Key Takeaways

- Alexandria's strategy leverages heightened life sciences demand, with mega campus investments and aggressive asset recycling driving rent growth, occupancy, and significant earnings expansion.

- Outpaced demand for specialized lab spaces and durable, long-term leases with high-quality tenants ensure strong cash flow visibility and sustained earnings and dividend growth.

- Prolonged high costs, shifting tenant dynamics, regional risks, and increased competition threaten Alexandria's revenues, occupancy, and profitability, raising concerns about long-term financial flexibility and growth.

Catalysts

About Alexandria Real Estate Equities- Alexandria Real Estate Equities, Inc. (NYSE: ARE), an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world.

- Analysts broadly agree Alexandria's mega campus strategy in premier innovation hubs positions it for solid growth, but this potentially understates the acceleration in demand as life sciences R&D intensifies; the largest lease in company history and rising pre-leasing in the multi-year pipeline signal that Alexandria should see outsized increases in both rent growth and occupancy well above industry averages, fueling same-property net operating income and earnings expansion.

- While analyst consensus anticipates stability from Alexandria's top-tier balance sheet and tenant base, the company's aggressive asset recycling and cost discipline are likely to further enhance margin expansion and capital efficiency, positioning it to out-invest peers and accelerate both AFFO growth and dividend increases as market conditions normalize.

- The sustained ramp in venture capital investment and an unprecedented wave of biopharma licensing and M&A activity are materially expanding the pool of high-quality tenants, resulting in a virtuous cycle of new company formation and lab demand that can meaningfully compress vacancy rates and drive incremental leasing velocity and revenue growth for Alexandria.

- Demand for specialized lab space is poised to structurally outpace supply, given rising regulatory standards, advances in precision medicine and gene therapy, and the increasingly mission-critical requirement for fit-for-purpose research infrastructure, allowing Alexandria to achieve outsized rental rate premiums and further expand operating margins.

- Alexandria's growing exposure to long-duration leases with global pharmaceutical and institutional tenants-supported by secular demographic drivers and chronic disease prevalence-should translate to superior earnings visibility, durability of cash flows, and a sustained platform for compounded earnings and dividend growth over the next decade.

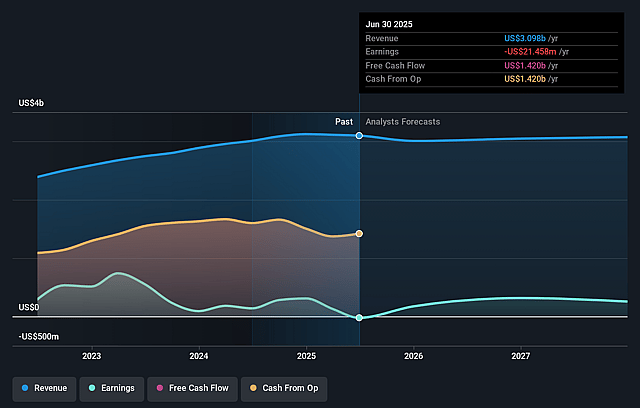

Alexandria Real Estate Equities Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Alexandria Real Estate Equities compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Alexandria Real Estate Equities's revenue will grow by 1.5% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -0.7% today to 13.3% in 3 years time.

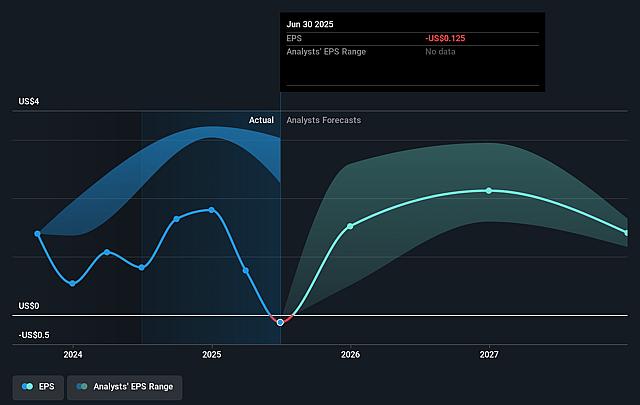

- The bullish analysts expect earnings to reach $431.8 million (and earnings per share of $2.21) by about September 2028, up from $-21.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 67.4x on those 2028 earnings, up from -668.1x today. This future PE is greater than the current PE for the US Health Care REITs industry at 34.4x.

- Analysts expect the number of shares outstanding to decline by 1.03% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.56%, as per the Simply Wall St company report.

Alexandria Real Estate Equities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent high interest rates and higher cost of capital continue to weigh on the life science real estate sector, with Alexandria management highlighting ongoing macro headwinds, elevated free rent required to secure leases, and increased capitalization rates on asset dispositions, all of which could pressure net margins and asset values for an extended period.

- Structural shifts in workplace models and caution among tenants-including increased capital discipline by private and public biotechs, lack of new biotech IPOs, and elongated tenant decision timelines-signal potential for slower leasing activity, elongated vacancies, and pressure on revenue growth and occupancy rates.

- Escalating competitive supply from new lab and life science developments, including significant vacant deliveries in core life science markets like Boston and San Francisco, raises the risk of prolonged oversupply, downward pressure on rental rates, and higher vacancy that could weigh on Alexandria's revenues and cash flow over the long term.

- Alexandria's heavy concentration in a few urban life science clusters leaves it vulnerable to regional economic downturns, localized oversupply, or regulatory changes, while climate change risks in cities like Boston and San Francisco may drive insurance, maintenance, and retrofitting costs higher and thus impact overall profitability and net margins.

- Large capital requirements for long-term project pipeline paired with management's stated need for ongoing asset sales and reliance on dispositions to fund developments expose Alexandria to the risk of rising interest expense, potential earnings per share dilution, and asset impairments, especially if market conditions remain unfavorable or demand for commercial real estate softens further.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Alexandria Real Estate Equities is $136.2, which represents two standard deviations above the consensus price target of $96.42. This valuation is based on what can be assumed as the expectations of Alexandria Real Estate Equities's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $144.0, and the most bearish reporting a price target of just $71.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $3.2 billion, earnings will come to $431.8 million, and it would be trading on a PE ratio of 67.4x, assuming you use a discount rate of 8.6%.

- Given the current share price of $82.89, the bullish analyst price target of $136.2 is 39.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.