Key Takeaways

- Early-mover advantage, production automation, and strategic customer partnerships position Wolfspeed for accelerated market share gains and recurring revenue growth.

- Operational streamlining and alignment with government policy enable lower costs, improved margins, and greater access to financial support than competitors.

- Persistent financial pressures, operational risks, reliance on external funding, and market competition threaten Wolfspeed's growth, industry leadership, and long-term profitability.

Catalysts

About Wolfspeed- A semiconductor company, focuses on silicon carbide and gallium nitride (GaN) technologies in Europe, Hong Kong, China, rest of Asia-Pacific, the United States, and internationally.

- Analyst consensus expects margin expansion from 200-millimeter facility ramp, but given Wolfspeed's early-mover advantage and fully automated, high-yield production, the company could leapfrog competitors in both capacity and quality, enabling far greater market share gains and explosive revenue growth earlier than expected.

- While most recognize restructuring benefits, the scope of operational streamlining-including aggressive leadership cuts, factory consolidation, and technology focus-positions Wolfspeed to deliver much lower cost-per-wafer and higher blended net margins, with cash flow inflecting meaningfully ahead of consensus timelines.

- Wolfspeed's deepening strategic engagement with blue-chip customers in high-growth verticals like EVs, AI data centers, and defense creates a pipeline of long-term supply agreements, unlocking visible, recurring revenue and improved earnings predictability as electrification trends accelerate globally.

- Accelerating demand for SiC in next-generation power management across automotive, renewables, and industrial automation is likely to drive structurally higher utilization rates at Wolfspeed's Mohawk Valley fab, amplifying both top-line growth and operating leverage as the market shifts rapidly from legacy silicon solutions.

- The company's leadership in domestic manufacturing and proactive alignment with government policy priorities positions it to be the primary beneficiary of multiple rounds of federal support and incentives, which could dramatically reduce capital needs, bolster liquidity, and enable outsized strategic investment compared to industry peers.

Wolfspeed Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Wolfspeed compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Wolfspeed's revenue will grow by 14.5% annually over the next 3 years.

- Even the bullish analysts are not forecasting that Wolfspeed will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Wolfspeed's profit margin will increase from -146.4% to the average US Semiconductor industry of 14.4% in 3 years.

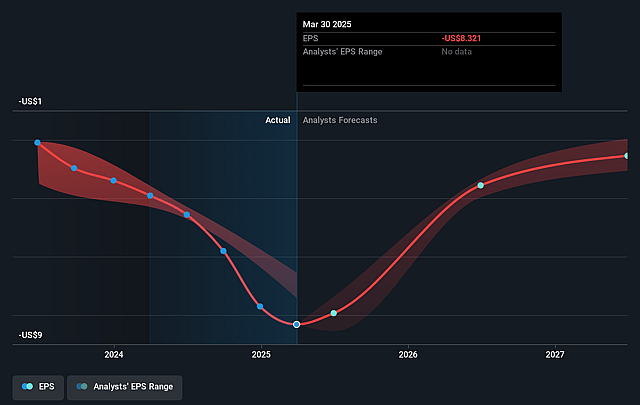

- If Wolfspeed's profit margin were to converge on the industry average, you could expect earnings to reach $164.6 million (and earnings per share of $0.87) by about August 2028, up from $-1.1 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.4x on those 2028 earnings, up from -0.2x today. This future PE is lower than the current PE for the US Semiconductor industry at 28.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Wolfspeed Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Wolfspeed continues to experience high capital expenditure requirements and negative free cash flow, with the most recent quarter reporting negative free cash flow of 168 million dollars, reflecting ongoing financial strain and potential pressure on earnings and liquidity.

- Major restructuring efforts, including facility closures and a workforce reduction of approximately 25 percent, signal ongoing operational and execution risk; delays or missteps could harm revenue growth as markets and technologies evolve.

- The company's reliance on securing federal funding and favorable negotiations with lenders introduces financial uncertainty, and the mention of potential in-court debt restructuring scenarios may raise concerns about balance sheet strength and net margins.

- Slowing demand from materials customers and lumpy performance in key end markets, such as industrial and energy, could result in unpredictable or stagnant revenue as economic or regulatory headwinds impact the sectors critical to Wolfspeed's growth projections.

- Accelerated industry transitions and advancements in alternative semiconductor materials, along with increasing competition, risk eroding Wolfspeed's silicon carbide market leadership, potentially compressing future margins and reducing the company's share of industry revenue.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Wolfspeed is $7.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Wolfspeed's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $1.5.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.1 billion, earnings will come to $164.6 million, and it would be trading on a PE ratio of 11.4x, assuming you use a discount rate of 12.3%.

- Given the current share price of $1.5, the bullish analyst price target of $7.0 is 78.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.