Key Takeaways

- Accelerating adoption of AI-driven analytics and partnerships with industry leaders are supporting recurring revenue growth and improved margins in semiconductor manufacturing solutions.

- Integration of recent acquisitions and platform expansion is unlocking new cross-selling, high-margin opportunities, positioning for long-term earnings and market share gains.

- Geopolitical risks, long adoption cycles, rising competition, high operating expenses, and customer concentration threaten future growth, revenue stability, and market share for PDF Solutions.

Catalysts

About PDF Solutions- Provides proprietary software, physical intellectual property for integrated circuit designs, electrical measurement hardware tools, proven methodologies, and professional services in the United States, Japan, China, Taiwan, and internationally.

- Adoption of advanced analytics and AI/ML solutions across the semiconductor supply chain—including expanded deployments of the Sapience Manufacturing Hub and enterprise-wide Exensio platforms—is accelerating as semiconductor manufacturers seek greater efficiency and data-driven decision-making, supporting higher recurring SaaS revenue, improved revenue visibility, and elevated gross margins.

- Ongoing complexity in semiconductor design and manufacturing, including advanced nodes and 3D packaging, is driving demand for integrated collaboration and analytics platforms; PDF Solutions’ recent SecureWise acquisition and integration with products like Cimetrix and DEX are positioned to unlock cross-selling opportunities, incremental high-margin revenues, and strengthen long-term earnings growth.

- Increased reliance on connected devices and IoT in manufacturing is expanding the addressable market for robust, scalable data analytics and “smart manufacturing” solutions—areas where PDF Solutions has demonstrated momentum with growing bookings and new enterprise wins, fueling top-line revenue growth.

- Deepening partnerships with industry leaders (e.g., SAP, Advantest, Siemens) are building a foundation for sustained market share gains and improved customer stickiness, enabling broader platform adoption, enhanced recurring revenue streams, and potential for higher net margins over time.

- Strong, improving gross margin profile (77% in Q1, up from 72% YoY) and a clear roadmap for further operational leverage post-SecureWise acquisition suggest additional future upside to operating margins and EPS, especially as R&D investments begin to translate into scaled, high-value offerings.

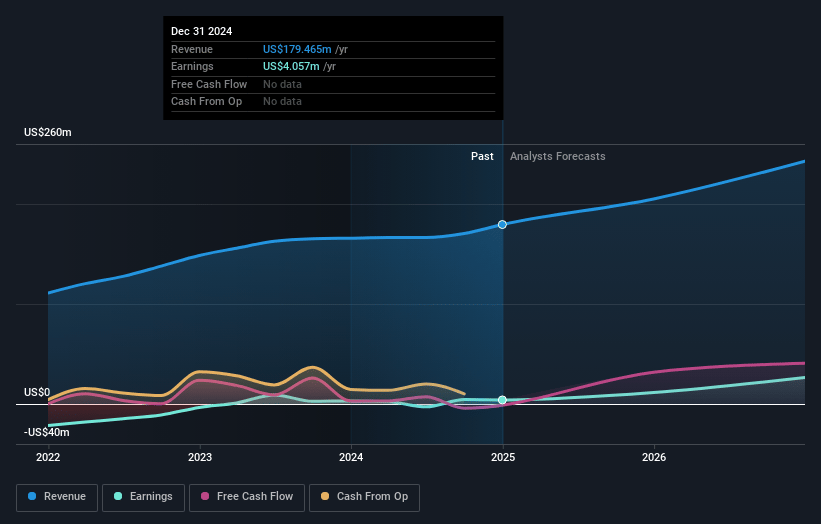

PDF Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming PDF Solutions's revenue will grow by 19.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.8% today to 15.7% in 3 years time.

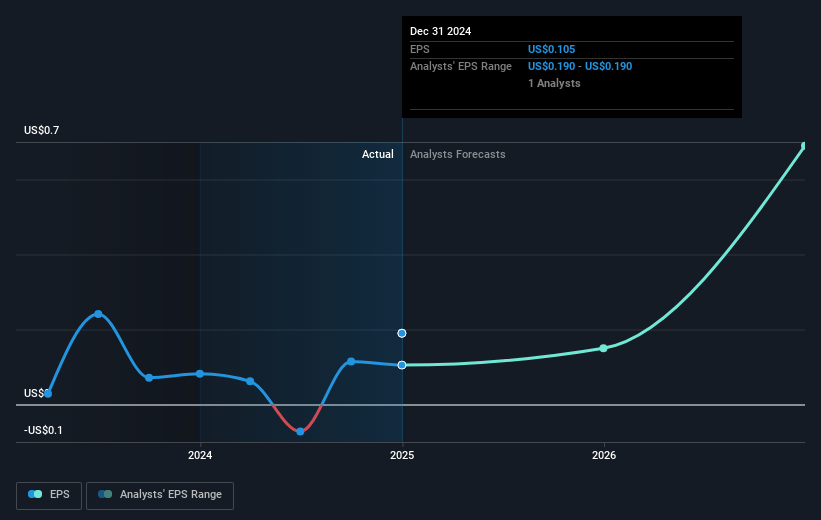

- Analysts expect earnings to reach $49.9 million (and earnings per share of $1.01) by about May 2028, up from $1.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.4x on those 2028 earnings, down from 543.8x today. This future PE is greater than the current PE for the US Semiconductor industry at 23.5x.

- Analysts expect the number of shares outstanding to grow by 1.02% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.49%, as per the Simply Wall St company report.

PDF Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heightened geopolitical instability and evolving tariffs, especially between the US and China, could disrupt global semiconductor supply chains and customer behavior over time; while currently minimal, increased restrictions or fragmentation could eventually impact PDF Solutions’ international revenue and growth opportunities.

- Customer adoption cycles for new analytics platforms and enterprise solutions such as Sapience Manufacturing Hub are long and complex, creating a risk of lumpy, delayed, or slowed revenue recognition—especially as deployments expand to full enterprise scale, which could pressure both near-term and longer-term revenue growth.

- Rising competition from large Electronic Design Automation (EDA) vendors and foundries developing integrated, in-house fab analytics or AI-driven solutions could erode PDF Solutions’ market share, drive down pricing, and reduce its future top-line revenue potential.

- The company's high R&D and sales/marketing expenditures required to innovate in advanced nodes and complex packaging, together with acquisition-related integration costs (e.g., SecureWise), may limit operating margin expansion if revenue growth is uneven or below expectations in certain markets.

- Significant reliance on a few large enterprise contracts and customer concentration, especially among leading-edge or recurring customers, exposes the business to potential revenue and earnings volatility should any key relationships fail to convert pilots to full deployments or reduce ongoing usage of PDF Solutions’ platforms.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $31.75 for PDF Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $36.0, and the most bearish reporting a price target of just $24.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $318.2 million, earnings will come to $49.9 million, and it would be trading on a PE ratio of 33.4x, assuming you use a discount rate of 9.5%.

- Given the current share price of $19.7, the analyst price target of $31.75 is 38.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.