Key Takeaways

- Investments in technology, store remodeling, and new products aim to drive revenue growth and improve customer experience and net margins.

- Strategic acquisitions and supply chain improvements are expected to expand market reach and enhance operational efficiency for long-term profitability.

- Macroeconomic pressures, deflation in key categories, and underperformance in discretionary segments may limit revenue growth and affect profitability.

Catalysts

About Tractor Supply- Operates as a rural lifestyle retailer in the United States.

- The acquisition of Allivet, an online pet pharmacy, is expected to be accretive to earnings in 2025, expanding Tractor Supply's total addressable market by $15 billion. This can drive future revenue and earnings growth through the integration of Allivet’s platform and customer base with Tractor Supply.

- Investment in store remodels and new store openings, such as the Project Fusion layout and garden centers, are anticipated to generate long-term growth by enhancing customer experience and broadening the product offerings. This supports revenue growth and potentially improved net margins by optimizing store profitability.

- New technology implementations in inventory management, customer service tools, and digital sales channels aim to increase operational efficiency and customer satisfaction. These enhancements can lead to cost savings and higher revenues, positively impacting net margins.

- The launch of innovative and varied product lines, including exclusive brands and new categories, is intended to drive sales growth and customer engagement. The focus on higher-margin proprietary products could also help improve net margins.

- Strategic investments in supply chain efficiencies and distribution centers provide a foundation for long-term operational savings and scalability, supporting revenue growth and potential improvements in net margins by reducing logistics costs.

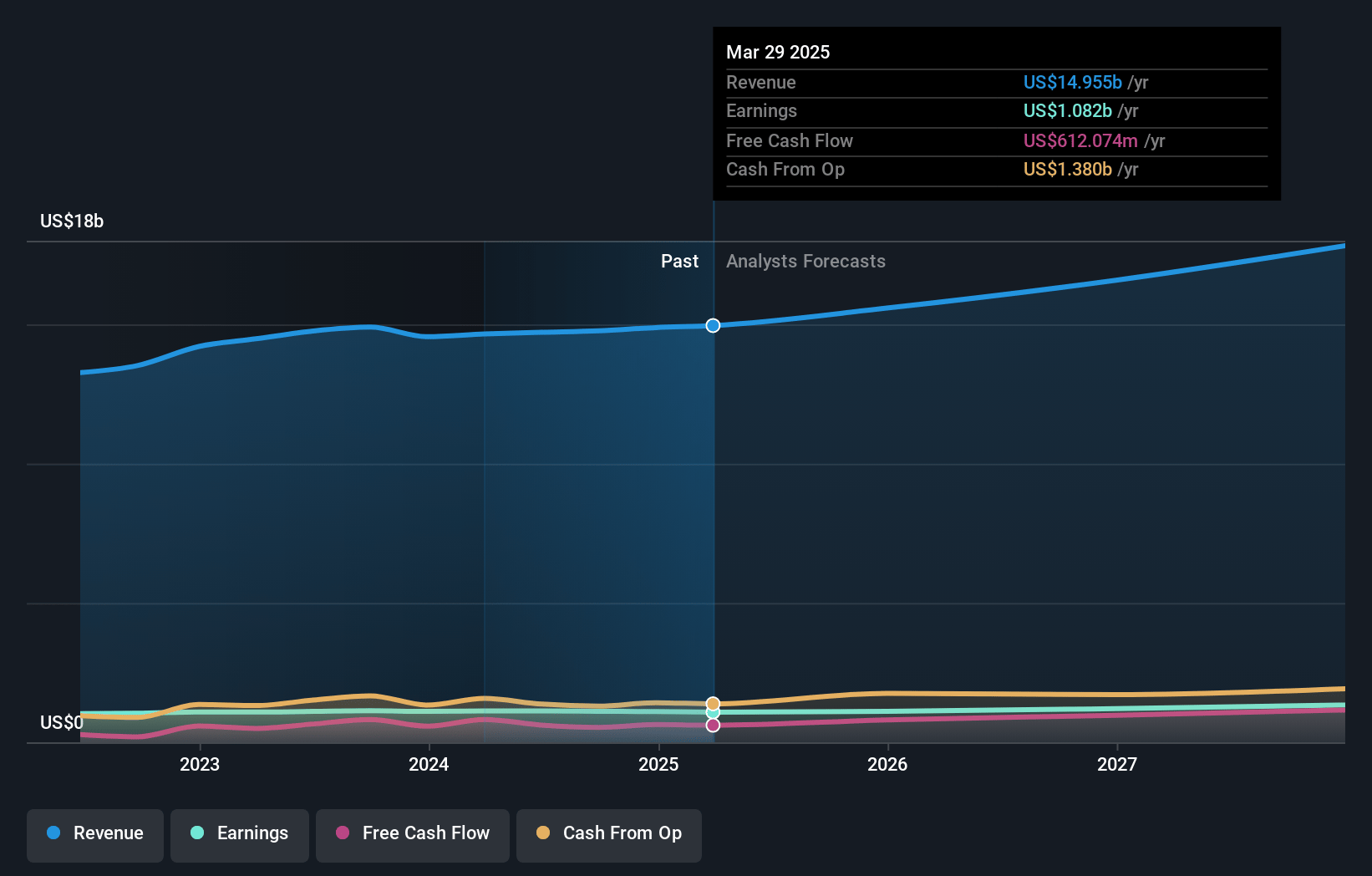

Tractor Supply Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tractor Supply's revenue will grow by 6.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.5% today to 7.7% in 3 years time.

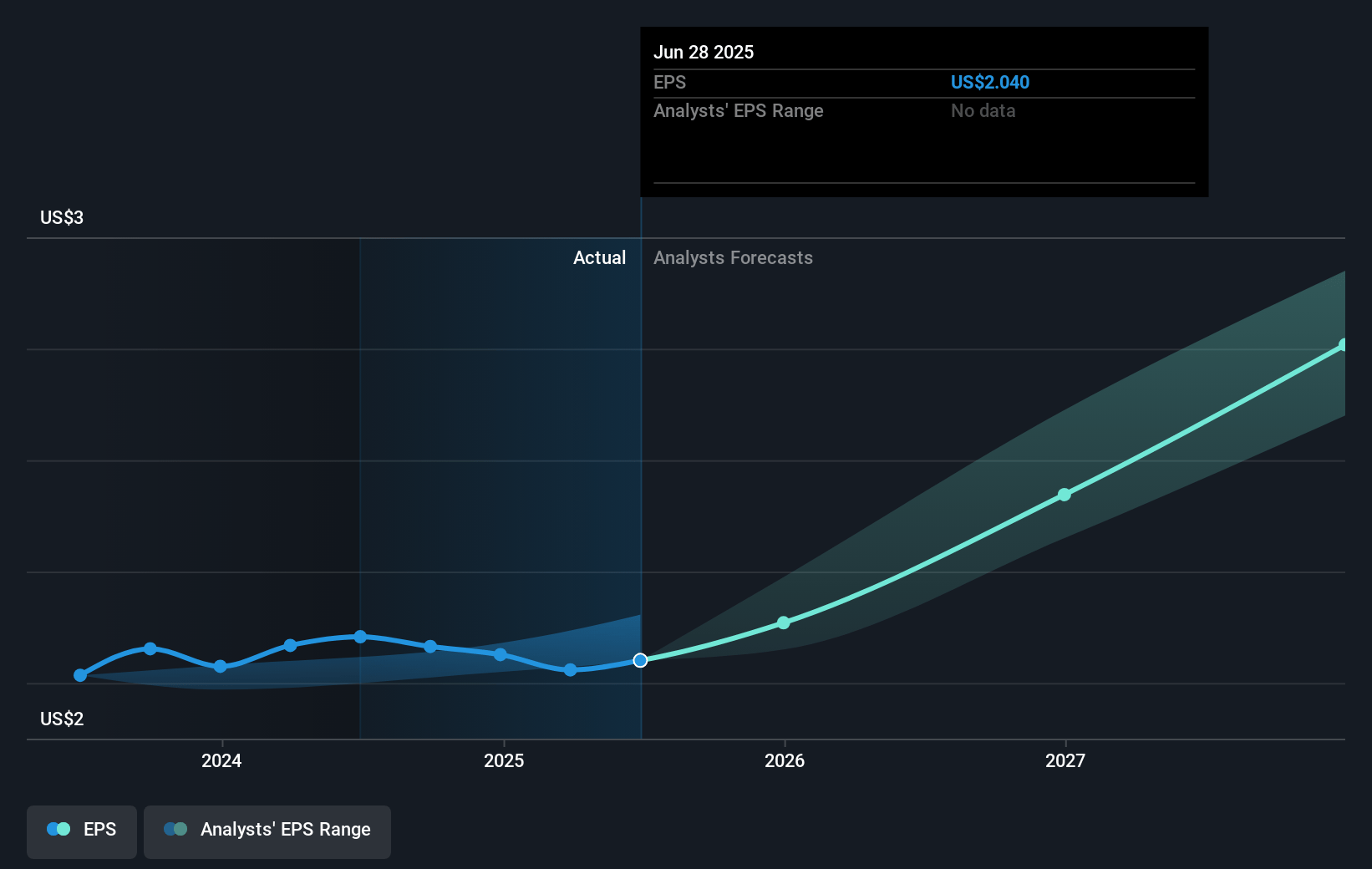

- Analysts expect earnings to reach $1.4 billion (and earnings per share of $2.65) by about January 2028, up from $1.1 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.2x on those 2028 earnings, down from 27.5x today. This future PE is greater than the current PE for the US Specialty Retail industry at 16.3x.

- Analysts expect the number of shares outstanding to decline by 1.29% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.12%, as per the Simply Wall St company report.

Tractor Supply Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tractor Supply faces macroeconomic pressures, such as consumer spending shifts from goods to services, which might limit revenue growth as retail sales growth remains flat.

- Deflationary pressures, particularly in consumable, usable, and edible (CUE) categories, have impacted average ticket sales, potentially affecting net margins and earnings.

- Discretionary categories like clothing, footwear, and outdoor living continue to underperform, which could negatively impact revenue and profitability.

- Seasonal weather variations significantly affect sales in the winter, indicating potential volatility in revenue if expected weather patterns do not materialize.

- The ongoing impact of federal election year uncertainties may reduce consumer spending, affecting revenue and earnings in the short term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $58.58 for Tractor Supply based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.0, and the most bearish reporting a price target of just $45.91.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $17.7 billion, earnings will come to $1.4 billion, and it would be trading on a PE ratio of 27.2x, assuming you use a discount rate of 7.1%.

- Given the current share price of $57.38, the analyst's price target of $58.58 is 2.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives