Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and robust liquidity enable revenue growth without capital market reliance, improving future earnings and net margins.

- High occupancy and long-term leases ensure income stability, supporting a strong earnings outlook.

- Tenant credit issues and lease termination fee reliance could threaten revenue stability, while a tight acquisition market may impact growth prospects and net margins.

Catalysts

About NNN REIT- NNN REIT invests primarily in high-quality retail properties subject generally to long-term, net leases.

- Strategic acquisitions and an increased pipeline, with a 22% raise in acquisition midpoint to $550 million, indicate potential for enhanced revenue growth and earnings through active portfolio expansion.

- NNN REIT's high liquidity position, with no debt drawn on the $1.2 billion line of credit and substantial cash reserves, enables the company to pursue lucrative deals without needing capital markets, potentially improving future earnings and net margins.

- Strong occupancy levels of 99.3% and a 10-year lease term average provide stability in rental income, promoting sustained revenue and a robust earnings outlook.

- Projected long-term yield improvements, due to strategic acquisitions at favorable cash cap rates coupled with projected rent increases, suggest future enhancement in net margins and earnings.

- The combination of industry-leading free cash flow and efficient expense management ensures financial flexibility, which can support earnings growth through strategic reinvestment and debt management.

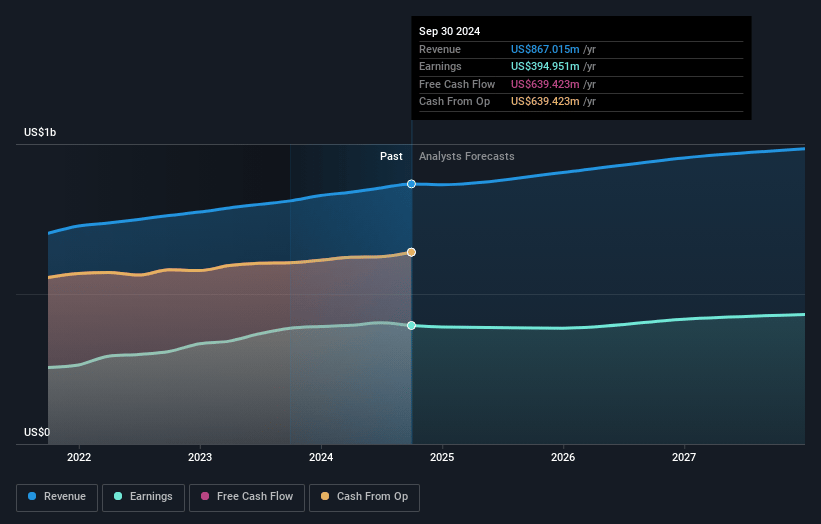

NNN REIT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming NNN REIT's revenue will grow by 4.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 45.6% today to 43.8% in 3 years time.

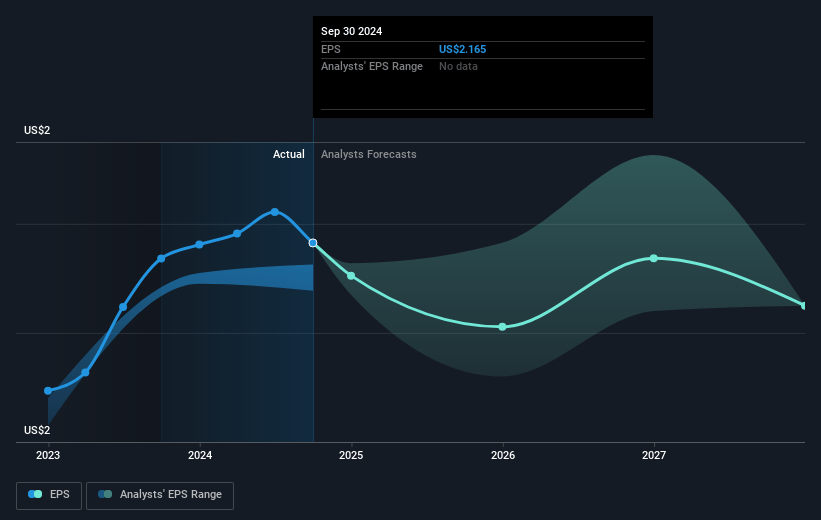

- Analysts expect earnings to reach $427.1 million (and earnings per share of $2.07) by about January 2028, up from $395.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 27.2x on those 2028 earnings, up from 19.1x today. This future PE is lower than the current PE for the US Retail REITs industry at 33.1x.

- Analysts expect the number of shares outstanding to grow by 3.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.84%, as per the Simply Wall St company report.

NNN REIT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant tenant credit challenges, specifically with tenants like Frisch's and Conn's, which could result in higher rent losses, impacting revenue stability and net margins.

- There is an elevated level of lease termination fee income, which, while beneficial now, is not a sustainable or recurring source of revenue and could impact future earnings if it reverts to historical averages.

- The potential timing gap in re-leasing or selling assets from struggling tenants could create periods of reduced rental income, negatively affecting revenue generation.

- Although the AFFO payout ratio is currently healthy, continued defaults or tenant bankruptcies could increase bad debt, thus lowering free cash flow and potentially impacting dividends or reinvestment funds.

- The competitive acquisition market and potential cap rate compression could hinder the ability to secure deals at favorable terms, potentially impacting future revenue growth and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $45.02 for NNN REIT based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $975.6 million, earnings will come to $427.1 million, and it would be trading on a PE ratio of 27.2x, assuming you use a discount rate of 7.8%.

- Given the current share price of $40.22, the analyst's price target of $45.02 is 10.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives