Catalysts

About ATRenew

ATRenew operates China wide platforms and store networks that power the recycling, refurbishment and resale of pre-owned consumer electronics and other high value categories.

What are the underlying business or industry changes driving this perspective?

- Rapidly rising trade in penetration at major partners such as JD.com, combined with national upgrade subsidies and more frequent flagship launches, is expected to unlock a larger, recurring flow of high quality used devices into ATRenew’s ecosystem. This is described as supporting sustained double digit revenue growth and greater earnings visibility.

- Scaling of compliant refurbishment and 1P to consumer retail channels, with refurbished product revenue already more than doubling and 1P2C mix approaching 40 percent of product revenue, is expected to enhance pricing power and structurally lift gross margin and net margins over time.

- Expansion of the nationwide AHS Recycle store and to door service network, including multi category capabilities in most self operated stores, is described as positioning ATRenew as a default offline destination for recycling and resale. This is expected to drive higher transaction volumes, better store unit economics and operating leverage in fulfillment.

- Growth of asset light marketplace and consignment models across PJT Marketplace, Paipai and multi category recycling, supported by over one million contracted merchants and rising take rates in higher value categories, is expected to increase high margin service revenue and improve overall operating margin and earnings quality.

- Accelerating participation in the global circular economy for electronics, including rising exports of China sourced devices and plans to replicate marketplace capabilities internationally, is described as creating a long runway for cross border volume growth that can compound revenue and support margin expansion as scale efficiencies deepen.

Assumptions

This narrative explores a more optimistic perspective on ATRenew compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

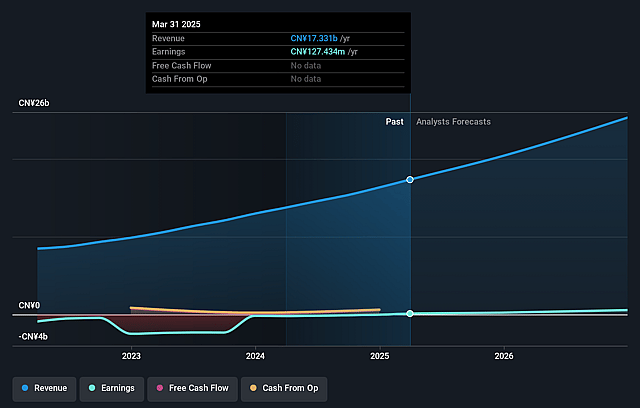

- The bullish analysts are assuming ATRenew's revenue will grow by 25.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 1.4% today to 3.4% in 3 years time.

- The bullish analysts expect earnings to reach CN¥1.3 billion (and earnings per share of CN¥6.68) by about December 2028, up from CN¥283.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 16.3x on those 2028 earnings, down from 30.0x today. This future PE is lower than the current PE for the US Specialty Retail industry at 19.7x.

- The bullish analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.17%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The business model is heavily reliant on robust device upgrade cycles and trade in penetration in China. Any slowdown in premium smartphone demand, weaker national trade in incentives or a cyclical downturn in consumer spending could reduce volumes through JD.com and AHS Recycle channels, pressuring revenue growth and limiting operating leverage.

- ATRenew is aggressively expanding its AHS store network and multi category capabilities, which increases fixed fulfillment, personnel and technology costs. If new stores or categories do not scale as expected or require lower take rates to remain competitive, this could erode store unit economics and cap improvements in gross margin and net margins.

- The 1P business and compliant refurbishment strategy depend on maintaining pricing power and high quality supply. Stronger competition from OEM trade in programs, e commerce platforms and local recyclers could force more promotional spending and lower resale prices, compressing gross profit and ultimately weighing on earnings.

- The asset light marketplace and consignment segments rely on sustaining and monetizing a very large base of small merchants. Management has already temporarily lowered take rates and enhanced post sale rights to support growth, so prolonged pressure to offer favorable terms could restrain service revenue expansion and slow the improvement in overall operating margin.

- The international and export strategy for secondhand devices is still nascent and subject to evolving cross border standards and demand. If global recycling penetration or overseas pricing is weaker than expected, the contribution from exports and any international PJT Marketplace could remain subscale, limiting long term diversification of revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for ATRenew is $8.04, which represents up to two standard deviations above the consensus price target of $6.86. This valuation is based on what can be assumed as the expectations of ATRenew's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.04, and the most bearish reporting a price target of just $5.34.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be CN¥39.1 billion, earnings will come to CN¥1.3 billion, and it would be trading on a PE ratio of 16.3x, assuming you use a discount rate of 9.2%.

- Given the current share price of $5.39, the analyst price target of $8.04 is 33.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ATRenew?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.