Key Takeaways

- Vipshop's growth in SVIP memberships and strategic initiatives to enhance customer engagement could boost revenue and customer loyalty.

- Focus on technology, merchandising, and share repurchase programs may drive revenue growth and support stock valuation.

- Consumer spending headwinds, competitive pricing, and a challenging macroeconomic environment threaten Vipshop's revenue growth, net margins, and earnings despite maintained profitability.

Catalysts

About Vipshop Holdings- Operates online platforms in the People's Republic of China.

- Growth in Vipshop's SVIP membership program with 11% year-over-year increase in active SVIP customers, which represents 49% of online spending, could potentially increase revenue as these high-value customers spend more frequently.

- Emphasis on merchandising capabilities to drive long-term growth is aimed at ensuring product offerings are aligned with consumer lifestyle trends, which can positively impact revenues through increased sales.

- Utilization of technology and AI to improve customer experience through better search accuracy and personalized recommendations has the potential to drive revenue by increasing the likelihood of purchases across various categories.

- Strategic value-offering initiatives and targeted incentives to attract family shoppers are expected to enhance customer engagement and loyalty, potentially boosting both revenue and net margins by increasing the frequency and size of customer purchases.

- Share repurchase programs, including a new 2-year buyback up to USD 1 billion and plans to allocate no less than 75% of 2025 non-GAAP net income towards buybacks and dividends, could increase EPS and support the stock's valuation.

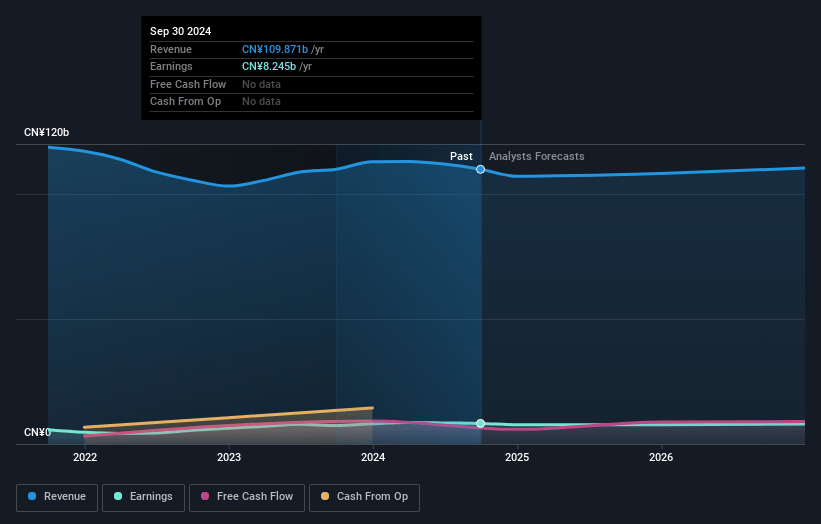

Vipshop Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vipshop Holdings's revenue will decrease by -4.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 7.5% today to 7.0% in 3 years time.

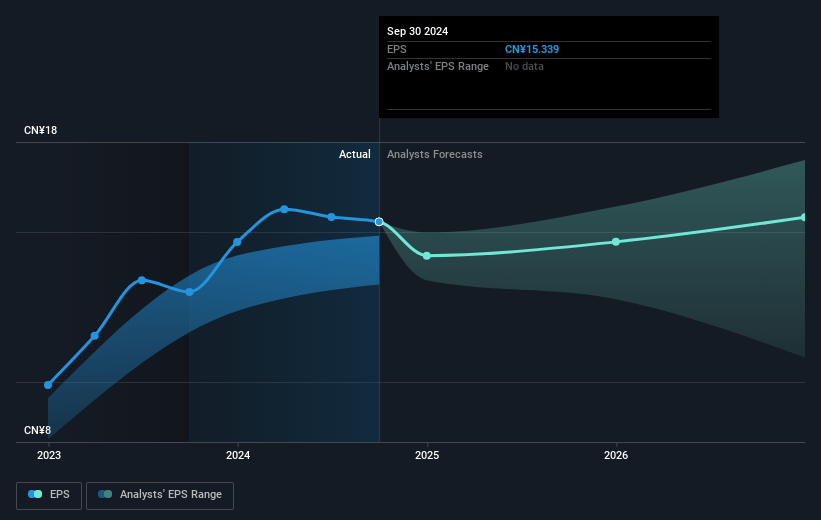

- Analysts expect earnings to reach CN¥6.8 billion (and earnings per share of CN¥10.9) by about January 2028, down from CN¥8.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CN¥9.4 billion in earnings, and the most bearish expecting CN¥5.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, up from 6.3x today. This future PE is lower than the current PE for the US Multiline Retail industry at 19.9x.

- Analysts expect the number of shares outstanding to grow by 6.43% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.92%, as per the Simply Wall St company report.

Vipshop Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The decline in third-quarter sales, particularly in discretionary categories, indicates that consumer spending is facing headwinds. This trend could lead to lower revenues if consumer sentiment does not improve.

- The ongoing challenges in standardized items, where other platforms offer competitive pricing, suggest potential pressure on revenues if these challenges persist.

- The decline in the average revenue per SVIP customer, driven by reduced shopping frequency, could suggest future impact on net margins and overall earnings if not addressed effectively.

- High competition and price pressures across various product categories might require the company to invest more in marketing and promotions, which could impact net margins.

- While maintaining profitability, the company faces a difficult macroeconomic environment and cautious consumer sentiment, which could threaten its ability to achieve revenue growth targets and improve earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $15.58 for Vipshop Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.36, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥97.1 billion, earnings will come to CN¥6.8 billion, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 7.9%.

- Given the current share price of $13.89, the analyst's price target of $15.58 is 10.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives