Key Takeaways

- Explosive demand for PDF's integrated SaaS and secure data platforms is fueling sustained margin expansion and long-term, resilient revenue growth above industry expectations.

- Category leadership and strategic partnerships create a powerful network effect, locking in customers and structurally boosting recurring revenue and operating leverage.

- Reliance on major clients, sluggish SaaS growth, high spending, and industry pressures heighten PDF Solutions' margin, revenue, and international expansion risks.

Catalysts

About PDF Solutions- Provides proprietary software, physical intellectual property for integrated circuit designs, electrical measurement hardware tools, proven methodologies, and professional services in the United States, Japan, China, Taiwan, and internationally.

- While analyst consensus expects increased adoption of Exensio and Sapience to lift SaaS recurring revenue and margins, actual demand for enterprise-wide solutions is materially outpacing expectations, with major pilots rapidly converting to full-scale deployments-this accelerating pace signals the potential for revenue growth rates and margin expansion to sustain well above current targets into future years.

- Analyst consensus sees cross-selling from SecureWise and Cimetrix as a strong opportunity; however, SecureWise's integration unlocks not just product synergies but creates a transformative, end-to-end secure data platform across the global semiconductor supply chain-positioning PDF as the only vendor able to provide integrated, standards-driven, AI

- and security-enabled collaboration at global scale, which may lead to multi-year, high-margin contracts and unrivaled customer lock-in, structurally raising gross and net margins.

- With the semiconductor industry's aggressive move toward geographical diversification and rapid fab construction globally, PDF is positioned as a key beneficiary as new fabs routinely "design in" analytics and smart manufacturing platforms from day one, supporting a structural increase in annual bookings, backlog visibility, and highly resilient top-line growth regardless of economic cycles.

- The proliferation of AI/ML-driven chip design and manufacturing-combined with PDF's leadership in process control and proprietary IP-opens the door to new, premium pricing models for advanced analytics and yield solutions, which could drive pricing power above industry norms and translate directly into significant long-term operating income and EPS upside.

- PDF's deepening ecosystem of partnerships (SAP, Advantest, Siemens) and category leadership in AI-enabled semiconductor data platforms create an emerging "network effect", making the company a potential industry standard and accelerating customer wins, while also establishing a strategic moat that may result in robust revenue growth and stronger-than-expected increase in recurring revenue as share shifts from point solutions to tightly integrated platforms.

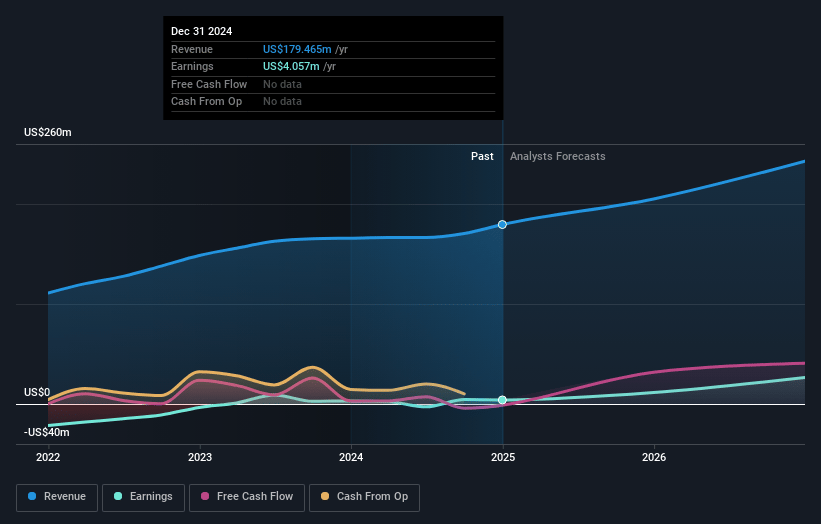

PDF Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on PDF Solutions compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming PDF Solutions's revenue will grow by 22.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 0.8% today to 26.7% in 3 years time.

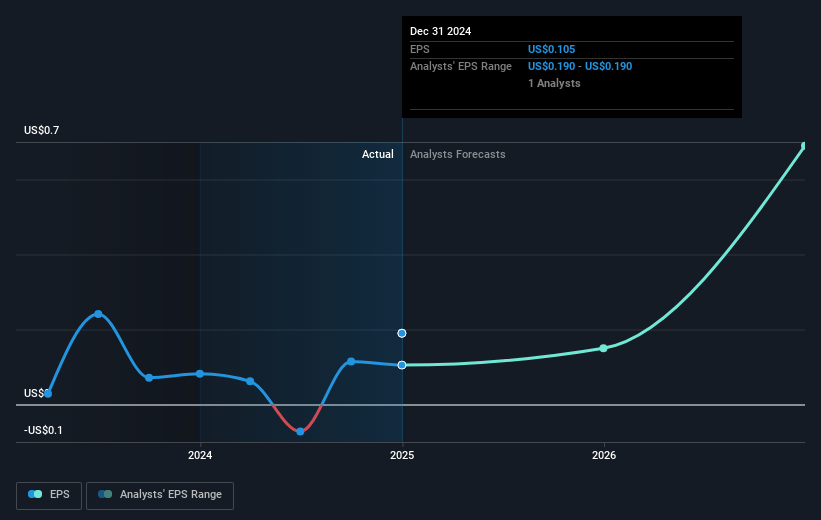

- The bullish analysts expect earnings to reach $91.0 million (and earnings per share of $1.67) by about July 2028, up from $1.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 20.9x on those 2028 earnings, down from 656.1x today. This future PE is lower than the current PE for the US Semiconductor industry at 28.1x.

- Analysts expect the number of shares outstanding to grow by 1.02% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.78%, as per the Simply Wall St company report.

PDF Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened consolidation among semiconductor manufacturers and increasing customer bargaining power may pressure PDF Solutions' contract terms and lead to declining gross margins over time, especially as some partnerships and revenue streams with key players like Advantest are described as potentially shrinking or remaining flat.

- The company's reliance on a few large client contracts, such as recent enterprise-wide platform deals and eProbe equipment sales, introduces revenue volatility and concentration risk, making the business susceptible to outsized impact on both revenue and earnings should any major customer pause or terminate engagements.

- The text notes challenges with growing and effectively selling enterprise analytics offerings, with management rating their sales execution as "still a C student," which-alongside complex, slow customer adoption cycles-indicates ongoing difficulties in scaling recurring SaaS revenue and maintaining predictable cash flows or net margins.

- Continued high research and development spending, coupled with stepped-up sales and marketing expenses as the company pushes new product adoption, could erode net margins if incremental revenue does not scale sufficiently, especially as previous innovation "takes a while to get digested" by customers.

- Accelerating regulatory scrutiny, potential for increased tariffs, and the risk of supply chain decoupling between the US and China heighten uncertainty, which may limit PDF Solutions' international expansion efforts and restrict parts of its addressable market, ultimately impacting long-term revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for PDF Solutions is $36.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of PDF Solutions's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $36.0, and the most bearish reporting a price target of just $24.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $340.5 million, earnings will come to $91.0 million, and it would be trading on a PE ratio of 20.9x, assuming you use a discount rate of 9.8%.

- Given the current share price of $23.77, the bullish analyst price target of $36.0 is 34.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.