Narratives are currently in beta

Key Takeaways

- Strong growth in product commerce and new offerings boosts revenue potential and net margins, while deepening customer engagement.

- Investment in technology and infrastructure is expected to drive margin expansion and earnings growth, supported by promising untapped market opportunities.

- Coupang's strategy of investing in technology and acquisitions, while expanding into new markets, poses risks to earnings, margins, and future financial stability.

Catalysts

About Coupang- Together with its subsidiaries owns and operates retail business through its mobile applications and Internet websites primarily in South Korea.

- Coupang is seeing strong growth in product commerce through deeper engagement from existing customer cohorts, driven by selection expansion in established categories and new offerings like Fresh and Fulfillment and Logistics by Coupang (FLC). This is expected to impact future revenue growth positively.

- The company's nascent offerings, such as Eats, Taiwan, Play, and Farfetch, along with ads in FLC, are in early stages but show promise for future growth and potential to create meaningful customer experiences. This could boost future net margins and overall earnings.

- Coupang's constant currency revenue growth remains high, and there is substantial untapped market opportunity in the regions they serve. This suggests potential future revenue expansion given their small current market share.

- The WOW membership savings program, offering benefits like free shipping and delivery, leads to higher order frequency and spend. As more customers engage with WOW, the overall revenue per customer and net margin could see an uplift.

- Focused investment in technology and infrastructure aimed at improving efficiencies, alongside scaling margin-accretive offerings, is expected to drive future margin expansion and earnings growth.

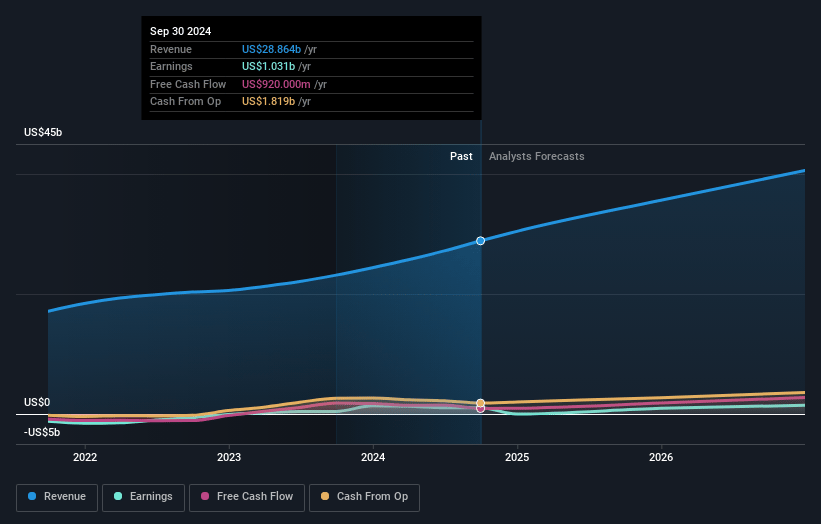

Coupang Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Coupang's revenue will grow by 15.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 3.6% today to 3.4% in 3 years time.

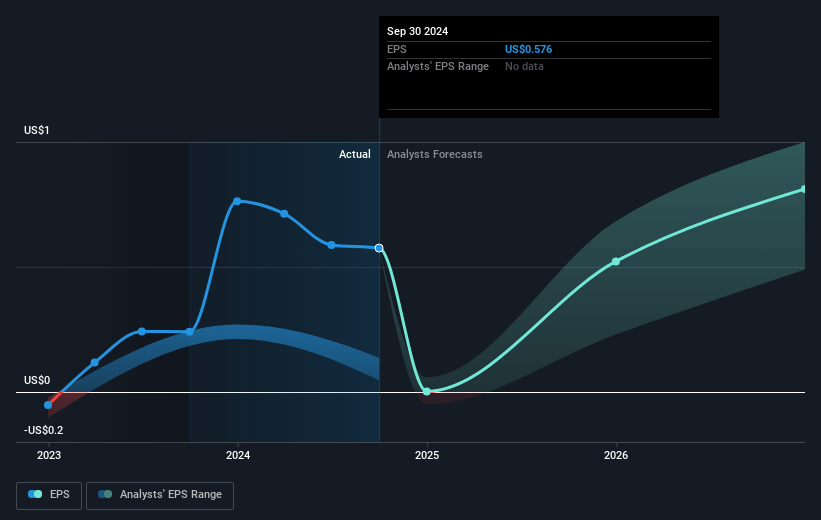

- Analysts expect earnings to reach $1.5 billion (and earnings per share of $0.83) by about December 2027, up from $1.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $2.0 billion in earnings, and the most bearish expecting $889 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 43.1x on those 2027 earnings, up from 39.9x today. This future PE is greater than the current PE for the US Multiline Retail industry at 20.7x.

- Analysts expect the number of shares outstanding to decline by 0.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.01%, as per the Simply Wall St company report.

Coupang Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Coupang's reliance on continuous investments in technology and infrastructure, which may not immediately yield returns, could impact future earnings and financial stability.

- The acquisition and integration of Farfetch could introduce volatility in earnings due to nonrecurring acquisition and restructuring costs, potentially impacting net margins.

- The fluctuation in fulfillment-related operational costs and technology spend may lead to inconsistencies in quarterly margins, affecting profit predictability.

- Coupang's emphasis on increasing market share in new areas like Taiwan carries execution risk, which could affect projected revenue growth if consumer uptake is slower than expected.

- Developing Offerings, although progressing, still contribute losses; their path to profitability is uncertain and could negatively impact net income if anticipated improvements do not materialize.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.03 for Coupang based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $34.0, and the most bearish reporting a price target of just $23.1.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $43.9 billion, earnings will come to $1.5 billion, and it would be trading on a PE ratio of 43.1x, assuming you use a discount rate of 7.0%.

- Given the current share price of $22.86, the analyst's price target of $29.03 is 21.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives