Key Takeaways

- Growing sustainability awareness, digitalization, and rapid device turnover are increasing supply and demand for ATRenew's electronics recycling and trade-in platform in China.

- Expanded store network, proprietary technology, and key partnerships enhance market reach, customer loyalty, and profitability as the circular economy gains traction.

- Heavy reliance on subsidies, rising costs, and intense competition threaten net margins and expose revenue to volatility from category concentration and platform dependencies.

Catalysts

About ATRenew- Operates pre-owned consumer electronics transactions and services platform in the People’s Republic of China.

- National trade-in subsidies and rising consumer adoption of recycling-supported by broadening sustainability awareness-have just begun to expand electronics recycling penetration in China, still at low single digits but with management (and industry) expecting growth to over 20% in coming years; this creates room for sustained volume expansion and revenue growth.

- Accelerated digitalization and rapid smartphone turnover, evidenced by five consecutive quarters of new device shipment growth and a two-year average replacement cycle, are driving a consistently robust supply of trade-ins for ATRenew's platform, directly underpinning future sales volumes and revenue visibility.

- The ongoing expansion of ATRenew's O2O store network (net 458 stores added YOY, targeting 800 for the year) and enhanced offline fulfillment capabilities are boosting market reach and customer satisfaction, supporting higher transaction volumes and the potential for margin expansion as scale increases.

- Continued investment in proprietary refurbishment, quality inspection, and data-driven pricing-demonstrated by improved gross margins in the 1P business (from 10.9% to 15.2%) and innovations like warehouse-to-retail stores-should drive higher take rates, gross margins, and customer loyalty, positively impacting net margin and long-term earnings.

- Strengthened strategic partnerships with major e-commerce platforms (notably JD.com) and brand collaborations, especially amid growing industry consolidation and policy support for recycling, position ATRenew to capture a greater share of the expanding circular economy, supporting both topline growth and operating leverage.

ATRenew Future Earnings and Revenue Growth

Assumptions

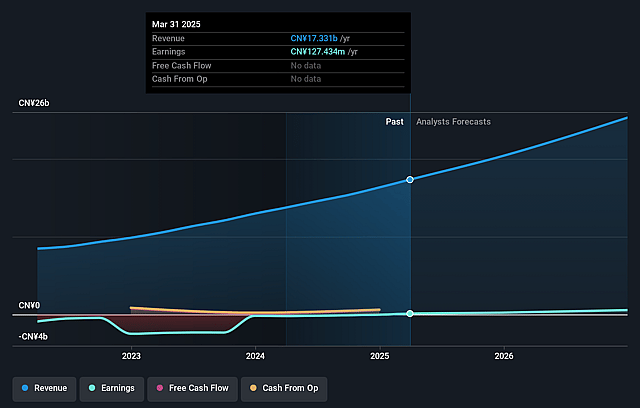

How have these above catalysts been quantified?- Analysts are assuming ATRenew's revenue will grow by 22.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.7% today to 3.4% in 3 years time.

- Analysts expect earnings to reach CN¥1.1 billion (and earnings per share of CN¥7.79) by about July 2028, up from CN¥127.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.5x on those 2028 earnings, down from 44.5x today. This future PE is lower than the current PE for the US Specialty Retail industry at 17.6x.

- Analysts expect the number of shares outstanding to decline by 3.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.81%, as per the Simply Wall St company report.

ATRenew Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on national subsidy programs and government stimulus policies may artificially inflate trade-in volumes and revenue growth; any reduction or discontinuation of these subsidies could significantly reduce demand and directly impact both top-line revenue and operating margins.

- Ongoing aggressive expansion of physical retail stores and addition of fulfillment staff is driving up fulfillment and operating expenses at a faster rate than revenue, as reflected in the rising fulfillment and selling/marketing expense ratios, posing risks to net margins and constraining operating leverage if scale efficiencies fail to materialize.

- Persistently high customer acquisition and promotional costs to build the AHS Recycle brand, combined with escalating commission and channel expenses (especially due to partnerships with major platforms like JD.com), may compress net margins and increase overall customer acquisition costs over the long term.

- Intense competition from both large e-commerce platforms (e.g., JD.com, Alibaba) and smaller local players with similar offerings could erode ATRenew's market share, force pricing concessions, and result in diminishing net margins and earnings growth over time.

- High dependency on major categories (with mobile phones accounting for about 70% of total transaction volume) and partner platforms exposes revenue streams to rapid technological obsolescence, changes in upgrade cycles, and platform policy shifts, all of which could cause volatility in average selling prices and overall revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.0 for ATRenew based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥32.0 billion, earnings will come to CN¥1.1 billion, and it would be trading on a PE ratio of 8.5x, assuming you use a discount rate of 8.8%.

- Given the current share price of $3.54, the analyst price target of $5.0 is 29.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.