Introduction

Realty Income (O) is a Real Estate Investment Trust (REIT) known for its consistent monthly dividends. It has increased its dividend for 30 consecutive years, reflecting a stable and predictable income stream.

Given its predictable payout structure and dividend growth in line with inflation and the risk-free rate, the most suitable valuation methods are:

- Dividend Discount Model (Stable Growth)

- Historical Dividend Yield Analysis

Valuation Methods

📈 Historical Dividend Yield (Weight: 40%)

- Current Dividend Yield: ~5.70%

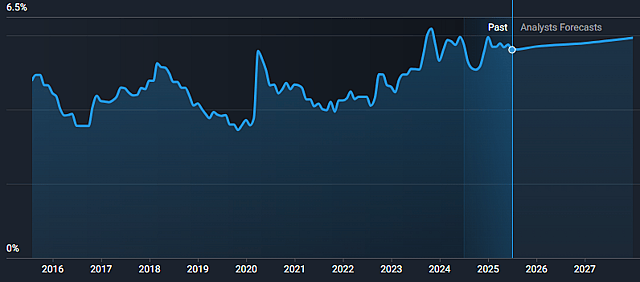

- 10-Year Average Dividend Yield: ~4.74%

This suggests the stock is trading below its average valuation, indicating a potential upside of 16.84% if it reverts to the mean.

Fair Value (Historical Dividend Yield): $66.20

💰 Dividend Discount Model – Stable Growth (Weight: 60%)

We apply the Gordon Growth Model, assuming:

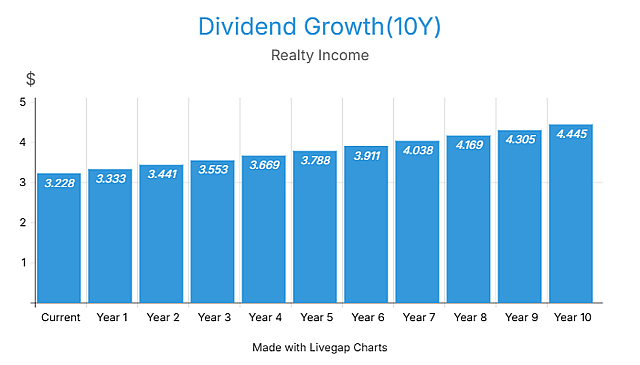

- Dividend growth rate (g): 3.25% (assuming a rate a little below its 10 year average growth of ~3.5%)

- Next year’s dividend (D1): $3.333 (current dividend of $3.228 grown by 3.25%)

- Required return (r): 9% (15% margin of safety minus the dividend yield of ~6%)

P = 3.333 / (0.09 - 0.0325) = 57.97

Fair Value (DDM – Stable Growth): $57.97

Valuation Summary

Given the expectation that Realty Income’s dividend growth will decelerate in the coming years, greater weight will be assigned to the Dividend Discount Model. This model reflects more appropriately the anticipated slowdown in dividend growth. In contrast, the Historical Yield method assumes mean reversion, which introduces a higher degree of uncertainty, and so it will have a lower weight on the valuation.

Weighted Average = (66.20*0.4) + (57.97*0.6)

Fair Value: $61.26

⚠️ Conclusion: HOLD

Realty Income currently appears to be trading slightly below its estimated fair value, with a discount of approximately 7.5%.

Although future dividend growth is expected to moderate, the company remains a reliable option for investors seeking consistent and predictable monthly income.

I intend to initiate or increase a position closer to the $55.13 price target, which offers an estimated total return potential of around 15%, including dividends.

At this time, no action is required — the stock remains a HOLD.

How well do narratives help inform your perspective?

Disclaimer

The user andre_santos has a position in NYSE:O. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.