Key Takeaways

- Rent the Runway aims for cash flow breakeven and enhanced margins by focusing on subscriber growth, marketing efficiency, and inventory expansion.

- Technological upgrades and high-demand brand offerings are projected to drive revenue growth by improving customer satisfaction and loyalty.

- Reliance on inventory for rental rather than resale, along with competition and economic uncertainties, pressures margins and threatens revenue growth if demand and cost controls falter.

Catalysts

About Rent the Runway- Operates shared designer closet in the United States.

- Rent the Runway is focusing on achieving free cash flow breakeven by the end of fiscal year 2024, emphasizing a turnaround from burning $70 million in cash last year to a more sustainable business model. This transition is expected to significantly enhance net margins and overall earnings.

- The company is working on accelerating subscriber growth by improving inventory acquisition, enhancing subscriber onboarding, and expanding their subscription plans. This should lead to an increase in revenue as the user base grows and becomes more engaged.

- Rent the Runway plans to increase its inventory of high-demand designer brands in 2025, leveraging revenue-sharing and exclusive design collections. This strategy is likely to boost revenue by satisfying customer demand and maintaining customer loyalty.

- Marketing efficiencies and a diversified marketing channel approach are expected to lower customer acquisition costs (CAC), contributing to margin improvement and ultimately boosting net earnings by allocating saved resources to enhance their brand and increase organic traffic.

- Technological advancements and customer experience improvements, like the faster-loading grids, personalized merchandising, and a new subscription plan, are expected to drive revenue growth through improved customer satisfaction and higher transaction volumes.

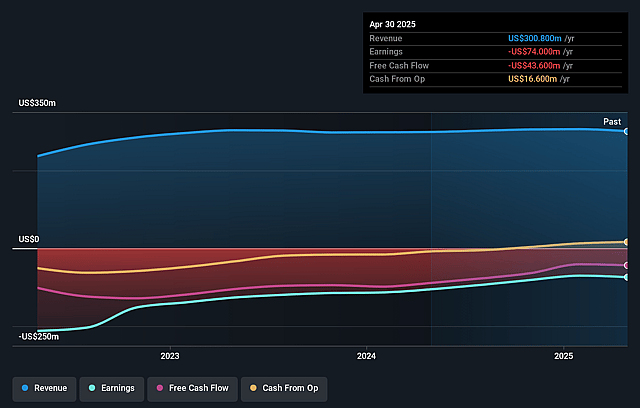

Rent the Runway Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Rent the Runway's revenue will grow by 1.7% annually over the next 3 years.

- Analysts are not forecasting that Rent the Runway will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Rent the Runway's profit margin will increase from -26.6% to the average US Specialty Retail industry of 4.4% in 3 years.

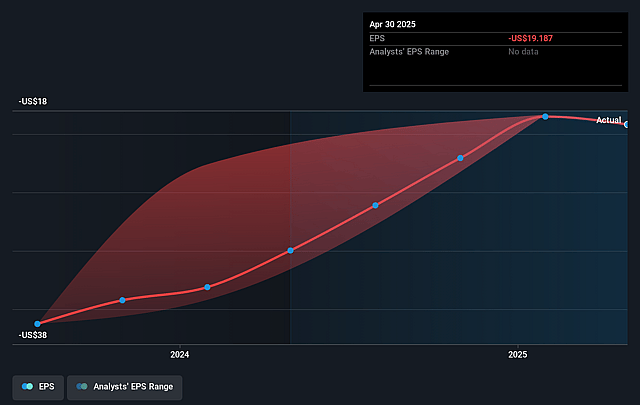

- If Rent the Runway's profit margin were to converge on the industry average, you could expect earnings to reach $14.2 million (and earnings per share of $3.55) by about April 2028, up from $-81.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.6x on those 2028 earnings, up from -0.3x today. This future PE is greater than the current PE for the US Specialty Retail industry at 13.8x.

- Analysts expect the number of shares outstanding to grow by 4.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Rent the Runway Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The reliance on keeping more inventory for rental rather than reselling could impact cash flow and limit revenue from other streams, especially if demand expectations aren't met. This impacts revenue and free cash flow.

- Challenges in subscriber growth due to previous focus on cost-cutting rather than growth could impact future revenues if not effectively addressed. There's a risk of slower subscriber acquisition impacting earnings.

- The diverse competition in the rental market may limit the company's pricing power, pressuring margins as they aim to maintain a superior customer service position. This could affect earnings and net margins.

- A reliance on improvements in fulfillment costs and cost control measures to achieve free cash flow breakeven suggests vulnerability if cost efficiency efforts aren't sustainable. This impacts net margins and free cash flow.

- Economic uncertainties and changes in consumer habits post-pandemic could affect the demand for luxury rental services, influencing overall revenue growth and long-term earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $40.0 for Rent the Runway based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $321.7 million, earnings will come to $14.2 million, and it would be trading on a PE ratio of 15.6x, assuming you use a discount rate of 11.4%.

- Given the current share price of $5.26, the analyst price target of $40.0 is 86.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.