Key Takeaways

- Strong momentum in data center and AI accelerators, product pipeline, and strategic partnerships are driving substantial growth and higher-margin opportunities across compute infrastructure markets.

- Expanding into premium client processors and diverse edge and embedded platforms broadens the addressable market and supports structural revenue and margin improvements.

- Regulatory scrutiny, supply chain dependencies, client insourcing, intense competition, and costly innovation all threaten AMD’s growth, margins, and long-term financial stability.

Catalysts

About Advanced Micro Devices- Operates as a semiconductor company worldwide.

- The accelerating ramp and widespread adoption of AMD’s Instinct AI accelerators and EPYC server CPUs by hyperscalers and major cloud providers signals significant future growth in data center and AI-related revenues, which is reinforced by strong customer demand, expanding use-cases in generative AI, and strategic wins such as the multibillion-dollar Oracle partnership. This momentum positions AMD to capture a larger share of the rapidly expanding compute infrastructure market, driving double-digit top-line growth.

- The upcoming launches of MI350 and next-generation MI400 Series AI accelerators, along with rack-level solutions enabled by the ZT Systems acquisition, enhance AMD’s competitive positioning and ability to deliver on complex AI workloads at scale. These product ramps are expected to rapidly broaden deployments starting in the second half of 2025, fueling step-changes in both revenue and gross margin as higher value-add data center products become a greater share of the mix.

- AMD’s consistently increasing R&D investments and execution on advanced node technologies (including the 2nm EPYC “Venice” CPUs and CDNA 4 AI architecture) sustain the company’s technological leadership, enable higher ASPs, and support premium pricing power across both client and data center markets. These factors support structural improvements in gross margins and operating income over the long term.

- Rapid share gains and strong ASP expansion in the Client segment, driven by high-end Ryzen desktop and AI PC processors, open opportunities for outsized revenue growth and margin uplift as AMD expands into premium commercial and notebook markets. The fact that AMD expects client processor revenues to outpace overall market growth in the coming years supports North Star operating model improvements in both revenue and operating leverage.

- Broadening adoption in edge computing, IoT, and embedded AI platforms—exemplified by record wins in automotive, enterprise, healthcare, and telecom verticals—positions AMD to capture the growing semiconductor content across distributed compute environments. This diversification boosts the company’s total addressable market, stabilizes revenue, and offers incremental margin opportunities in new high-growth end-markets.

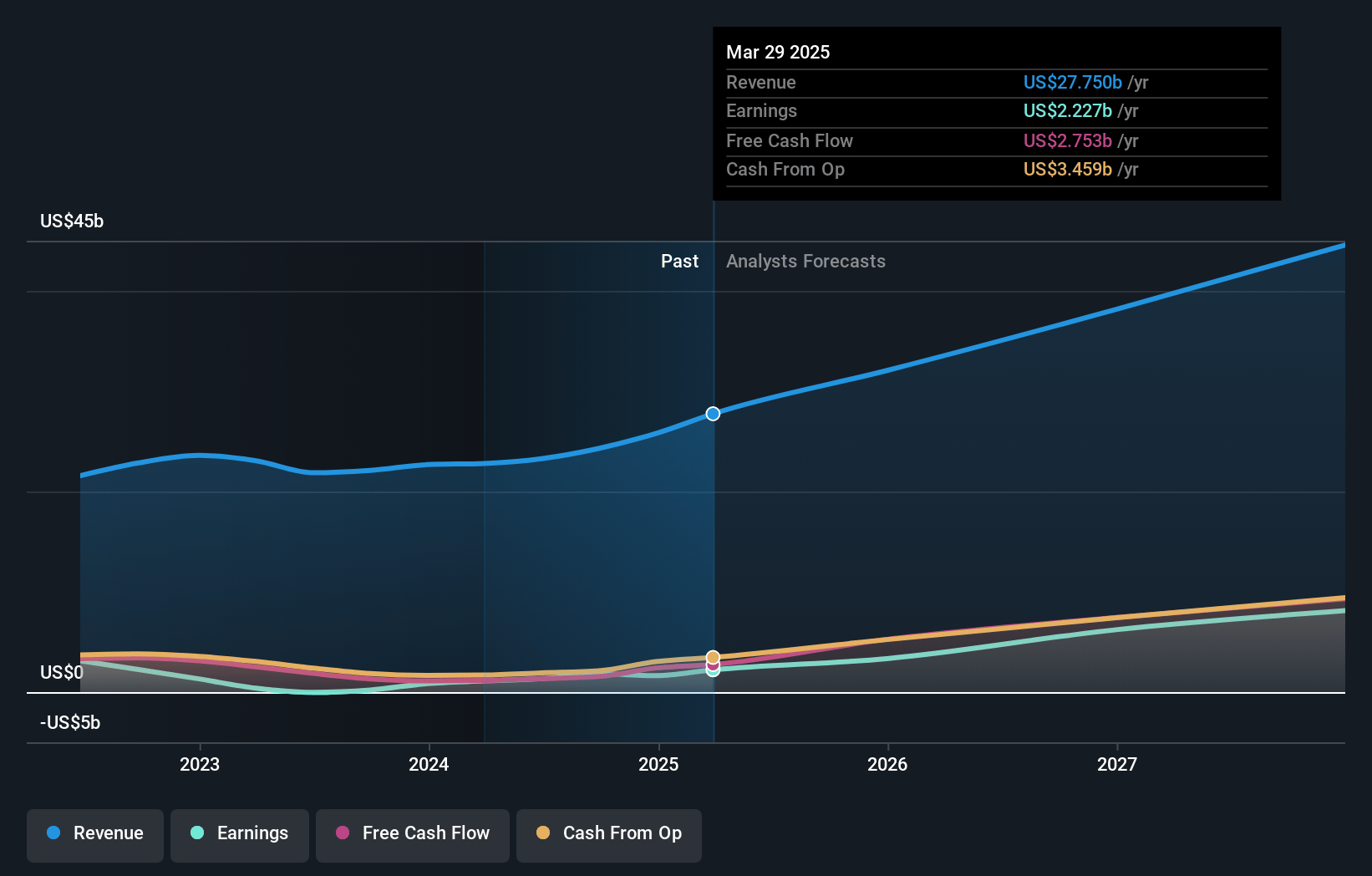

Advanced Micro Devices Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Advanced Micro Devices compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Advanced Micro Devices's revenue will grow by 24.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 6.4% today to 21.8% in 3 years time.

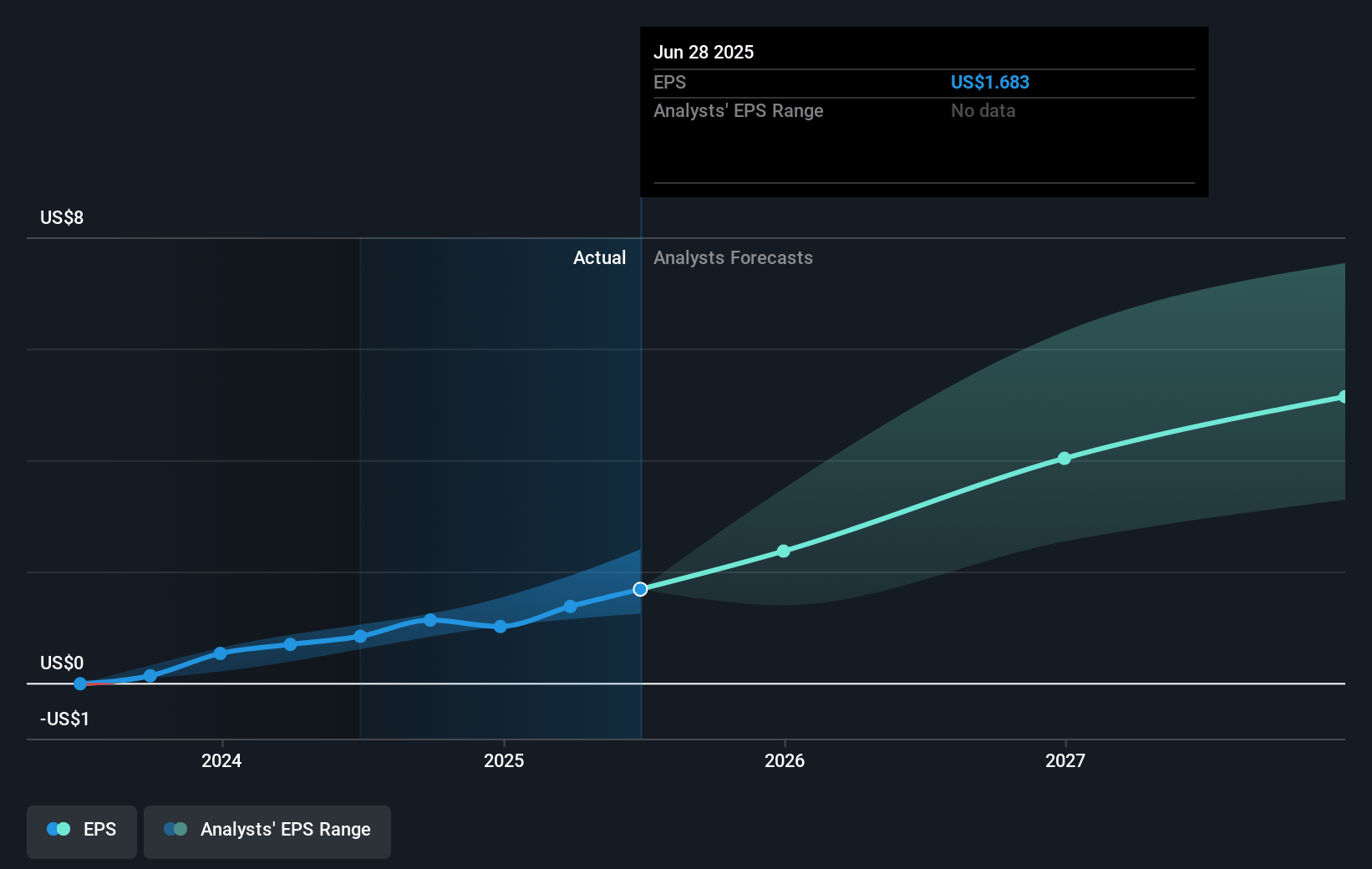

- The bullish analysts expect earnings to reach $10.7 billion (and earnings per share of $5.96) by about May 2028, up from $1.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 37.7x on those 2028 earnings, down from 97.1x today. This future PE is greater than the current PE for the US Semiconductor industry at 22.5x.

- Analysts expect the number of shares outstanding to grow by 0.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.13%, as per the Simply Wall St company report.

Advanced Micro Devices Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing regulatory scrutiny and new export controls, such as the recently announced export license requirements for AI GPUs shipped to China, are already resulting in material revenue reductions amounting to $1.5 billion for 2025, which could continue to hamper AMD’s revenue growth and limit its access to critical end-markets in the long term.

- Heavy reliance on TSMC for advanced node manufacturing, including new products like 5th Gen EPYC and upcoming Venice 2nm CPUs, exposes AMD to single-source risk; any delays or disruptions at TSMC could directly impact AMD’s production timelines, gross margins, and overall profitability.

- The accelerated push for in-house chip design among major cloud providers, such as AWS, Google, and Microsoft, represents a secular trend that threatens to reduce AMD’s long-term market share, erode its pricing power, and decrease data center revenues as these customers decrease reliance on third-party CPUs and GPUs.

- Sustained competitive pricing pressure from Nvidia and Intel, especially in the data center and gaming segments, may force AMD to further sacrifice margins to maintain or grow share, impacting both net margins and long-term earnings potential.

- Long, capital-intensive product cycles and high ongoing R&D expenses to remain competitive in AI and advanced computing may pressure free cash flow and limit AMD’s ability to return value to shareholders, particularly if overall industry demand or AI adoption slows, leading to lower-than-expected revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Advanced Micro Devices is $191.26, which represents two standard deviations above the consensus price target of $133.98. This valuation is based on what can be assumed as the expectations of Advanced Micro Devices's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $200.0, and the most bearish reporting a price target of just $70.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $49.2 billion, earnings will come to $10.7 billion, and it would be trading on a PE ratio of 37.7x, assuming you use a discount rate of 9.1%.

- Given the current share price of $98.62, the bullish analyst price target of $191.26 is 48.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.