Narratives are currently in beta

Key Takeaways

- New CEO Ashley Buchanan's expertise in retail operations aims to drive growth via customer engagement and business transformation.

- Investment in diversified categories like Sephora and Home Décor seeks to optimize revenue and expand beyond traditional apparel.

- Leadership changes, declining sales, inventory missteps, competitive pressures, and lowered 2024 guidance highlight challenges in revenue stability and profitability for Kohl's.

Catalysts

About Kohl's- Operates as an omnichannel retailer in the United States.

- The appointment of Ashley Buchanan as the new CEO, with his experience in retail operations, merchandising, and e-commerce, is expected to drive future growth and potentially increase revenue through improved customer engagement and business transformation.

- The reintroduction of fine jewelry and the expansion of bridge jewelry in stores highlight a focus on recapturing lost market share and increasing revenue in product categories where consumer demand remains strong.

- Targeted marketing efforts, including direct mail and enhanced digital engagement, aim to increase customer traffic and loyalty, potentially enhancing revenue and net margins by boosting sales and customer retention.

- Investment in key growth areas, such as Sephora and new categories like Home Décor, Gifting, and Babies R Us, seeks to diversify revenue streams and drive sales growth beyond traditional apparel offerings.

- The strategic balancing of inventory levels between private brands and market brands, along with improved product assortment, is expected to optimize cost efficiencies and enhance net margins through better inventory management and sales performance.

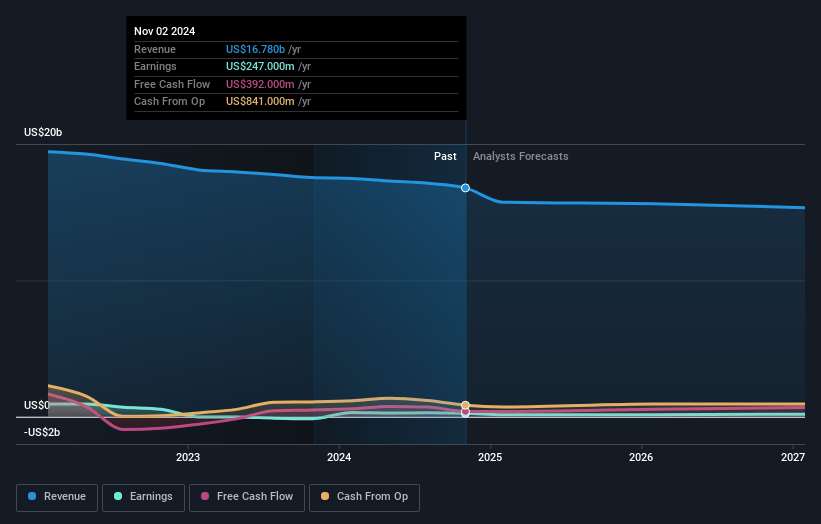

Kohl's Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kohl's's revenue will decrease by -4.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.5% today to 2.0% in 3 years time.

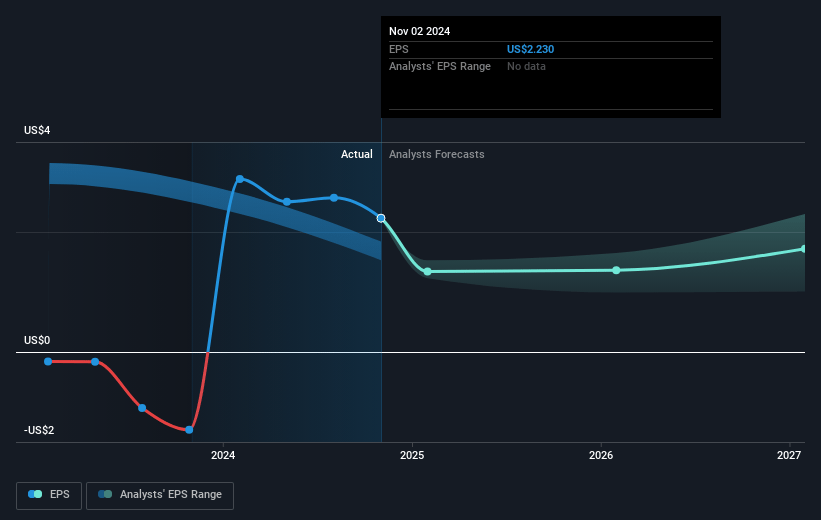

- Analysts expect earnings to reach $294.6 million (and earnings per share of $2.87) by about January 2028, up from $247.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.7x on those 2028 earnings, up from 6.1x today. This future PE is lower than the current PE for the US Multiline Retail industry at 19.3x.

- Analysts expect the number of shares outstanding to decline by 2.61% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.86%, as per the Simply Wall St company report.

Kohl's Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Executive changes, including a new CEO appointment and Tom Kingsbury's transition to an advisory role, may create uncertainty and potential disruption, impacting future continuity of strategic initiatives and execution, potentially affecting revenue stability.

- Continued declining traffic and a decrease in comparable sales indicate challenges in maintaining customer engagement and increasing footfall, negatively impacting Kohl's revenue and overall sales growth.

- Underestimating the impact of reductions in private apparel brand inventory and the impact of exiting certain categories (e.g., fine jewelry) suggests missteps in inventory management and product strategy, affecting sales and revenue.

- Competitive pressures, highlighted by expectations of a highly competitive holiday season, could lead to increased promotional activity, negatively affecting margins and overall profitability.

- Kohl's revised downward guidance for 2024, indicating expected declines in net sales and operating margin, reflecting ongoing sales pressure and challenges in achieving expected financial targets.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.31 for Kohl's based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $45.0, and the most bearish reporting a price target of just $10.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $14.8 billion, earnings will come to $294.6 million, and it would be trading on a PE ratio of 7.7x, assuming you use a discount rate of 10.9%.

- Given the current share price of $13.56, the analyst's price target of $16.31 is 16.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives