Key Takeaways

- Shifting work patterns and tenant preferences are reducing demand for traditional office space, pressuring occupancy, rents, and portfolio income.

- Rising debt costs, increased capital expenditures, and exposure to weaker markets are constraining earnings, cash flow, and rent growth potential.

- Strategic focus on Sun Belt markets, asset redevelopment, and operational improvements positions the company for stable rental income, growth potential, and increased shareholder value.

Catalysts

About City Office REIT- The Company reported that its total portfolio as of March 31, 2025 contained 5.4 million net rentable square feet and was 84.9% occupied, or 87.6% including signed leases not yet occupied.

- Rising remote and hybrid work adoption continues to erode long-term demand for traditional office space, leading to persistently elevated vacancy rates in City Office REIT's portfolio and placing sustained downward pressure on rental income, which threatens to contract both future revenue and net margins.

- Refinancing risk is set to intensify as legacy debt matures; higher interest rates and tighter lending standards will significantly increase interest expense for City Office REIT, reducing net earnings and constraining cash available for shareholder distributions.

- Ongoing urban-to-suburban migration and shifting tenant preferences are likely to further diminish demand for centrally located office properties, increasing lease-up times and forcing the company to offer costly incentives or accept lower rents, which will directly depress operating income and NOI growth.

- Elevated exposure to secondary and tertiary markets exposed to weaker structural population and job growth trends-especially outside key Sun Belt nodes-limits City Office REIT's ability to drive same-store NOI expansion and puts sustained pressure on portfolio-wide rent growth.

- Greater capital expenditure requirements for tenant-driven upgrades (wellness, sustainability, and smart building technology) are expected to rise in order to keep pace with evolving workplace standards, significantly reducing free cash flow and weighing on long-term EBITDA margins.

City Office REIT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on City Office REIT compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming City Office REIT's revenue will grow by 3.7% annually over the next 3 years.

- The bearish analysts are not forecasting that City Office REIT will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate City Office REIT's profit margin will increase from -75.7% to the average US Office REITs industry of 10.7% in 3 years.

- If City Office REIT's profit margin were to converge on the industry average, you could expect earnings to reach $20.2 million (and earnings per share of $0.5) by about September 2028, up from $-127.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, up from -2.2x today. This future PE is lower than the current PE for the US Office REITs industry at 37.5x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.64%, as per the Simply Wall St company report.

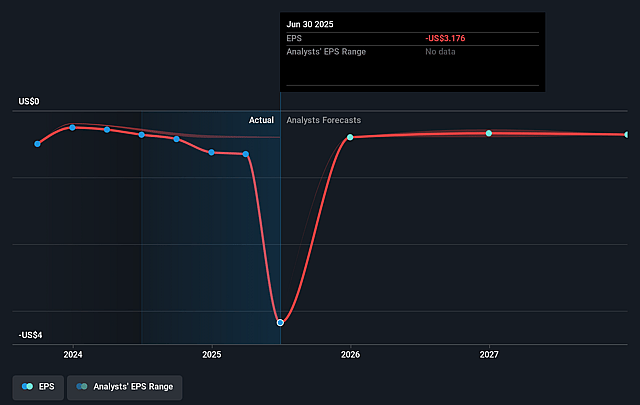

City Office REIT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued strength in Sun Belt markets, with high leasing activity and positive rent growth in cities like Phoenix and Raleigh, suggests stable or growing rental revenue and supports potential for higher net operating income in the long run.

- The successful renewal and extension of major leases, such as the Greenwood Boulevard 10-year new lease and rent step-ups, significantly improves long-term occupancy and cash flow visibility, boosting earnings stability and reducing income volatility.

- The planned redevelopment of City Center in St. Petersburg into a luxury residential and mixed-use tower in partnership with a leading developer demonstrates asset repositioning with upside, which could unlock substantial value and lead to higher asset valuations and increased shareholder equity.

- Management's focus on capital investment in high-growth Sun Belt markets, such as prioritizing leasing in Phoenix and having the bulk of [leasing] value in these regions, aligns with ongoing demographic and economic trends, supporting long-term portfolio rent growth and net margin expansion.

- Operational improvements, including consistent positive cash releasing spreads (8.5% on renewals) and expense management, have already resulted in NOI and core FFO growth, indicating that continued execution could further increase distributable earnings and support a higher share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for City Office REIT is $5.25, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of City Office REIT's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $5.25.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $188.4 million, earnings will come to $20.2 million, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 9.6%.

- Given the current share price of $6.93, the bearish analyst price target of $5.25 is 32.0% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.