Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and expanding demand in specific technologies are set to significantly boost Onto Innovation's revenue and earnings over the coming years.

- Focus on improved process yields and advanced metrology systems will sustain robust revenue levels amidst evolving customer needs.

- Increased R&D and acquisitions heighten expenses, risking margin pressure if returns fall short, while reliance on AI packaging and specialty devices underscores market vulnerability.

Catalysts

About Onto Innovation- Engages in the design, development, manufacture, and support of process control tools that performs optical metrology.

- The acquisition of Lumina Instruments, which specializes in laser-based inspection technologies, is expected to expand Onto Innovation's served available market (SAM) by $250 million annually in the next three years. This expansion could substantially increase revenue.

- The tuck-in acquisition of the lithography business from Kulicke & Soffa, which includes 24 issued patents and 8 more pending, is expected to positively impact earnings within 12 months and generate up to $100 million in annual revenue over the next three years. This is expected to contribute to both revenue growth and earnings.

- The anticipated increased demand for front-end metrology systems, particularly in films and acoustic metrology, driven by advances in logic packaging and higher process yields, will likely boost revenue.

- The potential increase in high-bandwidth memory (HBM) demand, driven by the doubling of 2.5D logic capacity, is expected to stimulate capital expenditure in process control, potentially increasing Onto Innovation's revenue.

- Despite a muted demand environment, the continued focus on driving yield improvements in power devices, especially as customers transition to larger wafer sizes, is expected to sustain record revenue levels, supporting both revenue and margins.

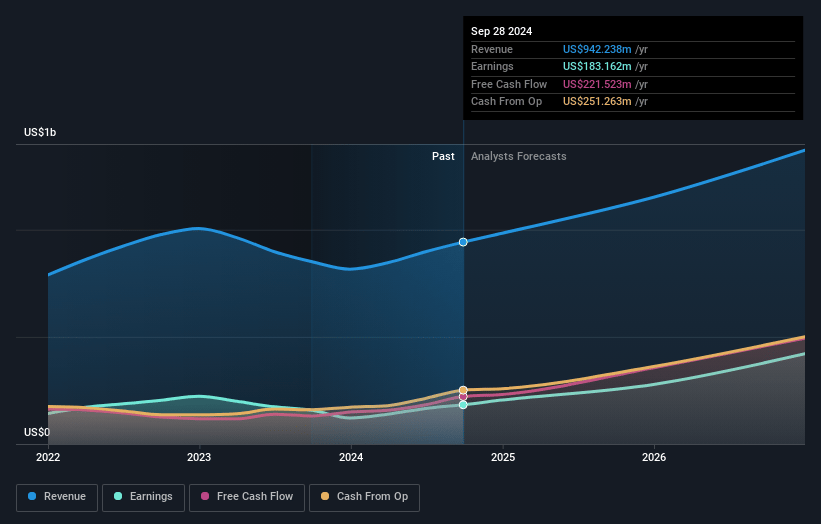

Onto Innovation Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Onto Innovation's revenue will grow by 16.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 19.4% today to 29.4% in 3 years time.

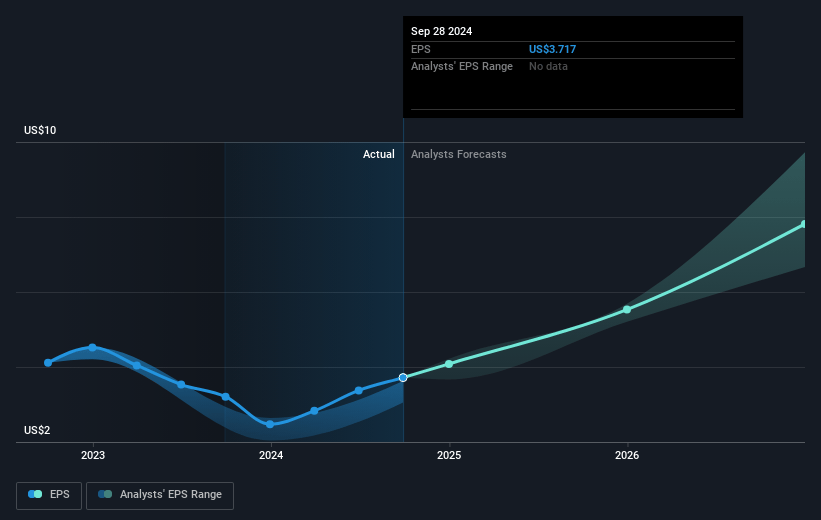

- Analysts expect earnings to reach $443.5 million (and earnings per share of $8.16) by about November 2027, up from $183.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $488 million in earnings, and the most bearish expecting $362.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.2x on those 2027 earnings, down from 44.4x today. This future PE is greater than the current PE for the US Semiconductor industry at 30.3x.

- Analysts expect the number of shares outstanding to grow by 3.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.05%, as per the Simply Wall St company report.

Onto Innovation Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Technical disruptions during the earnings call may indicate issues with investor communications and company transparency, potentially affecting investor confidence and future revenue projections.

- The pushout of over $10 million due to customer capacity needs in their JetStep lithography business highlights a risk of revenue recognition delays, which could impact short-term revenue growth and earnings.

- The muted demand and slow expansion in high-bandwidth memory (HBM), despite expectations for growth, pose a risk of revenue underperformance if this key market doesn't accelerate as anticipated.

- Increasing operating expenses due to ramped-up R&D investments and acquisitions might pressure net margins if these investments do not yield the expected returns in new technologies or enhanced market positioning.

- The continued reliance on advancements primarily in AI packaging and specialty devices indicates potential vulnerability to market fluctuations in these sectors. If the expected demand from AI packaging and advanced nodes doesn't materialize, it could impact future revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $255.12 for Onto Innovation based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.5 billion, earnings will come to $443.5 million, and it would be trading on a PE ratio of 39.2x, assuming you use a discount rate of 8.1%.

- Given the current share price of $164.74, the analyst's price target of $255.12 is 35.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives