Key Takeaways

- Focus on execution and strategy alignment enhances operational efficiencies, improving net margins, and supporting key product launches to drive revenue growth.

- Strategic AI and foundry investments expand capabilities and market share, strengthening financial stability and profitability with enhanced technology and capital support.

- Increased competition and execution risks, along with macro uncertainties and financial challenges, could impact Intel's market share, revenue growth, and profit margins.

Catalysts

About Intel- Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

- Intel is focusing on improving execution and strategy alignment, including streamlining operations and prioritizing high-value areas, which should enhance operational efficiencies and positively impact net margins.

- Intel is advancing its product roadmap, with key launches such as Panther Lake in 2025 and Nova Lake in 2026, which are expected to drive revenue growth and improved margins from a better cost structure and enhanced performance.

- The company is strategically expanding its AI PC and data center capabilities, investing heavily in AI CPU technology for consumer and enterprise markets, which should lead to increased revenues and higher market share.

- Intel Foundry is progressing with 18A technology, set to bolster external foundry services revenue as they target breakeven operations by 2027, which will enhance profitability and increase trust with new foundry customers.

- Updated agreements, such as the Department of Commerce grants, are providing significant capital injections that bolster gross margins and reduce operational risk while supporting advanced R&D and manufacturing capacity, which should improve long-term financial stability.

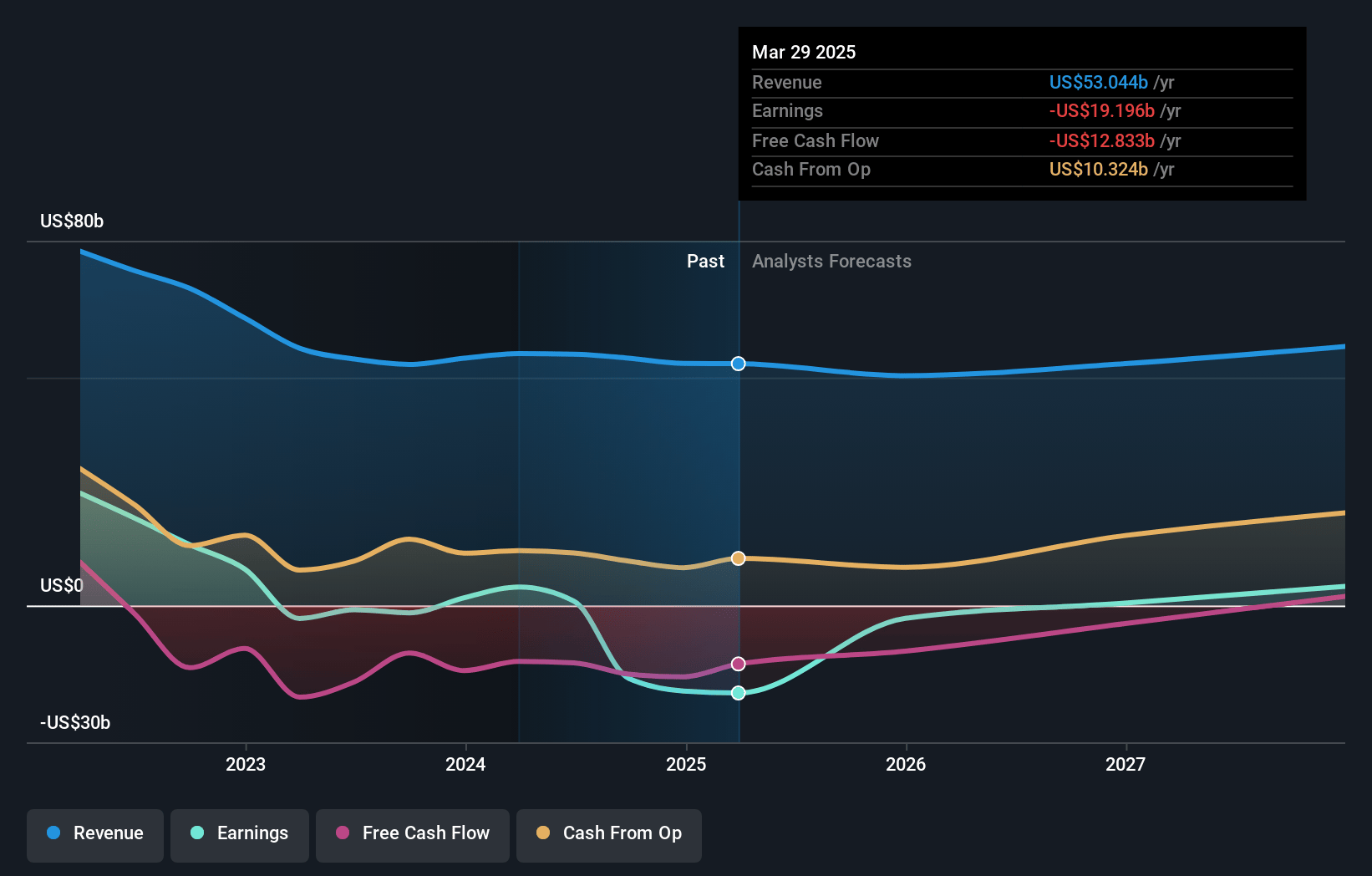

Intel Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Intel compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Intel's revenue will grow by 6.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -35.3% today to 9.3% in 3 years time.

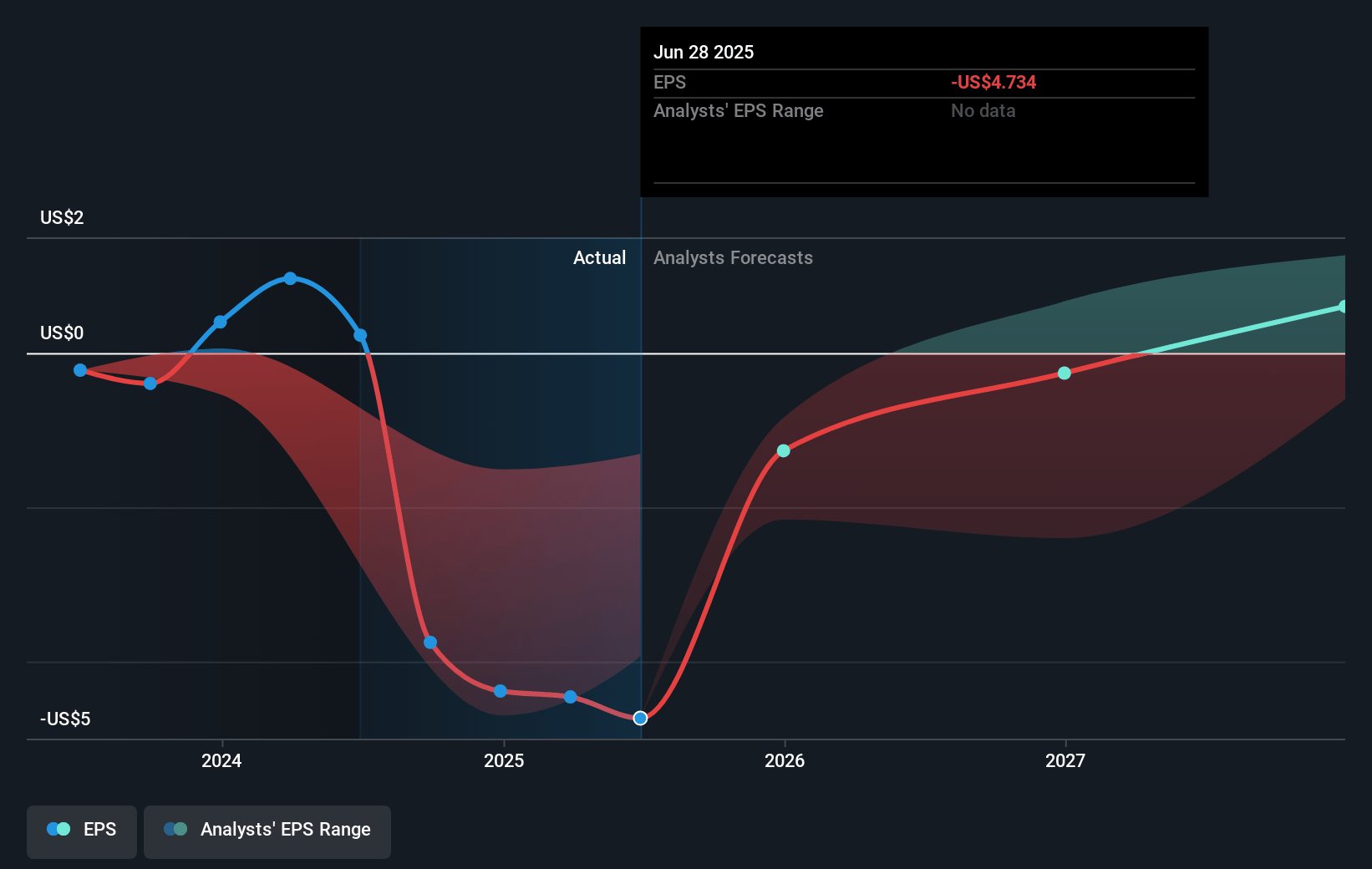

- The bullish analysts expect earnings to reach $6.0 billion (and earnings per share of $1.37) by about April 2028, up from $-18.8 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 27.0x on those 2028 earnings, up from -4.6x today. This future PE is greater than the current PE for the US Semiconductor industry at 23.2x.

- Analysts expect the number of shares outstanding to grow by 1.71% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.96%, as per the Simply Wall St company report.

Intel Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intel faces increased competition in the AI PC category and data center markets, which may challenge its market share and impact future revenue growth.

- The shift to more advanced process technologies like Intel 18A carries execution risks, and any delays or issues could lead to increased costs and impact net margins.

- Intel's dependence on successful product launches, such as Panther Lake and Nova Lake, introduces risks of not meeting market expectations, potentially affecting revenues and earnings.

- Macro uncertainties, including potential tariffs and geopolitical factors, could impact overall demand and financial performance, affecting revenue and profit margins.

- Intel Foundry's current financial performance is challenged with negative gross margins and operating losses that need to be systematically addressed to reach breakeven, presenting a risk to future earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Intel is $25.91, which represents one standard deviation above the consensus price target of $22.68. This valuation is based on what can be assumed as the expectations of Intel's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $31.0, and the most bearish reporting a price target of just $17.7.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $64.9 billion, earnings will come to $6.0 billion, and it would be trading on a PE ratio of 27.0x, assuming you use a discount rate of 11.0%.

- Given the current share price of $19.85, the bullish analyst price target of $25.91 is 23.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:INTC. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.