Key Takeaways

- Strategic focus on suburban areas and diversified market exposure strengthens occupancy levels, enhancing revenue stability and growth.

- Technological advancements and centralized operations boost efficiency, improving margins and growth from existing and new assets.

- Economic uncertainty, high supply, and weak job growth could negatively affect AvalonBay's occupancy, pricing, and revenue growth, impacting profitability and investment returns.

Catalysts

About AvalonBay Communities- A member of the S&P 500, is an equity REIT that develops, redevelops, acquires and manages apartment communities in leading metropolitan areas in New England, the New York/New Jersey Metro area, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California, as well as in the Company's expansion regions of Raleigh-Durham and Charlotte, North Carolina, Southeast Florida, Dallas and Austin, Texas, and Denver, Colorado.

- AvalonBay's development pipeline, with $3 billion of projects funded by attractively priced capital and locked construction costs, is expected to generate significant incremental earnings as these projects lease up. This directly supports future revenue and earnings growth.

- The firm's strategic portfolio optimization, including diversified market exposure and a shift to suburban areas in response to demographic trends, is aimed at enhancing future returns and maintaining high occupancy levels, which will positively impact revenue stability and growth.

- Limited new supply in AvalonBay's established regions, projected to be at historic lows, is likely to strengthen the company's pricing power, supporting revenue and potentially improving net margins through higher rents.

- AvalonBay has raised equity at favorable prices, providing capital to pursue accretive development opportunities. This leverage-efficient funding supports both revenue and earnings growth due to the lower cost of capital compared to development yields.

- Technological advancements and centralized services in AvalonBay’s operating model are expected to improve efficiency, support margins, and drive growth from both existing assets and new investment opportunities.

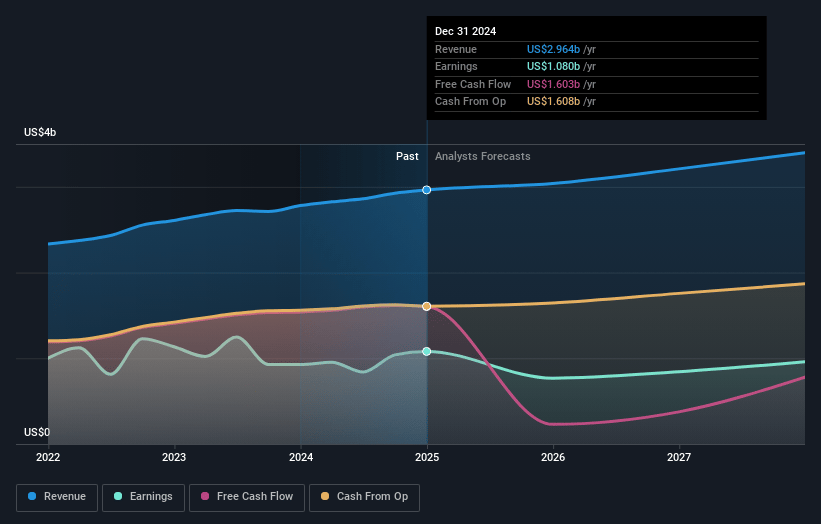

AvalonBay Communities Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AvalonBay Communities's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 38.1% today to 27.3% in 3 years time.

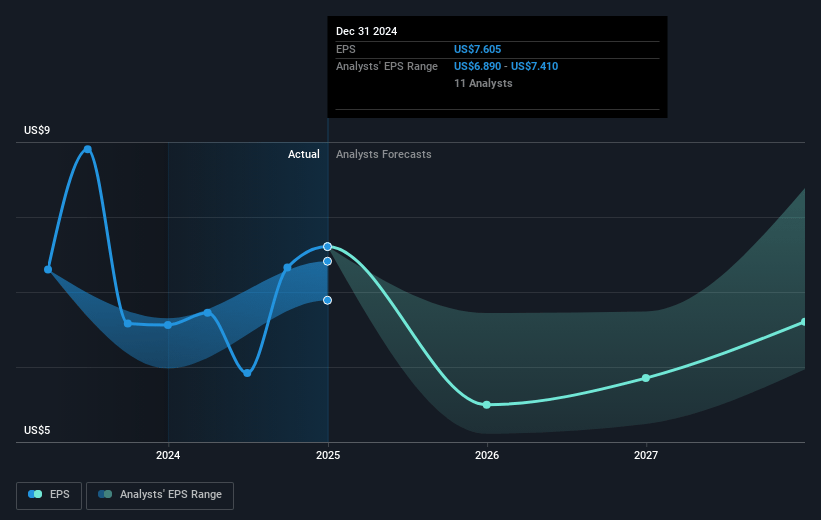

- Analysts expect earnings to reach $950.0 million (and earnings per share of $6.51) by about May 2028, down from $1.1 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $1.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 42.2x on those 2028 earnings, up from 25.9x today. This future PE is greater than the current PE for the US Residential REITs industry at 40.5x.

- Analysts expect the number of shares outstanding to grow by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.56%, as per the Simply Wall St company report.

AvalonBay Communities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing economic uncertainty and the impact of policy actions could affect AvalonBay's earnings growth and financial performance, potentially impacting future revenues and profitability.

- Operating softness in expansion regions due to high supply deliveries might negatively affect occupancy and pricing, which could impact revenue growth and net margins.

- Exposure to tariff increases that could raise material costs may affect AvalonBay’s project costs, thus impacting overall net margins and return on investment.

- Weak job growth, particularly in markets like Los Angeles, could limit improvement in occupancy and rental rates, thereby restricting revenue growth opportunities.

- Concerns and uncertainty from residents regarding job security might lead to increased hunkering down with reduced resident turnover, limiting opportunities for higher pricing, thereby affecting future rental revenue increases.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $233.095 for AvalonBay Communities based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.5 billion, earnings will come to $950.0 million, and it would be trading on a PE ratio of 42.2x, assuming you use a discount rate of 6.6%.

- Given the current share price of $207.87, the analyst price target of $233.1 is 10.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.