Key Takeaways

- Safehold's expansion into the Multifamily market's affordable sector aims to boost revenue with stable cash flows and high occupancy rates.

- Share buybacks and capital efficiency improvements through lower borrowing costs could enhance earnings per share and net margins.

- Persistent rate volatility, execution challenges in affordable housing, and reliance on asset appraisals could pressure Safehold's revenue and earnings growth.

Catalysts

About Safehold- Safehold Inc. (NYSE: SAFE) is revolutionizing real estate ownership by providing a new and better way for owners to unlock the value of the land beneath their buildings.

- Safehold plans to penetrate further into the Multifamily market, particularly focusing on the affordable sector, which has stable cash flows and high occupancy rates. They aim to double the affordable volume from last year and expand to new states in 2025. This expansion is likely to impact revenue positively due to increased deal volume.

- The Board's authorization of a $50 million share buyback program to take advantage of the significant undervaluation of shares could enhance earnings per share by reducing the outstanding share count and potentially boosting investor confidence.

- Safehold has enhanced its capital efficiency by lowering the cost of debt through tightening bond spreads and recognizing cash hedge gains, which could improve net margins by reducing interest expenses.

- The introduction of a commercial paper program has provided savings compared to the revolver, indicating further improvements in net margins due to reduced borrowing costs.

- By opening Caret to more investors, Safehold aims to unlock significant long-term value for shareholders not currently recognized in the share price, potentially impacting the overall earnings profile as the derivative value of Caret becomes more apparent.

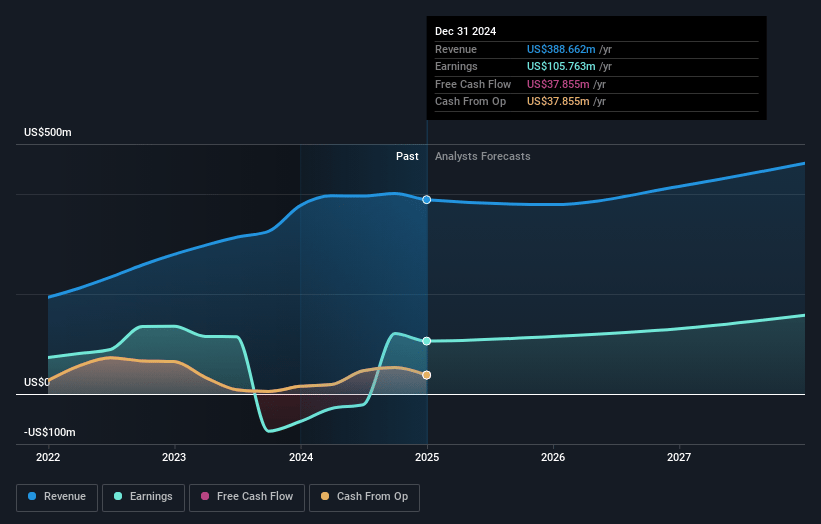

Safehold Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Safehold's revenue will grow by 6.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 27.2% today to 35.0% in 3 years time.

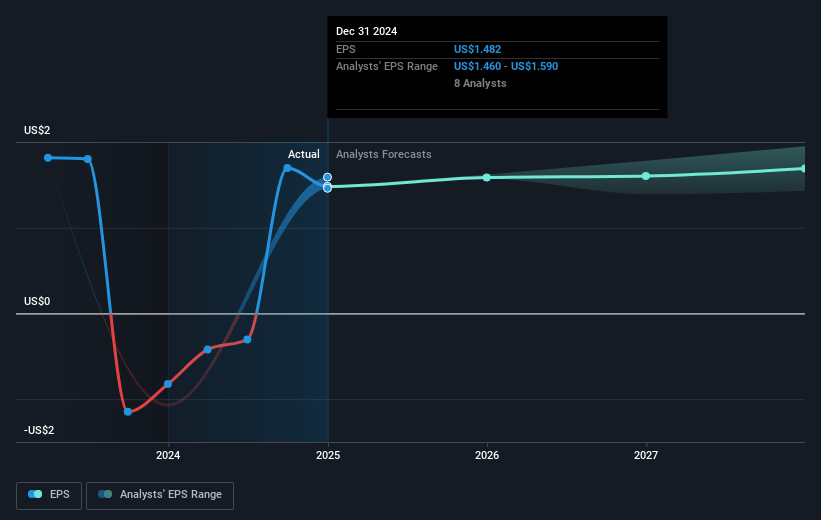

- Analysts expect earnings to reach $164.2 million (and earnings per share of $1.75) by about February 2028, up from $105.8 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $184 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.2x on those 2028 earnings, up from 11.6x today. This future PE is lower than the current PE for the US Specialized REITs industry at 25.0x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

Safehold Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent rate volatility has negatively impacted originations and the current share price, which may continue to pressure revenue and net margins if interest rates remain high.

- The company's growth in the Multifamily sector, especially affordable housing, presents execution challenges and smaller deal sizes may limit revenue growth despite increased origination volume.

- Reliance on the accuracy of asset appraisals and unrealized capital appreciation in the portfolio could mean that a downturn or misjudgment in asset valuation could impact earnings and the company's perceived value.

- Economic yields on new ground leases may decrease as market spreads tighten, potentially impacting the company's revenue and earnings growth if it decreases further.

- The use of share buybacks, while potentially beneficial for share price, might limit available capital for scaling the business and expanding revenue-generating assets if not executed prudently.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $25.0 for Safehold based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $32.0, and the most bearish reporting a price target of just $19.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $469.7 million, earnings will come to $164.2 million, and it would be trading on a PE ratio of 15.2x, assuming you use a discount rate of 11.4%.

- Given the current share price of $17.13, the analyst price target of $25.0 is 31.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives