Key Takeaways

- Expansion into Data Center AI and new MI350 GPUs will significantly drive revenue growth and enhance AMD's market competitiveness.

- Strategic acquisition and product roadmap enhancements position AMD for increased market reach, profitability, and operational efficiency.

- Over-reliance on Data Center AI and declining Gaming revenue highlight risks in revenue stability amid high competition and increased operational expenses.

Catalysts

About Advanced Micro Devices- Operates as a semiconductor company worldwide.

- AMD's rapid expansion in the Data Center AI segment, which contributed over $5 billion in 2024 with expectations to grow to tens of billions moving forward, is poised to significantly boost revenue and earnings as AI infrastructure investments proliferate across the industry.

- The anticipated volume production and deployment of next-generation MI350 series GPUs, featuring a 35x increase in AI compute performance, is expected to drive strong revenue growth and improve AMD's competitive positioning in the Data Center GPU market by mid-2025.

- The strategic acquisition of ZT Systems is expected to enhance AMD's market reach and operational efficiency, potentially translating into better net margins and earnings growth as integration progresses and manufacturing capabilities expand.

- Continued gains in server market share with the EPYC processor line, coupled with strong demand from hyperscalers and enterprise customers, are likely to drive robust revenue growth and enhance AMD's operating margins by offering high-performance, competitive server solutions.

- The comprehensive product roadmap, including the launch of new Ryzen and Radeon series, and AMD's strategic collaborations with OEMs like Dell, are expected to continue driving Client segment growth, potentially increasing revenue and profitability as more market share is captured in the commercial PC space.

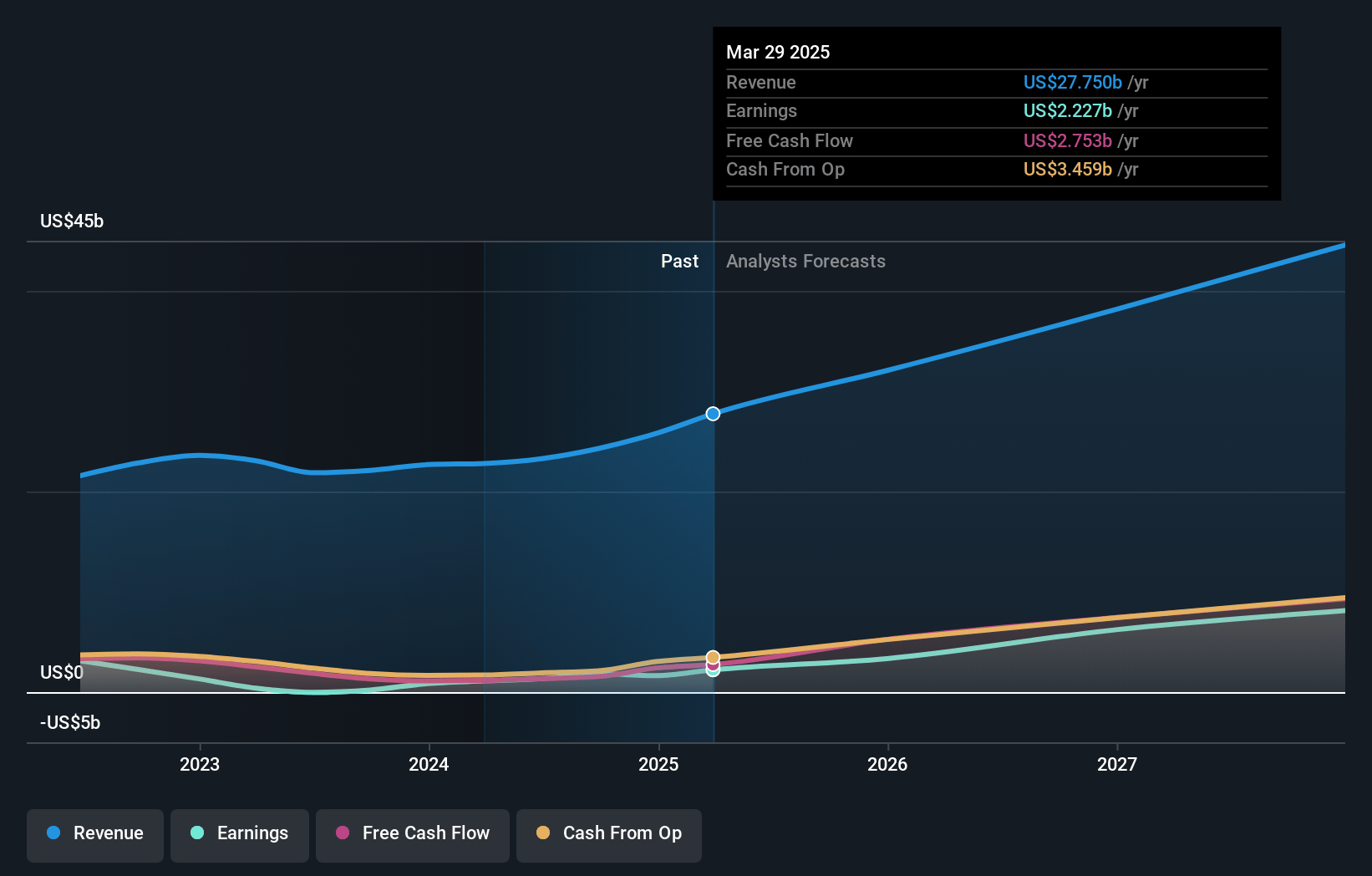

Advanced Micro Devices Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Advanced Micro Devices compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Advanced Micro Devices's revenue will grow by 24.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.4% today to 22.5% in 3 years time.

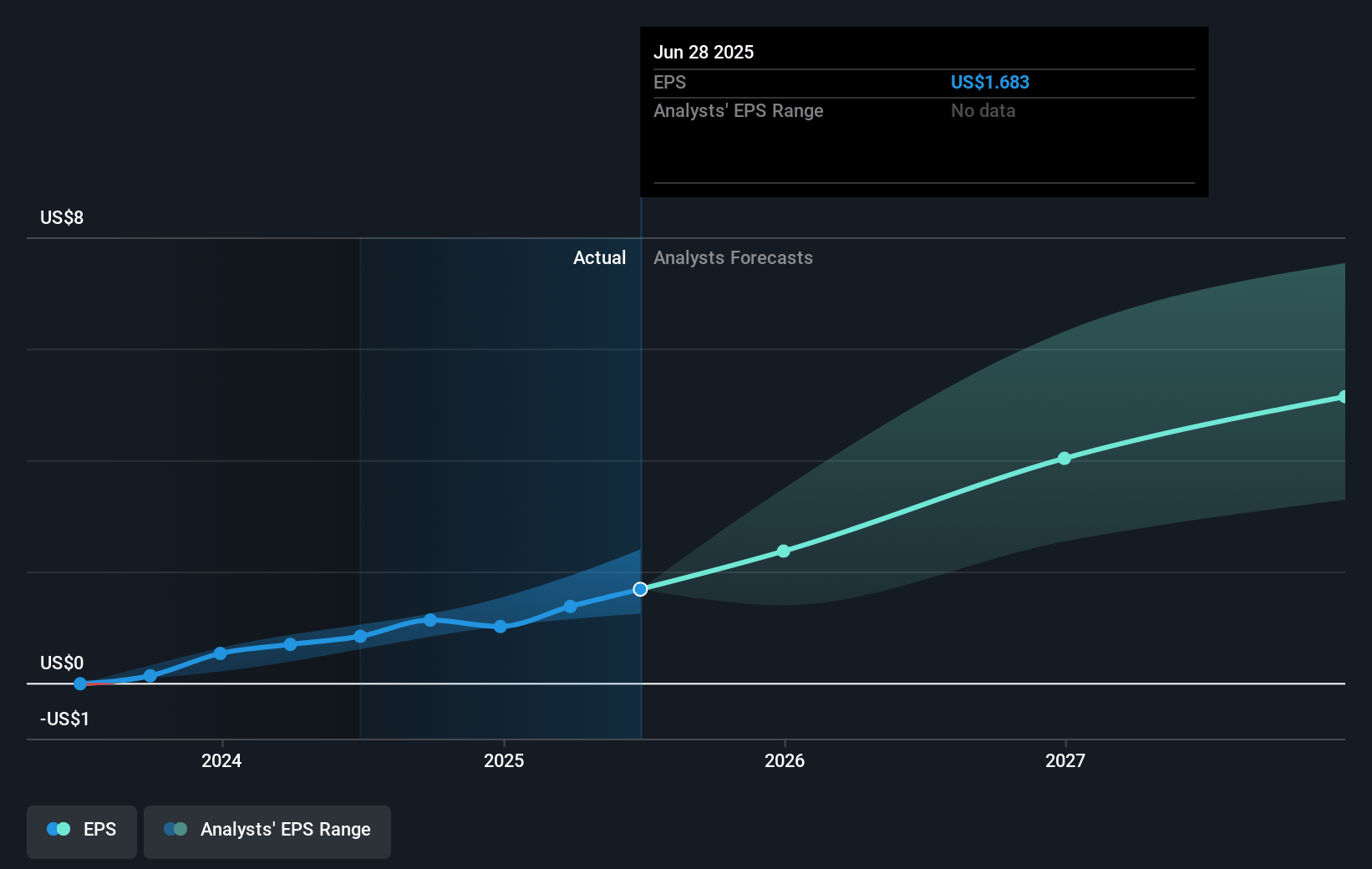

- The bullish analysts expect earnings to reach $11.3 billion (and earnings per share of $6.92) by about April 2028, up from $1.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 32.1x on those 2028 earnings, down from 93.9x today. This future PE is greater than the current PE for the US Semiconductor industry at 23.2x.

- Analysts expect the number of shares outstanding to grow by 0.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.9%, as per the Simply Wall St company report.

Advanced Micro Devices Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- AMD's reliance on its Data Center AI segment, which now accounts for a significant portion of revenue, introduces a risk of over-dependence on a high-growth but competitive market. This concentration could impact overall revenue stability if there are market shifts or increased competition.

- The decline in AMD's Gaming segment revenue by 59% year-over-year, primarily due to decreased semi-custom sales, indicates vulnerability to changing consumer demand patterns and pressures net margins in that segment.

- Despite record growth in Client and Data Center segments, AMD's Embedded segment saw a 13% revenue decline, highlighting challenges in certain end markets like industrial and communications that could affect long-term revenue diversification.

- The need for ongoing heavy investment in R&D and marketing to support AI and other business growth opportunities suggests increased operational expenses, which may limit net margin expansion if these initiatives do not yield anticipated returns.

- Intense competition in the server market, including pricing pressures from competitors attempting to maintain or grow their market share, presents an ongoing risk to AMD's revenue growth and net margins in this critical business segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Advanced Micro Devices is $172.3, which represents one standard deviation above the consensus price target of $144.34. This valuation is based on what can be assumed as the expectations of Advanced Micro Devices's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $225.0, and the most bearish reporting a price target of just $90.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $50.2 billion, earnings will come to $11.3 billion, and it would be trading on a PE ratio of 32.1x, assuming you use a discount rate of 8.9%.

- Given the current share price of $95.29, the bullish analyst price target of $172.3 is 44.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is an employee of Simply Wall St, but has written this narrative in their capacity as an individual investor. AnalystHighTarget holds no position in NasdaqGS:AMD. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.