Key Takeaways

- Strong housing demand and high barriers to entry drive stable occupancy, rent growth, and predictable long-term cash flow in core manufactured housing and RV segments.

- Operational efficiencies, leadership changes, and a stronger balance sheet enhance earnings and financial flexibility, enabling strategic expansion in high-demand markets.

- Growth prospects are challenged by halted developments, acquisition constraints, geographic risks, rising expenses, and persistent weakness in the RV segment threatening long-term revenue stability.

Catalysts

About Sun Communities- Established in 1975, Sun Communities, Inc.

- Structural U.S. housing affordability issues and persistent high home prices continue to drive record-high occupancy (97.6%) and rent growth within Sun's manufactured housing communities, resulting in resilient revenue growth and stable, long-term cash flow.

- The growing population of retirees and seniors, combined with high barriers to entry in the manufactured housing segment, positions Sun to capture sustained demand and rental rate increases-supporting reliable NOI growth and higher net operating margins.

- Streamlined operations, organizational restructuring, and expanded cost-saving initiatives (e.g., procurement standardization, payroll efficiency) have already delivered more than $17 million in annualized expense reductions, which are set to further enhance net margins and boost recurring earnings.

- The appointment of a new, experienced CEO alongside the company's strengthened balance sheet (substantial debt paydown, credit upgrades, ample financial flexibility) positions Sun to capitalize on selective acquisition and expansion opportunities in supply-constrained, high-demand markets, underpinning future revenue and asset value growth.

- The ongoing shift toward long-term annual RV residents, higher penetration of rental homes, and continued focus on converting transient sites to annual rentals create stable, high-quality recurring income streams and reduce volatility, thereby supporting predictable earnings and supporting future FFO growth.

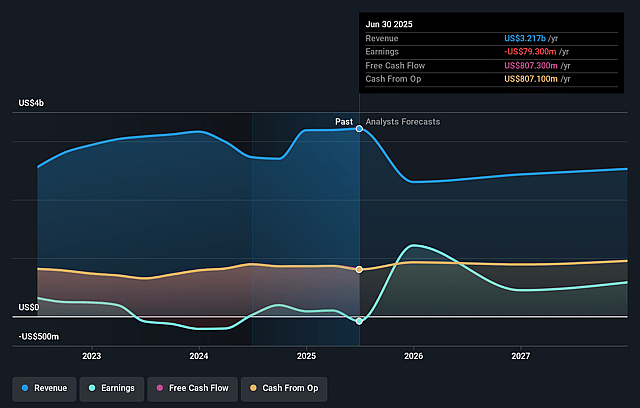

Sun Communities Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sun Communities's revenue will decrease by 6.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -2.5% today to 21.2% in 3 years time.

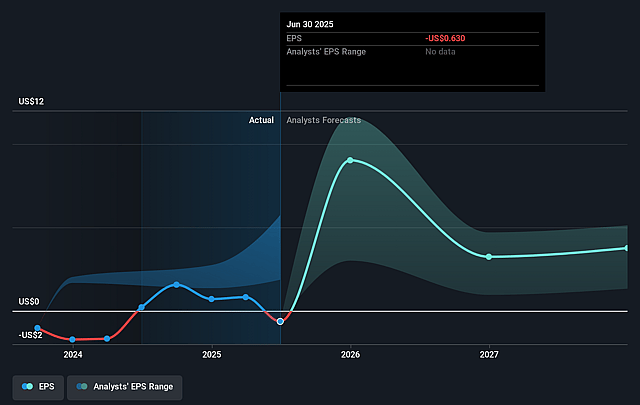

- Analysts expect earnings to reach $550.6 million (and earnings per share of $3.43) by about September 2028, up from $-79.3 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $632.3 million in earnings, and the most bearish expecting $352.3 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.7x on those 2028 earnings, up from -205.4x today. This future PE is greater than the current PE for the US Residential REITs industry at 32.5x.

- Analysts expect the number of shares outstanding to decline by 1.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.11%, as per the Simply Wall St company report.

Sun Communities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is no longer pursuing new greenfield developments in the U.S. or U.K., which could limit organic growth opportunities in their core manufactured housing and RV segments, potentially constraining long-term revenue and asset value expansion.

- Elevated cap rates for acquisitions of high-quality communities are at the lower end of the 4–5% range, and the company notes increased selectivity and fewer accretive opportunities, which may compress future return on invested capital and earnings growth as acquisition multiples rise across the industry.

- Geographic concentration remains high in the Sunbelt and select states (e.g., Florida, Arizona), leaving Sun Communities exposed to region-specific risks such as adverse weather, climate events, or regulatory changes, which could increase volatility in expenses or cause property damage, impacting net margins.

- Expense headwinds are apparent, including rising payroll, utilities, and property operating costs, which-despite recent savings-may escalate further due to inflation, higher labor costs, and property tax increases in primary markets, threatening long-term margin expansion and FFO per share.

- The RV segment, particularly transient RV revenue, continues to face persistent declines (projected 9% full-year revenue drop), raising concerns about sustained demand in this segment; the shift toward annual RV conversions and reliance on cost discipline may not fully offset potential longer-term declines in this business, potentially pressuring overall revenue and stable cash flows.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $139.647 for Sun Communities based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $155.0, and the most bearish reporting a price target of just $126.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.6 billion, earnings will come to $550.6 million, and it would be trading on a PE ratio of 37.7x, assuming you use a discount rate of 7.1%.

- Given the current share price of $130.14, the analyst price target of $139.65 is 6.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.