI Index, S&P TMI Index, S&P 1000, and all related Russell and S&P sub-indices (Key Developments, Periodicals).

- Ralliant Corp. replaced Wolfspeed in the S&P SmallCap 600 on July 1, 2025, as Wolfspeed was no longer eligible for inclusion following its bankruptcy filing (Periodicals).

- Executive changes included the interim appointment of Kevin Speirits as CFO effective May 30, 2025, and the subsequent appointment of Gregor van Issum as permanent CFO, effective September 1, 2025, to oversee the company’s financial restructuring (Key Developments).

Valuation Changes

Summary of Valuation Changes for Wolfspeed

- The Consensus Analyst Price Target has risen from $3.90 to $4.12.

- The Consensus Revenue Growth forecasts for Wolfspeed has significantly fallen from 15.1% per annum to 12.2% per annum.

- The Future P/E for Wolfspeed has significantly risen from 6.45x to 7.39x.

Key Takeaways

- Closing inefficient facilities will lower the breakeven point, enhancing net margins through reduced operating costs.

- Advancements in 200-millimeter technology position Wolfspeed to capture market share in the growing EV and renewable energy sectors, driving revenue growth.

- Slowing EV market growth, cost challenges, and competitive risks from China threaten Wolfspeed's revenue, profitability, and market share, with facility costs affecting margins.

Catalysts

About Wolfspeed- Operates as a bandgap semiconductor company focuses on silicon carbide and gallium nitride (GaN) technologies in Europe, Hong Kong, China, rest of Asia-Pacific, the United States, and internationally.

- Wolfspeed is aggressively executing a plan to improve financial performance and accelerate the path to profitability by leveraging its advanced 200-millimeter greenfield facilities, which should positively impact operating margins and earnings.

- The company is closing its less efficient Durham and Farmers Branch facilities, which will lower its breakeven point and enhance net margins through reduced operating costs.

- Wolfspeed is focusing on reducing CapEx by leveraging modular facility designs, which will improve cash flow and financial flexibility, impacting earnings positively.

- The receipt of U.S. government support, including CHIPS Act funding, is expected to significantly enhance liquidity and enable future growth, thereby improving the company's capital structure and potentially boosting future revenue.

- Wolfspeed's advancements in 200-millimeter technology and its leadership in silicon carbide production are poised to capture market share in the growing EV and renewable energy sectors, driving revenue growth in the coming years.

Wolfspeed Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Wolfspeed's revenue will grow by 15.1% annually over the next 3 years.

- Analysts are not forecasting that Wolfspeed will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Wolfspeed's profit margin will increase from -146.4% to the average US Semiconductor industry of 13.8% in 3 years.

- If Wolfspeed's profit margin were to converge on the industry average, you could expect earnings to reach $159.8 million (and earnings per share of $0.84) by about July 2028, up from $-1.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.4x on those 2028 earnings, up from -0.2x today. This future PE is lower than the current PE for the US Semiconductor industry at 30.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

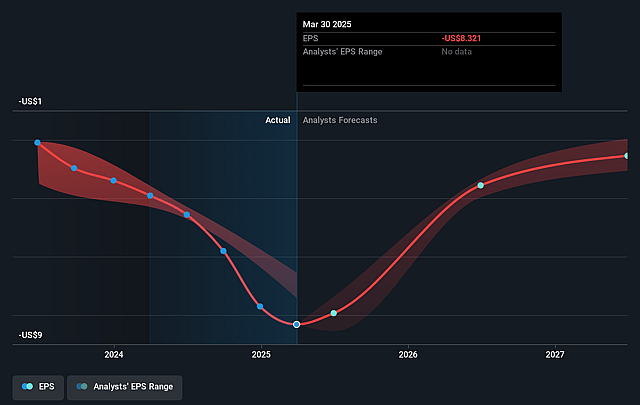

Wolfspeed Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Slowing growth in the EV market and other macroeconomic pressures could impact Wolfspeed's ability to increase revenue as anticipated, affecting future earnings.

- The company faces challenges in reducing costs and achieving positive free cash flow, which might delay improvements in net margins and profitability.

- The reliance on government funding, such as the CHIPS Act, introduces risk if operational milestones or financial requirements are not met, potentially impacting capital availability and liquidity.

- The competitive landscape, especially from China, presents risks that could affect Wolfspeed's market share and revenues in the silicon carbide sector.

- Underutilization and start-up costs related to new facilities like Mohawk Valley are expected to impact gross margins until sufficient revenue ramp-up occurs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $3.9 for Wolfspeed based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $1.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $159.8 million, and it would be trading on a PE ratio of 6.4x, assuming you use a discount rate of 11.6%.

- Given the current share price of $1.42, the analyst price target of $3.9 is 63.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.