Narratives are currently in beta

Key Takeaways

- Diversification into high-margin businesses and operational efficiencies should enhance profitability and stabilize margins, positively impacting future earnings.

- Expansion into the premium market and technological advancements may boost revenue growth and increase market share.

- Macroeconomic factors, weather disruptions, and high inventory levels threaten MarineMax's revenue, margins, and profitability amidst softer retail demand and potential insurance cost increases.

Catalysts

About MarineMax- Operates as a recreational boat and yacht retailer and superyacht services company in the United States.

- MarineMax's diversification strategy into higher-margin businesses such as marinas, superyacht services, finance and insurance, and brokerage services is providing more stable and resilient gross margins, which should positively impact future earnings.

- Expansion of the Cruisers Yachts brand in key Southern U.S. regions and recent leadership changes at Intrepid Powerboats are expected to enhance brand presence and drive future revenue growth.

- The company's strategic focus on operational efficiencies and cost reduction efforts, including the consolidation of certain locations, should help improve net margins and overall profitability.

- Opportunities within the premium market segment, characterized by resilient demand and faster recovery during market improvements, may allow MarineMax to achieve revenue growth and potentially increase market share.

- Technological advancements from New Wave Innovations, providing synergies across MarineMax's portfolio, are expected to offer a strategic advantage and drive revenue growth in the future.

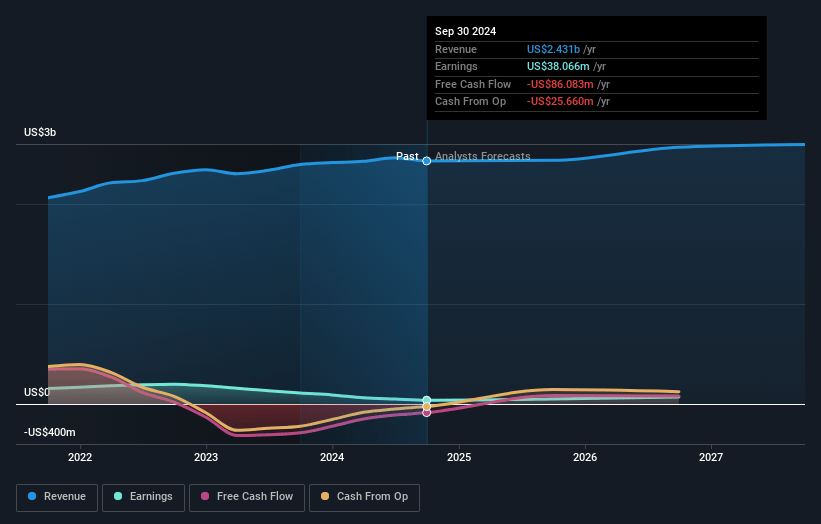

MarineMax Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming MarineMax's revenue will grow by 4.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.3% today to 3.1% in 3 years time.

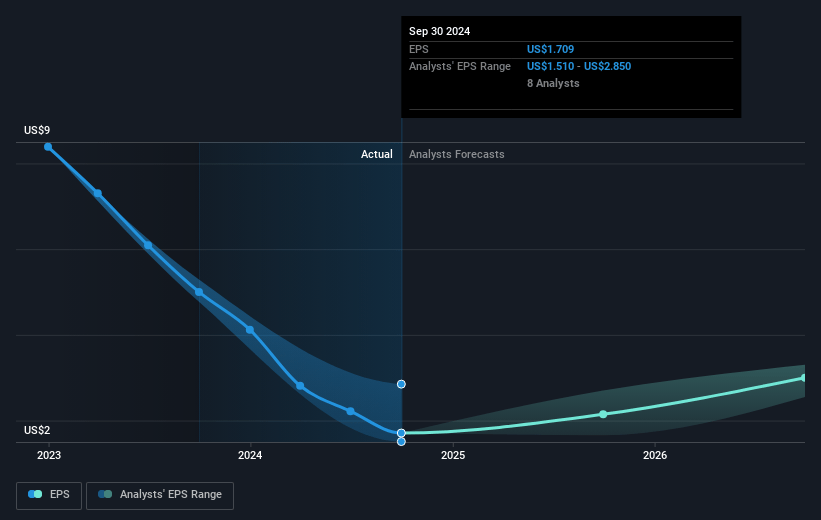

- Analysts expect earnings to reach $83.3 million (and earnings per share of $3.62) by about January 2028, up from $55.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.7x on those 2028 earnings, up from 12.5x today. This future PE is lower than the current PE for the US Specialty Retail industry at 16.3x.

- Analysts expect the number of shares outstanding to grow by 0.48% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.86%, as per the Simply Wall St company report.

MarineMax Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The impact of seasonality and weather, such as hurricanes disrupting operations and revenue, can significantly impact MarineMax's top-line growth, as demonstrated by the revenue declines attributed to Hurricanes Helene and Milton. This could affect future revenue stability.

- Softer retail demand across the outdoor recreation space and specifically in the premium boat market, potentially prolonged by mixed economic signals and geopolitical uncertainties, might continue to depress same-store sales, negatively affecting revenue and earnings.

- MarineMax's operations are vulnerable to macroeconomic factors such as persistent inflation and reduced consumer spending, which could pressure margins and net income as consumers might delay or forego large discretionary purchases like boats.

- High inventory levels, especially inventory that may remain unsold, could lead to increased carrying costs and promotional discounting, which might compress gross margins and affect the company's profitability.

- The potential increases in insurance premiums and broader insurance market constraints following natural disasters could elevate operating expenses for MarineMax, impacting net income margins if such costs are not offset by higher sales or price adjustments.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $39.0 for MarineMax based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $43.0, and the most bearish reporting a price target of just $35.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.7 billion, earnings will come to $83.3 million, and it would be trading on a PE ratio of 14.7x, assuming you use a discount rate of 10.9%.

- Given the current share price of $30.29, the analyst's price target of $39.0 is 22.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives