Key Takeaways

- Redevelopment and strong partnerships in luxury markets, plus Sunbelt migration and business shifts, could drive long-term outsized gains and revenue growth beyond current forecasts.

- Urban revitalization, tech sector growth, and financial optimization together support high occupancy, above-average cash flows, and the potential for step-change earnings expansion.

- Shifting work trends, geographic concentration, high leverage, and aging assets heighten risk to occupancy, margins, and profitability without significant modernization and strategic adaptation.

Catalysts

About City Office REIT- The Company reported that its total portfolio as of March 31, 2025 contained 5.4 million net rentable square feet and was 84.9% occupied, or 87.6% including signed leases not yet occupied.

- Analysts broadly agree the redevelopment of City Center in downtown St. Petersburg will add value after completion, but the involvement of PMG and the Waldorf Astoria branding, in one of the nation's strongest luxury condo markets, could drive exceptional outsized gains, both in asset valuation and recurring cash flow, far exceeding current analyst models and materially lifting long-term earnings power.

- Analyst consensus highlights strengthening Sunbelt office markets and rental growth, but this view may understate the compounding impact of sustained migration and business relocations to these regions, which can push both occupancy and rental rates well above industry forecasts, driving structurally higher revenue and net operating income.

- Large-scale federal and local infrastructure and urban revitalization initiatives in key secondary markets where City Office operates are set to dramatically boost downtown attractiveness and demand for Class A office assets, creating potential for multi-year leasing momentum and supporting margin expansion.

- Persistent growth in tech and professional services sectors, coupled with a preference for affordable, modern, and flexible space in Sunbelt and secondary cities, provides a robust, long-term tenant pipeline, anchoring high occupancy rates and supporting above-average cash flows.

- Successful balance sheet optimization, including potential accretive refinancing and untapped debt capacity on unencumbered high-value assets, provides a powerful engine for capital recycling and strategic acquisition, paving the way for step-change growth in core funds from operations per share.

City Office REIT Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on City Office REIT compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming City Office REIT's revenue will grow by 3.7% annually over the next 3 years.

- Even the bullish analysts are not forecasting that City Office REIT will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate City Office REIT's profit margin will increase from -75.7% to the average US Office REITs industry of 10.7% in 3 years.

- If City Office REIT's profit margin were to converge on the industry average, you could expect earnings to reach $20.1 million (and earnings per share of $0.5) by about August 2028, up from $-127.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 18.3x on those 2028 earnings, up from -2.2x today. This future PE is lower than the current PE for the US Office REITs industry at 37.3x.

- Analysts expect the number of shares outstanding to grow by 0.52% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.61%, as per the Simply Wall St company report.

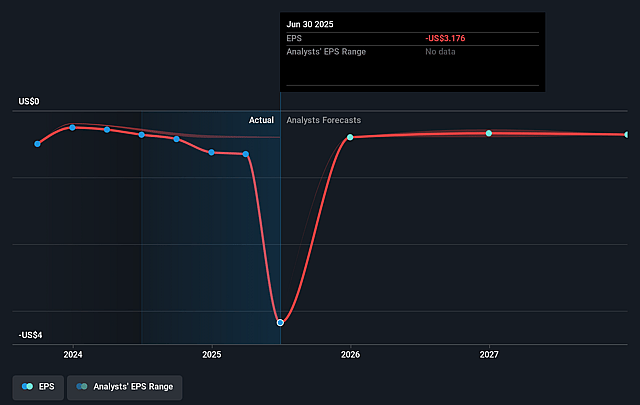

City Office REIT Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent adoption of remote and hybrid work models is likely to cap long-term office leasing demand, which threatens City Office REIT's occupancy rates and rental income, potentially weighing on revenue and net operating income growth.

- The company's geographic concentration in Sun Belt and select secondary markets increases its exposure to pockets of oversupply or slower office demand, which could drive higher vacancy rates and place sustained pressure on net margins.

- City Office REIT's relatively high leverage, with net debt to EBITDA at 6.7 times, amplifies refinancing risk and heightens debt service burdens, risking net earnings and future dividend coverage especially if cash flow volatility increases.

- An aging property portfolio poses a risk if not sufficiently modernized or upgraded to meet evolving tenant and ESG standards, potentially resulting in declining occupancy rates and suppression of rental rate growth, which would limit overall revenue and operating margins.

- Industry-wide preferences for flexible and Class A office space, as well as rising regulatory and sustainability requirements, may necessitate ongoing capital expenditures and compress margins for properties not meeting these standards, thereby impacting net operating income and decreasing profitability over time.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for City Office REIT is $7.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of City Office REIT's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.0, and the most bearish reporting a price target of just $5.25.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $188.2 million, earnings will come to $20.1 million, and it would be trading on a PE ratio of 18.3x, assuming you use a discount rate of 9.6%.

- Given the current share price of $6.94, the bullish analyst price target of $7.0 is 0.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.