Last Update 11 Dec 25

QCOM: Premium Android Strength And Emerging AI Inference Will Drive Balanced Future Outcomes

Analysts have modestly raised their price target on Qualcomm to about $205, citing broad based strength in premium Android handsets, autos and IoT; a solid earnings beat; and growing optionality from the company’s emerging AI and data center accelerator initiatives.

Analyst Commentary

Bullish analysts see Qualcomm's latest quarter as reinforcing a multi year growth narrative, with upside driven by premium Android share gains, expanding auto and IoT businesses, and early traction in AI accelerators. Several firms raised price targets into the $200 to $215 range, arguing that execution on diversification and AI could support further multiple expansion.

At the same time, not all observers are convinced that the new AI initiatives will translate into near term earnings leverage, and some caution that the stock already discounts a material portion of the handset recovery and automotive pipeline. The spread of targets from roughly $140 to the low $200s underscores differing views on how quickly Qualcomm can translate its AI optionality into durable, high margin growth.

Goldman Sachs and other large firms highlight that Qualcomm's AI accelerator and packaging efforts, including potential use of external foundry partners, could position the company more squarely as an AI beneficiary, but they also point to intensifying competition and pricing pressure across the broader AI hardware landscape.

Bullish analysts note that the announced rack scale AI deployments, including the large Saudi Arabia project, validate Qualcomm's technology roadmap and provide potential multi billion dollar revenue visibility over time, even if the contribution is likely to ramp gradually and remain a small slice of the company’s total mix in the near term.

Against this backdrop, the market debate centers on whether Qualcomm should be valued primarily as a premium mobile and connectivity leader with steady diversification, or increasingly as an AI play with higher growth but also higher execution risk.

Bullish Takeaways

- Price target increases into the $200 to $215 range reflect confidence that strong premium Android share, particularly at leading OEMs, can sustain above trend earnings growth and justify a higher multiple.

- Broad based QCT strength in handsets, autos, and IoT, with double digit growth across these segments, is seen as evidence that diversification is working and reducing reliance on a single end market in valuation models.

- Early AI data center wins, including a large multi year rack scale deployment, support the view that Qualcomm now has credible exposure to the high growth AI inference market, adding upside optionality to long term revenue forecasts.

- Improving execution, consistent beats versus guidance, and raised estimates are viewed as catalysts for continued multiple expansion as investors gain confidence in both the core franchise and emerging AI initiatives.

Bearish Takeaways

- Some bearish analysts keep targets closer to the mid $100s, arguing that concerns about an AI bubble and a less certain semiconductor growth backdrop could cap valuation despite recent momentum.

- AI accelerator and packaging activities are currently a small percentage of overall sales, leading skeptics to question whether the stock’s recent re rating as an AI play fully reflects actual near term earnings contribution.

- Intensifying competition in AI hardware from larger incumbents and new platforms raises execution and pricing risks, which could limit margin expansion and justify more conservative long term growth assumptions.

- Ongoing uncertainty around the broader semiconductor cycle, including utilization levels in certain nodes, fuels caution that current strength in premium tiers may not be fully sustainable across all end markets.

What's in the News

- South Korea's antitrust regulator inspected Arm's Seoul offices after a Qualcomm complaint over licensing practices, escalating global scrutiny of Arm's business model. (Bloomberg)

- Qualcomm and HUMAIN announced a large scale AI collaboration in Saudi Arabia, targeting 200 megawatts of Qualcomm AI200 and AI250 rack solutions starting in 2026 to deliver edge to cloud AI inference services and position the Kingdom as a global AI hub. (Company announcement)

- A U.S. District Court judge granted Qualcomm a complete victory in Arm's lawsuit over Nuvia licenses, upholding a prior jury verdict and reinforcing Qualcomm's ability to deploy its custom CPU cores under its own Arm architecture license. (Court ruling)

- China opened an antitrust investigation into Qualcomm's acquisition of Autotalks, after the company acknowledged it had completed the deal without notifying Chinese regulators. (Reuters, CNBC)

- Apple is planning to replace Qualcomm modems with in house C2 components in the iPhone 18 Pro lineup, raising longer term questions about Qualcomm's share of Apple's modem business. (Bloomberg)

Valuation Changes

- Fair Value: Unchanged at approximately $191.80 per share, reflecting a steady view of intrinsic equity value.

- Discount Rate: Fallen slightly from about 10.83 percent to 10.78 percent, implying a marginally lower required return on equity.

- Revenue Growth: Essentially unchanged at roughly 2.97 percent, indicating a stable outlook for long term top line expansion.

- Net Profit Margin: Stable at about 25.54 percent, with no material revision to long run profitability assumptions.

- Future P/E: Edged down slightly from around 20.59x to 20.57x, signaling a modestly lower valuation multiple applied to forward earnings.

Key Takeaways

- Diversification into AI devices, automotive, and industrial IoT is set to drive higher margins and reduce dependence on individual customers.

- Strategic expansion in data centers and next-gen connectivity broadens Qualcomm's addressable market and supports long-term sustainable growth.

- Rising competition, geopolitical risks, unproven diversification, regulatory pressures, and reliance on volatile smartphone markets threaten QUALCOMM's revenue, margins, and long-term earnings stability.

Catalysts

About QUALCOMM- Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

- Expanding adoption of AI-powered devices-including smartphones, XR wearables, smart glasses, and emerging personal AI products-should fuel higher average selling prices, increased unit demand, and ongoing upgrade cycles, positively impacting Qualcomm's future revenue and supporting gross margin expansion.

- Rapid growth in automotive and industrial IoT segments, supported by strong design win momentum and a robust multi-year pipeline (with a combined $22 billion revenue target by 2029), is set to diversify Qualcomm's revenue base and drive margin-accretive growth as these businesses become a larger share of total earnings.

- Successful execution of multi-year agreements with global OEMs (e.g., expanded Xiaomi partnership, strong Samsung baseline share), along with deepening relationships in key international markets, increases revenue visibility and reduces customer concentration risk, supporting steadier long-term top-line growth.

- Strategic entry into the data center accelerated by the Alphawave acquisition positions Qualcomm to capture new high-growth markets as AI inference and edge workloads scale, with potential material revenue contribution starting FY28; this catalyst can drive both revenue and high-margin licensing streams.

- Proliferation of 5G, Wi-Fi 7, and next-gen connectivity across devices and industries continues to grow device complexity and connectivity requirements, bolstering Qualcomm's addressable market and providing a structural tailwind to revenue-per-device and ecosystem-wide earnings.

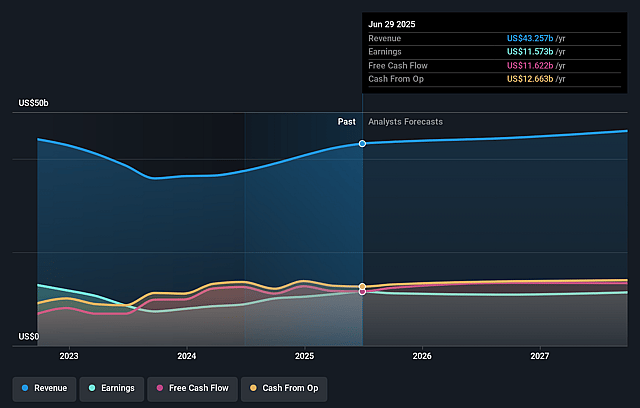

QUALCOMM Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming QUALCOMM's revenue will grow by 2.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 26.8% today to 26.1% in 3 years time.

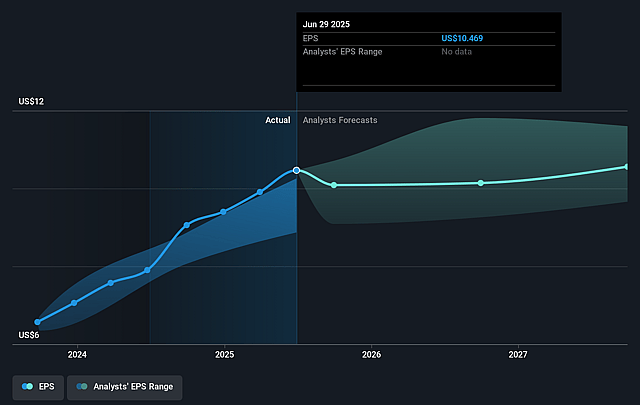

- Analysts expect earnings to reach $12.2 billion (and earnings per share of $11.24) by about September 2028, up from $11.6 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $10.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.2x on those 2028 earnings, up from 14.7x today. This future PE is lower than the current PE for the US Semiconductor industry at 33.5x.

- Analysts expect the number of shares outstanding to decline by 2.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.33%, as per the Simply Wall St company report.

QUALCOMM Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Escalating competition from major OEMs such as Apple and Samsung developing in-house chips, as well as local players in China, threatens QUALCOMM's mobile chipset market share, risking lower revenues and margin compression.

- Ongoing global trade volatility and geopolitical tensions, especially U.S.-China dynamics and tech sovereignty initiatives, may disrupt supply chains and shrink QUALCOMM's addressable market in key international regions, negatively impacting long-term revenue growth.

- The company's ambitious diversification initiatives into data centers and AI acceleration are in early, unproven phases and depend heavily on successful customer engagements and large design wins; delays, integration challenges (including Alphawave acquisition), or failure to capture significant share could result in higher R&D expenses without corresponding revenue growth, hurting net earnings and margins.

- Heavy legal and regulatory scrutiny remains a persistent risk, especially regarding QUALCOMM's patent licensing business model, which could result in lower royalty revenues and a structurally lower operating margin if adverse rulings or settlements occur.

- The reduction of Apple-related revenues and QUALCOMM's continued reliance on cyclical segments like smartphones expose the company to secular stagnation in handset sales, increasing volatility and threatening the sustainability of both revenue and net income over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $177.715 for QUALCOMM based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $225.0, and the most bearish reporting a price target of just $140.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $46.9 billion, earnings will come to $12.2 billion, and it would be trading on a PE ratio of 19.2x, assuming you use a discount rate of 10.3%.

- Given the current share price of $158.66, the analyst price target of $177.71 is 10.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on QUALCOMM?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.