Narratives are currently in beta

Key Takeaways

- AutoNation's market share expansion and after-sales growth could boost revenue and profit margins through improved customer satisfaction and optimized asset management.

- Strategic finance operations and divestitures are expected to enhance earnings and improve portfolio returns, supporting capital allocation through share repurchases.

- Operational disruptions and financial pressures from system outages, weather events, and rising interest expenses could challenge AutoNation's future earnings and revenue growth.

Catalysts

About AutoNation- Through its subsidiaries, operates as an automotive retailer in the United States.

- AutoNation is focused on expanding its market share in the new vehicle sales segment, which could lead to increased revenue growth as they capitalize on the reversal of previous underperformance due to a systems outage.

- The after-sales segment has shown significant growth and achieved record gross profits, indicating potential for further expansion in recurring revenue and profit margins through enhanced customer satisfaction and technician development.

- The AutoNation Finance business is initiating substantial loan originations with a focus on higher-margin, prime credit transactions, suggesting an opportunity for increased earnings from a more profitable finance model.

- The strategic divestiture of lower-performing stores is unlocking capital for redeployment into higher-return opportunities, potentially enhancing revenue growth and net margins through optimized portfolio management.

- AutoNation plans to leverage share repurchases as a key component of their capital allocation strategy, which may boost earnings per share by reducing the overall number of outstanding shares.

AutoNation Future Earnings and Revenue Growth

Assumptions

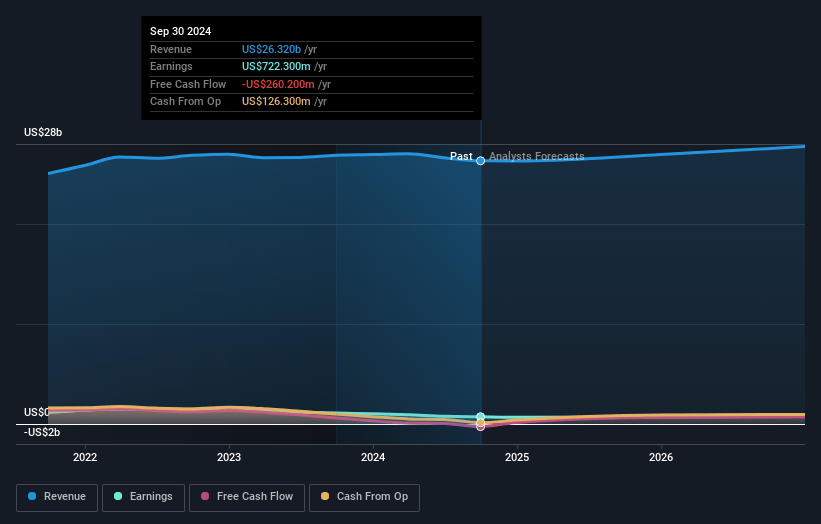

How have these above catalysts been quantified?- Analysts are assuming AutoNation's revenue will grow by 4.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.7% today to 3.0% in 3 years time.

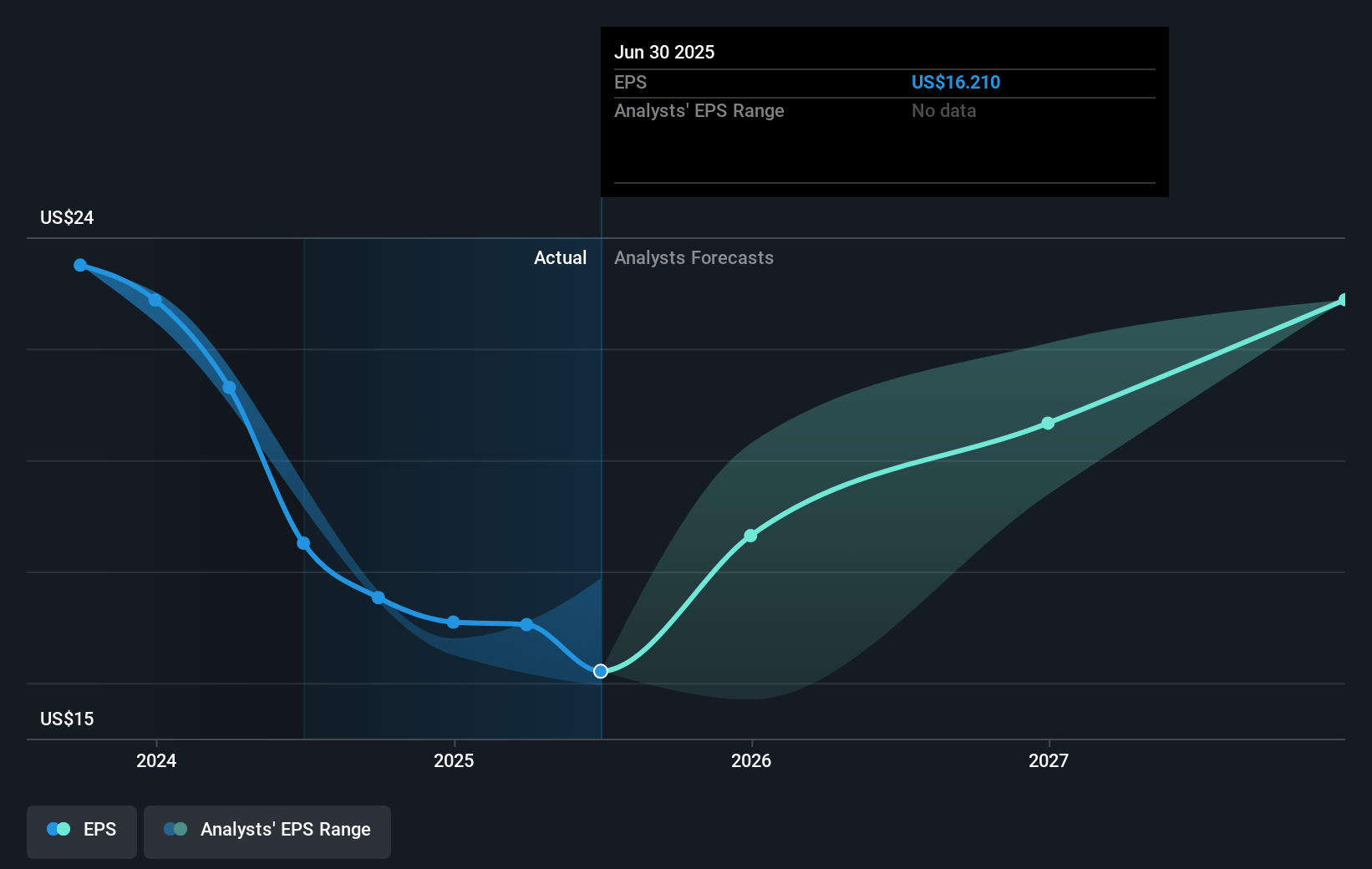

- Analysts expect earnings to reach $892.8 million (and earnings per share of $23.7) by about November 2027, up from $722.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.6x on those 2027 earnings, up from 9.2x today. This future PE is lower than the current PE for the US Specialty Retail industry at 15.3x.

- Analysts expect the number of shares outstanding to decline by 1.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.48%, as per the Simply Wall St company report.

AutoNation Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The CDK systems outage significantly impacted AutoNation’s used vehicle sales performance in the third quarter, demonstrating operational vulnerabilities that could negatively affect future earnings if similar outages occur.

- Weather events forced the temporary closure of approximately 50 stores, affecting service and sales operations, which could lead to reduced revenue in impacted regions if such events recur with increasing frequency.

- The normalization of new vehicle gross profit per vehicle retailed (PVRs) indicates potential pressure on top-line revenue as pricing power diminishes post-pandemic.

- Higher interest expenses, particularly from floor plan debt, pose a risk of increased financial costs impacting net margins, especially if federal interest rates rise or persist at elevated levels.

- The divestiture of eight stores and the recognition of a closing asset pricing window suggest a potentially shrinking market or less favorable future valuations, highlighting risks to revenue growth from acquisition strategies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $195.0 for AutoNation based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $220.0, and the most bearish reporting a price target of just $169.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $29.9 billion, earnings will come to $892.8 million, and it would be trading on a PE ratio of 10.6x, assuming you use a discount rate of 9.5%.

- Given the current share price of $167.06, the analyst's price target of $195.0 is 14.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives