Key Takeaways

- Share repurchase focus may boost EPS by reducing shares, enhancing shareholder value.

- Streamlined operations and strategic acquisitions could improve net margins and profitability.

- Economic challenges and natural disasters diminish LKQ's revenue prospects across regions, affecting profitability and prompting a downward earnings guidance adjustment.

Catalysts

About LKQ- Engages in the distribution of replacement parts, components, and systems used in the repair and maintenance of vehicles and specialty vehicle aftermarket products and accessories.

- LKQ's strategic focus on share repurchases, with an increased authorization of $1 billion, could lead to higher EPS by reducing the number of shares outstanding.

- Operational excellence initiatives, including portfolio simplification, integration of acquisitions, and SKU rationalization, are expected to streamline operations and drive improved net margins.

- The reorganization and restructuring activities in Europe aimed at cost reduction and increased logistical efficiency are expected to enhance operating margins in the long term.

- A commitment to a lean operating culture and additional annual cost structure reviews could help stabilize or improve net margins and profitability, especially amidst top-line headwinds.

- The sale of underperforming businesses and focus on high-synergy acquisitions may enhance future revenue streams and net margins by reprioritizing resources to more profitable operations.

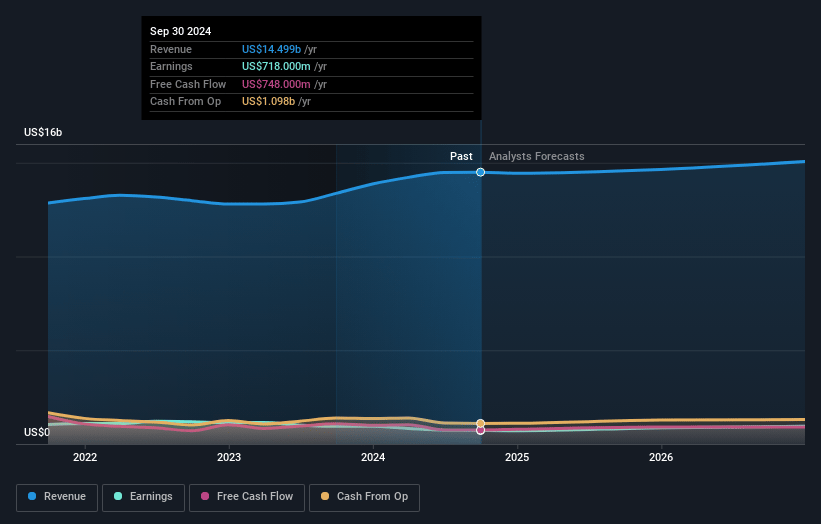

LKQ Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming LKQ's revenue will grow by 1.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.0% today to 6.9% in 3 years time.

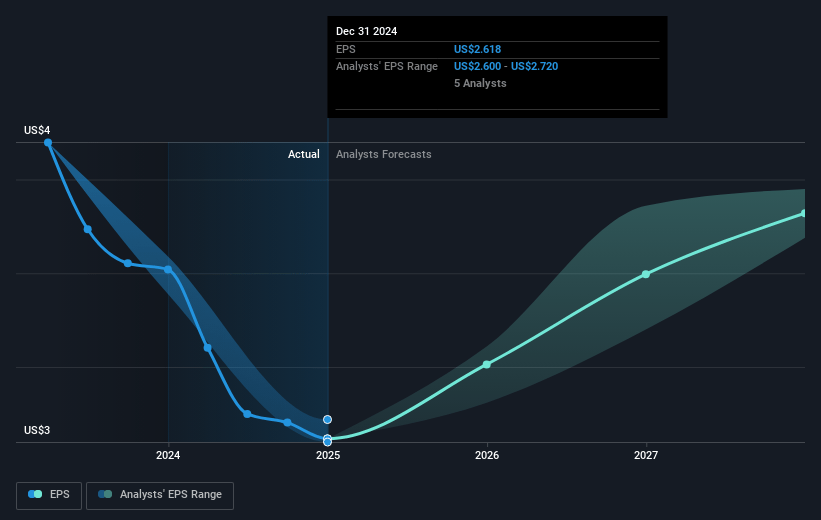

- Analysts expect earnings to reach $1.1 billion (and earnings per share of $4.28) by about January 2028, up from $718.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.1x on those 2028 earnings, up from 13.8x today. This future PE is lower than the current PE for the US Retail Distributors industry at 17.1x.

- Analysts expect the number of shares outstanding to decline by 1.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.43%, as per the Simply Wall St company report.

LKQ Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- LKQ’s North American revenue decline of 7.5% per day, larger than in previous quarters, was attributed to a decrease in repairable claims and revenue loss post-acquisition adjustments, impacting overall revenue performance.

- Economic conditions, including higher interest rates and low consumer confidence, have significantly decreased vehicle and RV sales, creating a headwind for parts sales in the Specialty segment and impacting revenue growth.

- European revenue faces challenges due to competitive pricing pressures and challenging macroeconomic conditions, particularly in the German and UK markets, which affects revenue and margins.

- Hurricanes Helene and Milton caused shutdowns of LKQ locations, leading to lost revenue. Additionally, strikes by dock workers could impact inventory and fill rates, potentially decreasing revenue and operating efficiency.

- The company's guidance adjustment, with expectations of adjusted diluted EPS being lower than previous forecasts, reflects difficulties in maintaining profitability due to soft revenue in North America and ongoing economic headwinds.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $52.14 for LKQ based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $43.3.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $15.3 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 15.1x, assuming you use a discount rate of 7.4%.

- Given the current share price of $38.13, the analyst's price target of $52.14 is 26.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

JU

julio

Community Contributor

LKQ valuation

Bull - Growth in miles driven increases the wear and tear on vehicles, requiring more maintenance and repair work to keep them on the road, benefiting LKQ. LKQ’s collision business could see rising demand from increasing auto claims as more drivers return to the road following the COVID-19 pandemic.

View narrativeUS$65.01

FV

37.7% undervalued intrinsic discount7.00%

Revenue growth p.a.

1users have liked this narrative

0users have commented on this narrative

13users have followed this narrative

about 2 months ago author updated this narrative