Key Takeaways

- Digital transformation and sustainability initiatives are enhancing efficiencies and decreasing costs, improving net margins and revenue growth outlook.

- Favorable supply conditions and strategic acquisitions supported by strong capital position are expected to boost revenue and earnings growth.

- Declining rents and FFO, along with market and acquisition challenges, may negatively impact profitability, revenue growth, and traditional customer engagement.

Catalysts

About Public Storage- A member of the S&P 500 and FT Global 500, is a REIT that primarily acquires, develops, owns, and operates self-storage facilities.

- Public Storage anticipates continued revenue growth acceleration across most markets due to stabilizing operating fundamentals and improving demand trends, particularly with a decline in move-out rates and strong payment patterns by in-place customers. This is expected to positively impact overall revenue growth.

- The company is leveraging a digital transformation strategy, with 75% of move-ins using e-rental and nearly 2 million PS app users. This new operating model is enhancing efficiencies, which is likely to improve net margins through reduced labor costs and optimized operations.

- The supply environment appears favorable, with a slowdown in new competitive property deliveries over the next few years. This reduction in supply growth, coupled with improving demand, is expected to further bolster operating fundamentals and revenue growth.

- Public Storage is making strides in sustainability by reducing utility usage, such as through LED conversion and installing solar power at over 800 properties, with plans to increase this further. These efforts are expected to decrease operating expenses and positively influence net margins.

- The company's strategic focus on acquisitions is supported by a strong capital and liquidity profile. With signs of an improving transaction market, increased acquisitions could drive future revenue and earnings growth, contributing positively to the company’s earnings per share.

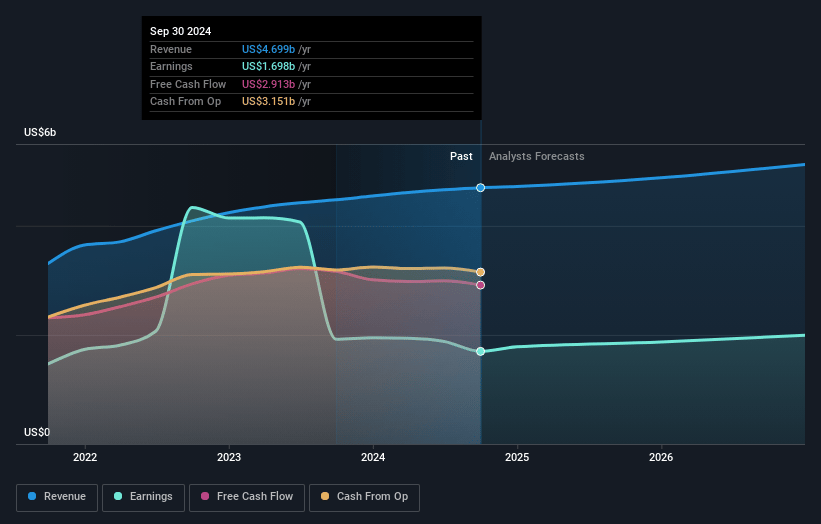

Public Storage Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Public Storage's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 36.1% today to 39.5% in 3 years time.

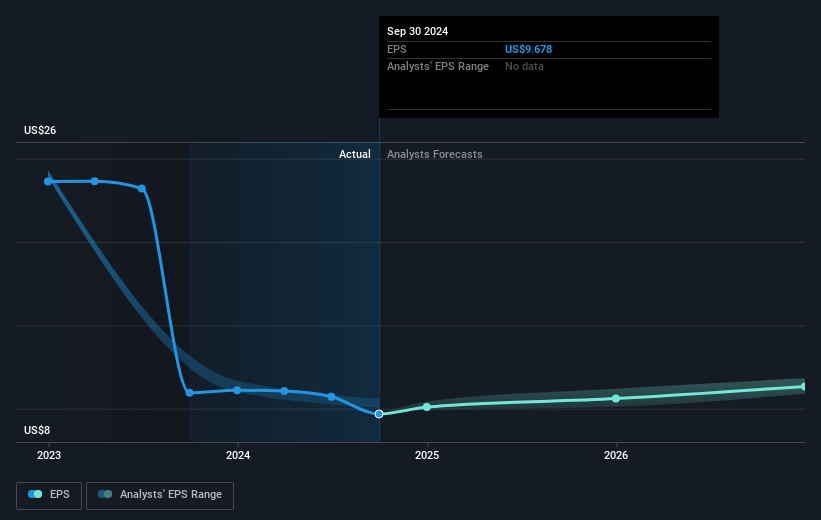

- Analysts expect earnings to reach $2.1 billion (and earnings per share of $11.94) by about January 2028, up from $1.7 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 33.8x on those 2028 earnings, up from 30.7x today. This future PE is greater than the current PE for the US Specialized REITs industry at 25.3x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.1%, as per the Simply Wall St company report.

Public Storage Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Move-in rents have decreased by around 30% since 2022, which could negatively impact revenue generation if this trend continues.

- Core Funds from Operations (FFO) per share declined by 3% year-over-year, indicating pressures on profitability and earnings.

- Same-store revenue for stabilized properties experienced a decline of 1.3% compared to last year, affecting overall revenue growth potential.

- The company faces potential risks from new customer acquisition being heavily reliant on digital engagement, possibly impacting traditional customer segments and associated revenues.

- Acquisition and development plans could be hindered by high cap rate expectations and fluctuating market conditions, which might affect revenue and net margins if deals don't close as anticipated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $338.61 for Public Storage based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $378.0, and the most bearish reporting a price target of just $299.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $5.3 billion, earnings will come to $2.1 billion, and it would be trading on a PE ratio of 33.8x, assuming you use a discount rate of 6.1%.

- Given the current share price of $297.48, the analyst's price target of $338.61 is 12.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives