Narratives are currently in beta

Key Takeaways

- Enhanced supply chain and logistics are expected to lower costs and improve margins, positively impacting revenue and net margins.

- Expansion in consumer electronics, home appliances, and groceries is projected to boost revenue and improve long-term net margins.

- Strategic shifts and reliance on external factors present execution risks and potential volatility in JD's revenue growth and profit margins.

Catalysts

About JD.com- Operates as a supply chain-based technology and service provider in the People’s Republic of China.

- JD.com’s enhanced supply chain capabilities and logistics infrastructure are expected to continue delivering lower costs, higher efficiency, and an improved user experience, which are likely to impact both revenue and net margins positively.

- The company’s participation in the government’s trading program, which promotes the trade-in and technological upgrade of consumer electronics and home appliances, is anticipated to drive a turnaround in revenue growth for these categories, potentially boosting overall earnings.

- JD.com’s focus on expanding its general merchandise category, particularly the supermarket sector, with a direct shipment model and enhanced product portfolio, is expected to sustain a healthy revenue increase, thereby improving net margins in the long run.

- Increasing user growth and engagement through initiatives like the JD Plus program and improved price competitiveness is likely to enhance shopping frequency, thereby driving revenue growth.

- A new USD 5 billion share repurchase program is expected to provide significant shareholder value by reducing outstanding shares and potentially boosting earnings per share (EPS).

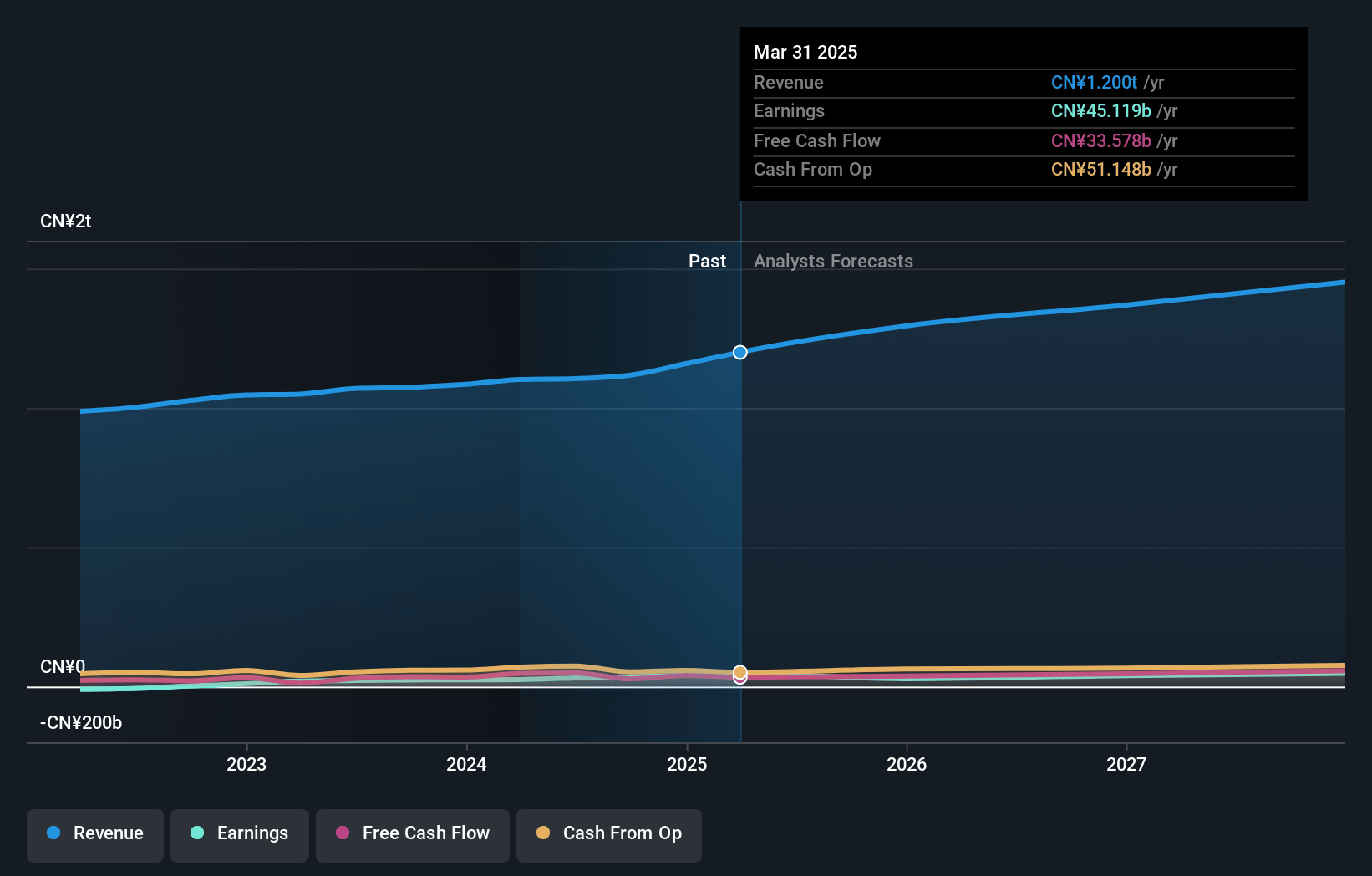

JD.com Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming JD.com's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 3.1% today to 3.4% in 3 years time.

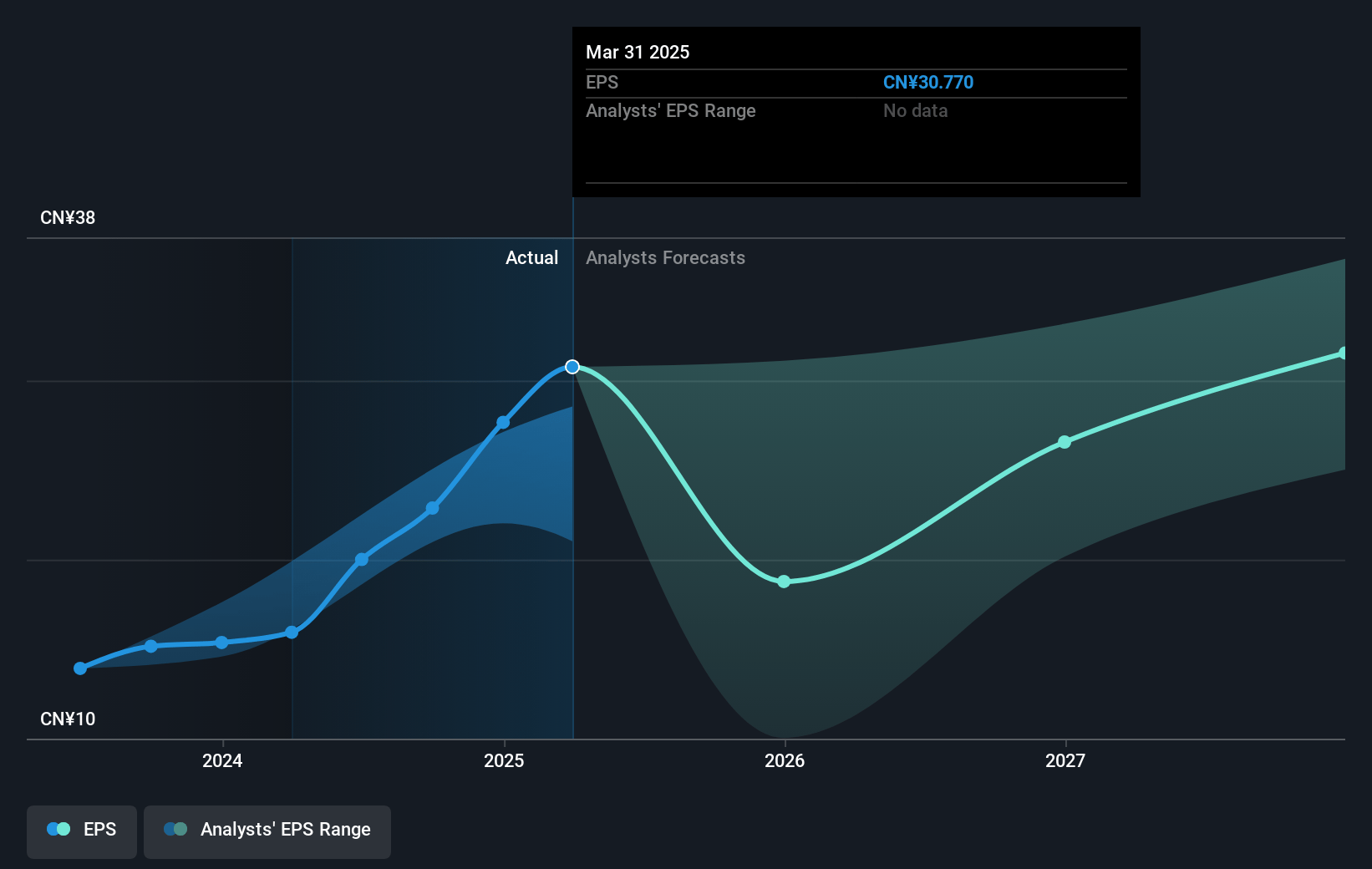

- Analysts expect earnings to reach CN¥44.0 billion (and earnings per share of CN¥32.1) by about January 2028, up from CN¥34.9 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CN¥50.5 billion in earnings, and the most bearish expecting CN¥36.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, up from 12.4x today. This future PE is lower than the current PE for the US Multiline Retail industry at 19.3x.

- Analysts expect the number of shares outstanding to decline by 1.81% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.14%, as per the Simply Wall St company report.

JD.com Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The trading program's full potential has not yet been realized, which means that short-term boosts in revenue from appliance sales may not be sustainable or replicable in the long term, potentially impacting future revenue growth.

- JD's ambition to maintain low prices might compress profit margins in the long term, especially if cost reductions from supply chain efficiency aren't consistently achieved or matched by further economies of scale.

- The exit from Yonghui Supermarket suggests a strategic shift, but it could also signal potential challenges or underperformance in integrating offline and online business models, affecting JD's broader retail strategy and revenue diversification efforts.

- Increasing investment in lower-tier markets and new product categories, although aimed at driving growth, could introduce execution risks and initially lead to higher operational costs, potentially impacting net earnings if not managed effectively.

- JD's heavy reliance on government stimulus measures, such as the trading program and broader economic policies, implies a risk of revenue volatility should these policies change or fail to yield the expected results in the future.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $50.02 for JD.com based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $70.72, and the most bearish reporting a price target of just $27.64.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥1297.7 billion, earnings will come to CN¥44.0 billion, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 8.1%.

- Given the current share price of $41.07, the analyst's price target of $50.02 is 17.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives